“Davidson” submits:

The Big Picture

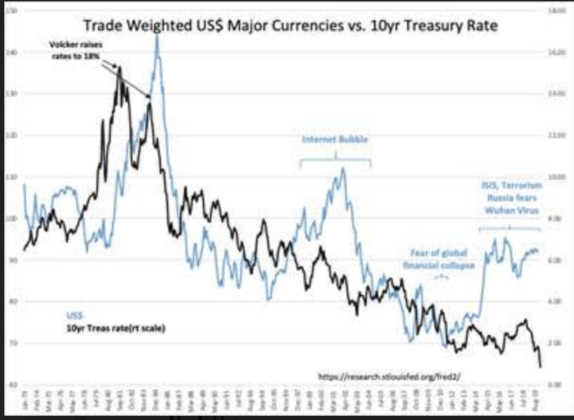

The DXY Index and US 10yr Treasury rate have been falling together since mid-Feb 2020. This may signal the beginnings of a reversal of global capital flows into the US. The trigger, which one could not predict ahead of time, appears to be 10yr Treasury rate falling to ~1.5%. A review of the US$(US Dollar) history monthly from 1973 shows periods of US$ strength as global investors sought out US assets during periods of higher returns or as a safe haven. In the early-1980s and late 1990’s it was the lure of highest global returns. A recent period of US$ strength began with Russia’s 2014 invasion of Ukraine and continued as US initiated economic sanctions against ‘terror states’ and moved to renegotiate global tariff barriers to trade. Today, may be the early stages of reversal in US$ strength. Understanding this requires some hindsight.

Global capital flows are based on a complex mix of factors which have evolved over decades with the development of Developing/ Emerging (23 countries- Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Qatar, Peru, Philippines, Poland, Russia, South Africa, South Korea, Taiwan, Thailand, Turkey, and United Arab Emirates) through capital flows from Developed Markets (Europe, Australia, Japan Canada, US). As globalization progressed and global wealth increased, a number of country leadershps shifted towards autocratic governance threatening citizen property rights. In response, business owners and investors with newly liquid capital due to the influx of Developed capital sought safe havens and returned as much capital back to Developed markets as they could.

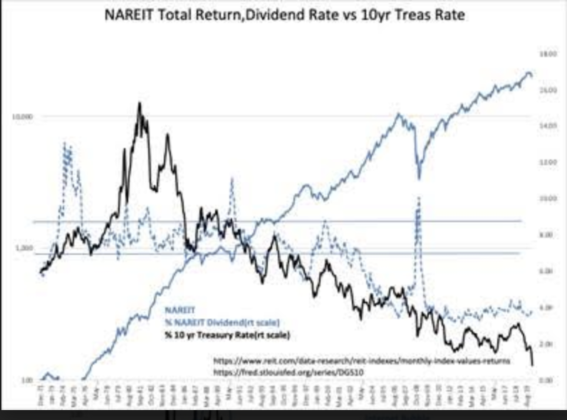

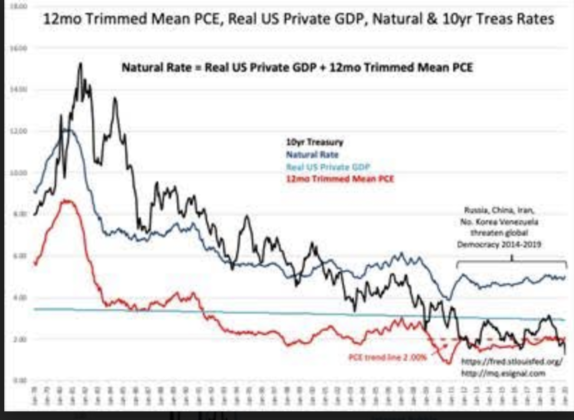

The evidence comes from REIT(Real Estate Investment Trust) dividend yields, Sovereign Debt history and the Natural Rate Indicator. These reveal that capital flowing into REITs and Sovereign Debt began to push dividend rates and yields lower late 1990s-2000 range. These asset classes gradually became over-bought. US REITS today offer ~3.5% yield or half the 7% this asset class used to offer on average and the 10yr Treasury today at 0.77% typically had been higher than the Natural Rate benchmark since 1978. Compared to the current Natural Rate’s ~5%, the 10yr Treasury is grossly over-priced. These flows continued as Emerging Markets became more liquid with the Developed Market capital influx. The boomerang of capital back to Developed Market Sovereign Debt and real estate continued. Flows accelerated with heightened global threats when Russia invaded Ukraine in 2014. Roughly the same time frame, China’s Xi and Turkey’s Erdogan were instituted autocratic controls of their respective counties. Capital flight from these countries caused exchange rate deterioration of the Chinese Yuan and Turkish Lira. US sanctions against No. Korea, Iran, Venezuela, China and threats of the same against Europe, Canada and Mexico to force renegotiation of tariff imbalances were reflected in additional US$ strength that in some instances correlated with declines in Sovereign Debt rates and specific exchange rates.

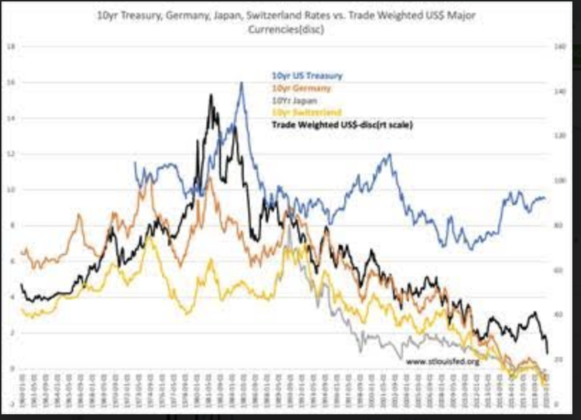

The net impact for Switzerland, Germany and Japan 10yr Sovereign Debt was the inability to absorb this capital flow with ~$300Bill, ~$2.3Tril and ~$10.5Tril outstanding respectively. Negative rates were experienced with Switzerland’s rate, the least able to absorb the influx of capital, most negative -0.70%. Most investors have assumed that lower rates indicated actions by Central Bankers in response to economic weakness. This was in fact foreign capital seeking safer and better returns as their domestic situations deteriorated. Paying a negative rate to exit a 10% decline in one’s own currency is a good relative return. The economies of Developed nations while slow have in fact been mostly growing even though narrow rate spreads curbed bank lending and higher economic expansion. Low rates and narrowing/inverted yield curves which have long been believed to signal economic distress have misunderstood the impact that global capital shifts have had.

Yield curve relationships are part of nearly every investment trading algorithm in use today. Algorithms operate using past trends. They operate using mathematical models and only incorporate a new trend when the bulk of investors have already shifted capital allocations enough to have a persistent price impact. This leaves algorithms at all times leading from behind and exaggerating a trend even when the underlying basis has changed direction. There is no evidence that any algorithm today has adjusted for the cultural biases occurring as global capital seeks out the better opportunities.

Markets are complex at any time but with the cultural differences between Developed vs Emerging Markets it becomes ‘complexity squared’(Complexity2). The best we can do is to be aware of this and observe carefully for signs that a significant change may be in process. The correlation of falling 10yr Treasury with the DXY Index is one of these that is new. It appears that US 10yr Treasury falling below 1.5% was that global trigger. On Feb 20th, 2020, once the 10yr Treasury rate fell to and below 1.5%, the DXY Index began to decline rapidly. The decline has been ~4% in the value of the currency package making up this US$ index and appears to be a historical decline. Let’s add emphasis, 4% decline in 3wks in the US$ is a huge decline in such a short period. Something significant appears at work.

For US algorithm traders, falling rates signal economic decline and they sell stocks and commodities and shift into Treasuries. It is why $WTI(West Texas Intermediate Oil Prices) have plunged as short-term economic fears grow. For foreign investors, it is a combination of US rates no longer meeting return/safe haven perceptions and losses on the currency exchange now going against them. A 4% decline in the US$ exchange rate represents 4yrs of yields at 1% and becomes a powerful motivator to exit. Rates on the 10yr Treasury have fallen as low as 0.67% today as algorithms drive the trend lower. Algorithmic buying of the 10yr Treasury is being countered by foreign investors selling and exiting US$ assets. What we are seeing are actions by investors with differing perceptions. The media is attempting to provide a simple interpretation that is not possible,

The best approach in my experience is to follow economic trends. Rates, prices of the US$, oil, stocks and etc are determined by short-term market psychology not economics. Economics become a factor in market psychology only after a trend of economic reports causes market psychology to conform. When market psychology diverges from economics as it does frequently during a cycle, it is when market psychology snaps back to the economic data that the best returns occur. What one hears in the media is a Tower of Babel.

In my opinion, we are seeing a wide misreading of the current economic conditions. It appears that foreign investors no longer happy with US$ returns are in the process of repatriating capital which drives the US$ lower. A falling US$ is very positive for US high-value exports which stimulates US productivity, employment, retail sales and wage growth. With existing US economic conditions already positive, a weaker US$ can only add to US economic expansion.

The Big Picture says buy equities.

https://www.marketwatch.com/investing/index/dxy