“Davidson” submits:

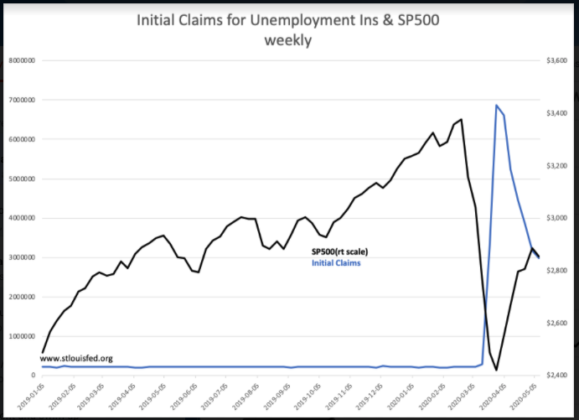

There is a strong correlation with the pace of Initial Claims for Unemployment and the SP500 which spans 50yrs. The SP500 rises after weekly Initial Claim levels peak signaling a belief that the worst part of layoffs are behind us. This week Initial Claims continued the downtrend from the Mar 28, 2020 peak.

While many view the SP500 as representing economic activity, the fact remains that the SP500 is really a reflection of investor perceptions of economic activity and lately driven wildly by computer algorithms which are price-trend driven formulas unconnected to economic activity. The continued media commentary declaring the SP500 as an economic indicator makes this confusing. The assertion that a rising SP500 means rising economic activity one day becomes irrelevant when the next day a falling SP500 is deemed a sign of a decline in economic activity.

‘Less-bad’ Initial Claims is a positive economic indicator. It drives equity prices higher.

Buy equities.