“Davidson” submits

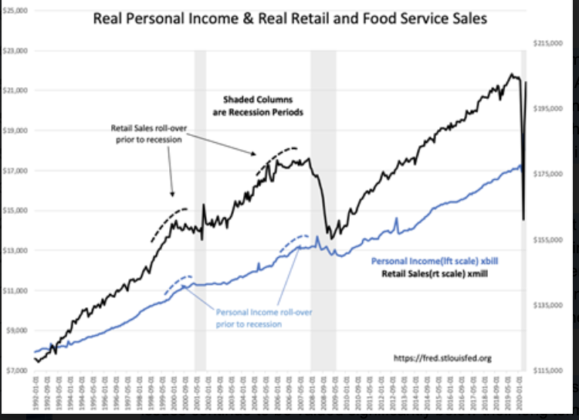

Retail Sales surprise on the upside, higher by a month-over-month 7.5% improvement. This is nearly a full recovery to pre-COVID-19 levels. The early evidence of the June Light Weight Vehicle SAAR(Seasonally Adjusted Annual Sales) of 17mil+ suggested this type of recovery. Multiple commentaries continue to discount what have been clear signs of rapid economic recovery even with some states retreating from plans to reopen their economies. Notably, supporting this Retail Sales report has been the recovery in the Trucking Tonnage Index(TTI) by which many retail items are shipped in the retail manufacturer-to-consumer supply chain. There are no better indicators of economic activity than the pace of transport and sales of items consumers are buying.

The overall commentary this morning continues skeptical that these unexpected trends will not continue. Analyst views are in contrast with reports from of all sectors the RV industry. Several companies have issued preliminary statements that sales are elevated with difficulty in refilling inventories. Even with reports of rapid recovery, institutional investors wait for quarterly reports before suddenly driving shares higher by 5%-10% once convinced numbers reported were better than anticipated. The current environment is a great example of markets following market psychology which in turn follows economic/business fundamental reporting. Markets are not the efficient mechanism of which many speak, but in fact are quite inefficient when identifying value and well-operated businesses.

The current period is one of great confusion if one only listens to the media. Critical thinking has been absent as economic indicators are ignored. Many issues continue to be valued significantly below their long term business prospects. Buy well-managed companies with the presence of active insider buying.