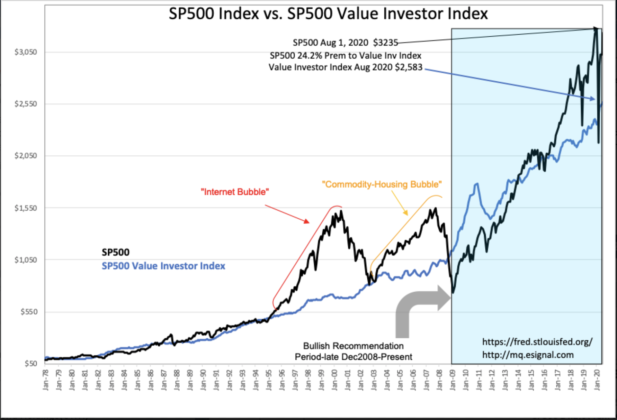

I’m still a bit opposed to “Davidson” optimism here. My growing concern is that Q3 and Q4 earnings are going to be dismal and we may hit these premium levels on the earnings fall alone.

“Davidson” submits:

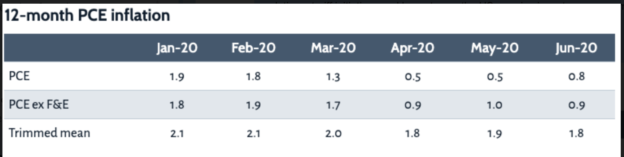

The 12mo Trimmed Mean PCE is reported 1.82%, down from last month’s 2% with the past 6mos revised lower. Lower inflation translates into higher Value Investor Index(VII) valuation to $2,583 for Aug 2020 with SP500 at $3,235, a 24.2% premium. The SP500 peaked in 2000 and 2007 at 100% and 65% premium levels respectively vs the VII. Those levels represent well over $5,000 in today’s low inflation environment.

Market prices represent investor perceptions of economic activity. As long as economic activity trends higher, equity prices trend higher. Coupled with falling regulations, tariff initiatives and lower taxes, the US remains in a strong economic trend implying that if conditions continue equity prices should trend significantly higher the next few years.