“Davidson” submits:

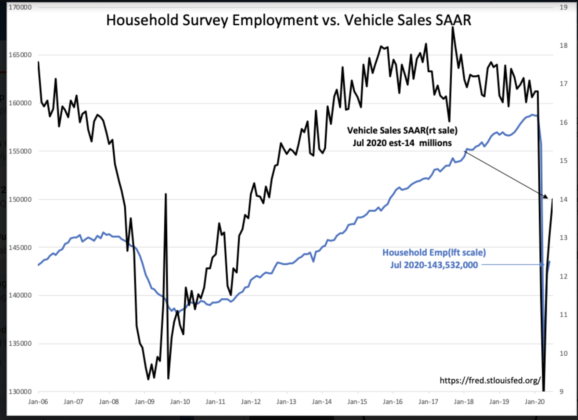

Household Survey Employment rose 1.35mil and the estimated Light Weight Vehicle Seasonally Adjusted Annual Rate(SAAR) for July was ~14mil level. This economic recovery remains at a rapid pace when compared to previous recoveries in the 0.25-0.30 mil monthly employment increases of the 2008 recession.

Having never experienced the type of economic shutdown the response to COVID-19 created, analysts using mathematical models of previous recessions have fallen short with their pessimistic forecasts. Financial/economic conditions prior the shutdown were nearly the best in more than 50yrs with low debt delinquencies indicating far less debt deployed in economic speculation. Recovery in the current period does not have the speculative debt burden typical of past recessions which in the past always required several years of financial adjustment. A fast recovery is in progress, but how this continues to trend will be in part dependent on political action to permit businesses to reopen. The public pressure to simply reopen and get on with normal activity has been growing sharply. Thus far Intermodal Rail traffic, Trucking Tonnage Index, Chemical Activity Barometer and Retail Sales suggest a recovery much further along and with much higher demand than 1month trailing employment currently implies.

The ‘Top Down’ perspective is based on consolidated and delayed by one month or so from the detailed information generated by thousands of individual companies. It is in the detail of corporate reporting where one develops expectations for Top Down trends. We just experienced a veritable flood of much better than expected individual reports(‘Bottom Up’). Many individual stocks have jumped 10%-20%(some more than this) in the days following the lifting of pessimism. Some of the sharp moves higher certainly were due to the reversal of short sellers recognizing that economic trends did not support their negative bets.

Economic reports, both Top Down and Bottom Up, support a more rapid recovery than many continue to forecast. With investor pessimism still far greater than conditions support, equity prices are likely to rise considerably from levels where the pessimism is highest. Investors need to be selective regarding the quality of management, but are advised to avoid the few but heavily favored COVID-19 related issues and add capital to those issues with significant discounts to historical solid financial performance. Adding active insider buying to one’s investment selection criteria is highly recommended.