The market is not what I would call “overvalued” at all based on current data, it is not, though, by any means “cheap”.

If economic conditions continue to deteriorate, there is room, I think, for a significant leg down.

“Davidson” submits:

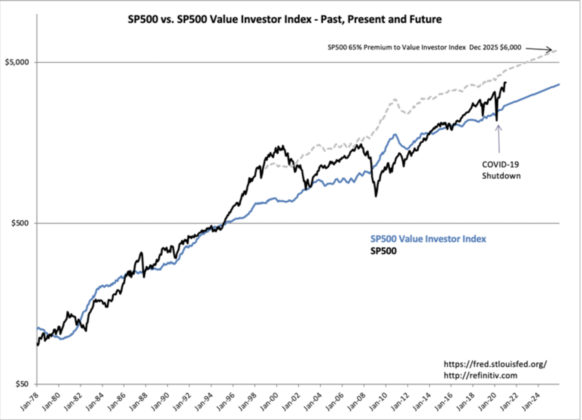

The SP500 Value Investor Index is a long-term fundamental measure of market pricing. When SP500 prices correct to the level of this index or below, there is a high correlation with corporate insider buying. The SP500 Value Investor Index is specific to the SP500 and represents the long-term earnings trend capitalized by the long-term Private GDP Growth Rate + the 12mo Trimmed Mean PCE(Inflation). It is useful during significant market corrections as occurred March-May 2020. As in previous significant corrections, this period also had a significant surge in corporate insider buying reports. Insiders are the most knowledgeable concerning their own companies and companies where they serve on Boards and deemed the best informed Value Investors. Likewise, those investors deemed Value Investors in the same period are most optimistic at locating investment opportunities. Thus the name Value Investor Index.

While more useful at market lows, the SP500 Value Investor Index has some utility in gauging excess market sentiment. The past two cycles peaked in 2000 and 2007 at 100% and 65% premiums to the SP500 Value Investor Index. Today, the premium is ~36% which suggests that a hefty rise in the SP500 remains in coming years.

Market prices are established by market psychology. The investor swing from optimism to pessimism back to optimism has a history of confusing many. It is when investors shift from pessimism to optimism that substantial returns occur. The SP500 Value Investor Index is useful as a guidepost but no precision is possible when prices are dependent on psychology.