We will have one eventually….gotta have a plan for when it comes..

“Davidson” submits:

In conjunction with the “Widening rate spread = Expanding lending activity = Economic expansion continues” note, it is always prudent to have devised an approach to deal with the eventual recession to come even if yet several years away. Market history of past recessions since 1953 provides a decent answer of what to do.

There are several indicators which tend to be coincidental with inversion of the yield curve. Being that market prices are driven by investor psychology, no one is truly ever able to identify the precise peak of equity/economic cycles(same for bottoms). All one must do in a multi-year cycle is to get close enough. One can make ‘market top’ decisions with a fair amount of confidence using a combination of the yield curve)T-Bill/10yr Treasury rate spread), signals in Retail Sales, the Chemical Activity Barometer(CAB) and employment statistics to be close enough. Same for major lows. That historically investors panic in recession and seek safety in Treasuries tells us what our investment choice should be. It should be a portfolio of 5yr US Treasuries managed for duration as in Vanguard’s Intermediate Treasury Fd (VFIUX).

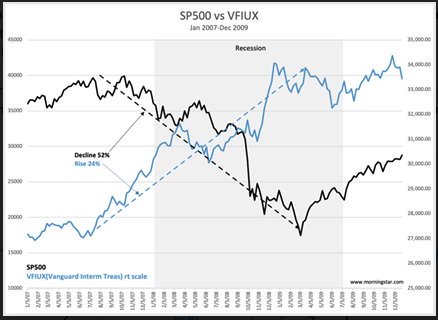

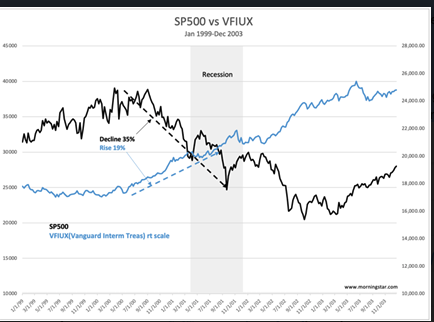

Two past recession periods are instructive with weekly prices of SP500 vs VFIUX spanning 1999 to 2003 and 2007 to 2009. In each instance the CAB index and Retail Sales identified the month economic activity made its low and these along with the inversion of the yield curve identified pending recessions. SP500 which reflects market psychology does not generally make its cycle lows and peaks identical with those of economic activity but is close.

This approach simplifies the decision making. Once indicators signal a turn higher off lows, one should transition from all 5yr Treas to equities at a pace which is comfortable and as one identifies specific opportunities. Once those same indicators signal the end of the economic cycle, one should transition into 5yr Treasuries and benefit from falling rates as other investors panic to find safety. A fund managed for duration like the Vanguard Fd captures interest with capital gain returns as rates fall.

The goal over multiple investment cycles is to capture as much upside during economic expansion without giving back too much during recessions. This is a long-long approach. Long equities during economic expansion and long Treasuries during recession. It will not be precise in capturing the major turning points, but as long as one is only roughly correct in cycles lasing 5yr-10yrs, then the outcome should be satisfactory.