“Davidson” submits:

“Inflation is coming, buy stocks” The fact is, it is more complicated than this simple, centuries-old mantra that has been repeated as long as there have been investible assets. That this perception remains firmly in place today is underscored by this quote from a well-known advisor.

“The history is that stocks more than compensate for inflation and there’s a lot of dividend paying stocks — 2%, 3%, 4%, 5%. So why would you go fixed income? The gap is huge. And that’s what I think is going to continue to drive the money into the market despite the fears that the Fed will tighten in the future.” CNBC May 14, 2021 https://www.youtube.com/watch?v=t3ygJbJjocI

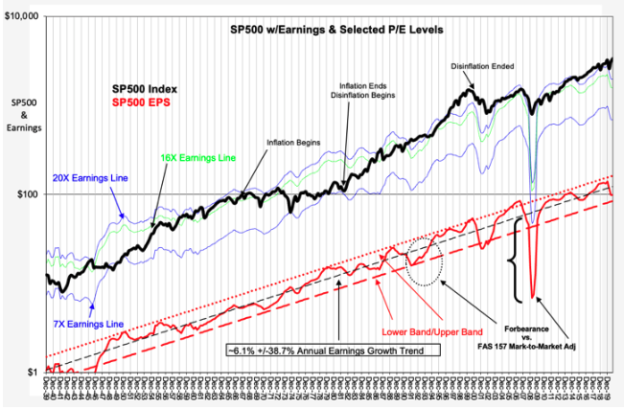

The history of market prices and market P/E (Price Earnings Ratio) reveals that periods of high inflation results in P/E contraction over time. Saying this another way, investors lower the price they are willing to pay because they discount the impact of inflation. The SP500 w/Earnings & Selected P/E Levels chart from Dec 1939 identifies a period of severe inflation beginning mid-1967 ending early 1982. While SP500 EPS continued to rise business cycle-to-cycle, investors lowered the P/E from ~20 in 1971 to ~7 in 1982. This was roughly a repricing 65% lower for earnings. The pricing process was not quid pro quo. Investors did not initially reprice earnings as they did not recognize that this would prove to be as severe a period of inflation till several years later. Inflation was only recognized as persistent in the 1970s. Earnings did not accelerate with inflation during this period but continued to grow on pace, 6.1%. Earnings were better in some companies than others.Real US GDP also continued on pace, ~3%, the long-term trend. When inflation ended in early 1982, investors expanded the SP500 P/E.

Inflation reprices stocks favorably for those issues whose earnings outpace inflation. In an inflationary environment, hard asset companies such as raw material producers have generally been favored. Interestingly, real estate suffered during inflation as its rental returns could not keep pace with inflation. Real estate soared once inflation abated in the early 1980s as P/E expanded. The point to make is that it is not a given that ‘stocks beat inflation’. One needs to be more selective and attentive to how specific companies are managed and invest in those likely to out-pace inflation. Even with the current crop of Momentum Investor chasing prices, it is never old to identify the better management teams and be sensitive to price when making investment decisions.