That sloshing sound is the Trillions globally pumped into markets…

“Davidson” submits:

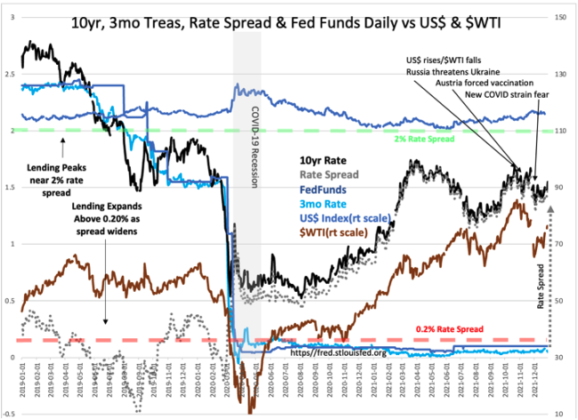

Liquidity reigns! Liquidity as reflected in the T-Bill/10yr Treas rate spread has a long history(from 1953) of indicating the market’s ability(in fact it is investor ability to wait out market shocks) to adjust to major events. Rising rates and rising $WTI, reversing the declines beginning early Nov 2021 in response to multiple threats 1st Russia, followed by Omicron and lockdowns in Austria, Australia and etc., indicate investor psychology has recovered.

On the horizon remains the likelihood that Russia will invade Ukraine and cause another shock to those not paying attention. Russia invading Ukraine to some degree has already been absorbed into market thinking and not likely to be as significant as if it occurred unexpectedly. Nonetheless, it will still have an impact of unpredictable consequence even if expected but adequate liquidity is present to ease markets through it. The rising rate spread of the moment indicates greater liquidity is present than a few weeks ago. Events which turn into ‘Black Swans’ historically have had little long-term impact unless liquidity is low. At the moment liquidity is high and rising.