“Davidson” submits:

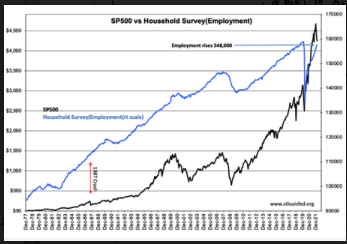

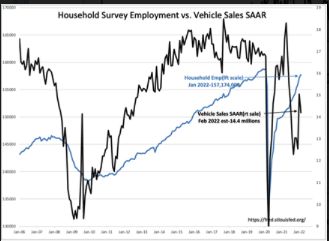

The Household Survey Employment rises 548,000, Establishment Survey rises 678,000 with unemployment lower at 3.8%. Temporary help pushes higher and Light Weight Vehicle SAAR est 14.4mil is holding higher with typical month-to-month volatility. Vehicle sales continue to work through the semiconductor supply issues.

The 3 charts show the relationships between past peaks/lows vs the SP500. The 1987 Crash shows the most important lesson from that period i.e., the market crash had zero impact on employment. It is the economic trend which controls the long-term direction of market prices which reflect investor psychology. Investor panics occur due to uncertainties emerging which confuse assumptions on which confidence rests. The proverbial ‘rug getting pulled out from one’s feet’ can occur from any direction and any time causing a plunge in market pricing till enough of a period of assessment has passed for confidence to recover. Economics never shift suddenly nor much. Economics trend at a relative snail’s pace even if our measurement of data is choppy and requires monthly revisions. For economics, it is not specific reports which carry important information on which the media builds to a hyper-anticipatory moment to get everyone’s attention(and sell ad revenue). Instead, for economics it is the trend over months and years vs past months and years that provides the greatest insight. Employment trended right through the 1987 market panic as if nothing occurred and investors aware of this took advantage of the discount. Many investors today are still puzzled how anyone could possibly know at the time that 1987 did not portend the end of the world. They believed then and believe today that market prices control economic activity. I hope I have shown that this is not true.

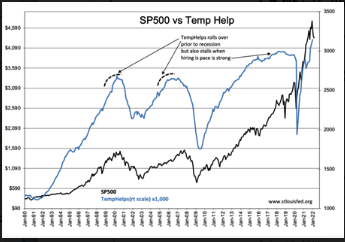

The current employment trend remains sharply higher despite the recent market correction. BUY EQUITIES! The Temp Help series is helpful in this decision. In the past Temp Help series has rolled over prior to recession, but it has also rolled over during a period of prolonged market pessimism as during 2018-2019. There were hundreds of recession calls during this period which did not occur as employment and other metrics continued to trend higher. Today Temp Help series is rising sharply. Regardless of the headline, there is no recession in the immediate future. Depending on who is counting, we still have ~4mil +/- individuals to return to the employment rolls. This will take perhaps 2-3yrs which stretches the economic cycle out perhaps 5yrs and much higher equity prices than today.

Rising Employment = Economic Expansion = Rising Equity Prices/Rising Interest Rates