“Davidson” submits:

A rapid rise in 10yr Treas rates is occurring as capital moves into core economic issues. There is an investor shift in process that is difficult to perceive because market indices have become dominated by over-valued Momentum issues. These issues were so favored during the COVID lockdown that 10 names grew to represent 25%+ of the SP500. The rise in these issues overwhelmed all other issues. This forced fund managers to invest in these issues to prevent shareholder disaffection. Many growing companies fell 20%+ as the SP500 rose 30%+. Net/net nearly every fund manager became in part Momentum Investors or faced losing capital as investors chased price performance.

As the economy continues to expand, it is becoming ever more apparent that lockdown favorites have widely missed expectations. Peloton, Zoom, Docusign and many Chinese issues have fallen from extreme valuations. These few represent a mere sampling of investors chasing prices without consideration for fundamentals which came to dominate all the indices used by many to measure fund manager performance quarter-to-quarter. The correction today represents the shift out of these issues and towards issues more economically sensitive such as industrials and commodity related issues. The shift out of former favorites makes it appear the indices are in a major correction interpreted by many as forecasting recession. Underneath the still high-priced issues, economically sensitive issues are rising in price, just not yet enough to offset the former’s dominance. The T-Bill/10yr Treas Rate Spread indicates economic acceleration not recession.

Examples of COVID-issues correcting:

- Peloton Interactive(PTON): fell from $170+shr to ~$25shr represented a Pr/Sales 19x falling to < 2x.

- Docusign(DOCU): fell from $300+shr to ~$90shr represented a Pr/Sales 30x falling to less than 9x

- ZOOM Video Com(ZM) fell from ~$590shr to ~$115shr represented a Pr/Sales 51+ falling to less than 9x

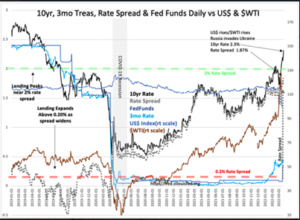

The T-Bill/10yr Treas Rate Spread has widened to 1.87% as of this morning. It has been so rapid that an update is justified. Many are concerned the rise in the 10yr Treasury to 2.3%+ as threatening economic expansion. History supports the contrary view.

- Point 1: Rising rates represent a shift from fixed income to equity as investor confidence builds for equity vs. fixed income.

- Point 2: A rising rate spread expands financing by financial institutions-the wider the rate spread the greater the liquidity

Rising rates represents a positive shift in market psychology towards equities. Equities are viewed as the better risk/return potential based on the current investment context. When the 10yr rate rises faster than the T-Bill rate, investors are not fully committed keeping some portion of their capital as a reserve. When investors have comfortable reserves, unexpected events, while they may prove disconcerting, do not develop into market tipping points leading to recession. Reserve capital permits investors to bridge short setbacks. The history of the T-Bill/10yr Treas Rate Spread indicates it has often risen to 3%. The 2% benchmark represents a level typically reached before T-Bill rates begin to rise reflecting a further rise in investor confidence. It is when T-Bill rates rise to 0.2% of 10yr Treas rates that we see investors overly committed to equities and any confidence threatening event can panic us into recession. If we view the T-Bill/10yr Treas Rate Spread as market psychology indicator, then it becomes obvious why some events lead to recession while others of the same magnitude to not.

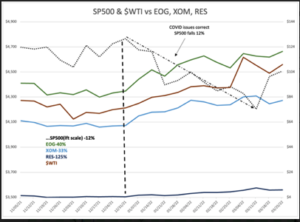

The sharp rise in the T-Bill/10yr Treas Rate Spread today represents increased investor commitments to equities. In the current inflationary climate, issues favored are energy related. These issues because they have been ignored for 7yrs and dominated recently by COVID-favored issues represent a historically low percentage of the indices. Their rise even though significant is only recently offsetting the correction of the COVID issues. One should always be selective to invest in the better managed companies. In SP500, $WTI vs EOG, XOM RES, The vertical market represents Jan 1, 2022 in weekly data from Nov 2021. The performances show the correction of COVID-favored issues began at the end Dec 2021. Capital shifts favored fossil fuel related issues. As $WTI continued to rise, algorithms that use oil prices as part of determining the trend of economic activity have stimulated buying in core economic issues which began to offset the COVID- issue correction the week of March 11, 2022.

It is never a stock market. It is always a market of stocks vying for the attention of Momentum vs Fundamental Investors. Once price trends are defined in core economic issues, we can expect Momentum Investors to pile in. The general advice at this time is to be fully invested in equities and to favor economically sensitive issues.