“Davidson” submits:

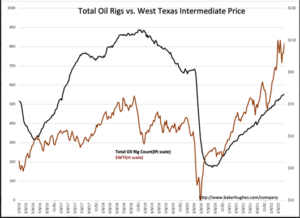

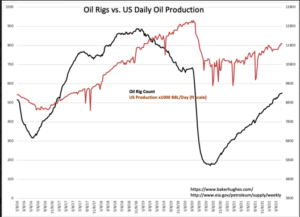

The Baker Hughes Rig Count rises by 3 oil rigs leaving the level of gas rigs unchanged. With crude and refined inventories continuing to decline and $WTI holding above $100/BBL providing strong cash flows to the E&P industry one might expect higher pace of production increases and equipment deployment but this is not what we see. There is a clash of perspectives in the market which is defined by the recent release of McKinsey&Co’s report “Energy Perspective 2022”. This report calls for EV(Electric Vehicles) to dominate transport and reduce oil consumption dramatically in 2yrs-5yrs. Counter to this is Exxon Mobil(XOM)’s announcement of 3x increase in their share buyback program yesterday reflecting high confidence in their industry’s future prospects.

Market perception of XOM being pulled higher by every financial release. While some will proclaim the co missed recently elevated eps expectations, the whole picture presented by management and their outlook continues to display a deep discount to management’s actions. Management’s commentary provides support for a very positive outlook.

The counter-argument is provided by mainstream consultant McKinsey&Co in their April 2022 report that EVs will dramatically lower demand for oil. https://www.mckinsey.com/~/media/McKinsey/Industries/Oil%20and%20Gas/Our%20Insights/Global%20Energy%20Perspective%202022/Global-Energy-Perspective-2022-Executive-Summary.pdf

There is a logic in this report that escapes me as I view it disconnected from technological reality in my analysis.

Exxon Q1 results – earnings miss partially offset by tripling of buyback program

08:07 AM | (XOM) | By: Nathan Allen, SA News Edito

Exxon (XOM) reported Q1 results ahead of the market open Friday, missing estimates and barely growing the bottom line sequentially, despite an improved commodity price environment. CEO Woods said, “earnings increased modestly, as strong margin improvement and underlying growth was offset by weather and timing impacts. The absence of these temporary impacts in March provides strong, positive momentum for the second quarter.” Despite the earnings miss, Exxon (XOM) tripled the company’s share buyback program:

- Earnings – the company generated $2.07 in adjusted earnings per share, excluding the $3.4b impact of charges related to exiting Sakhalin-1 operations, versus Street expectations for $2.23.

- Cash flow – free cash flow during the quarter came in at $10.8b, or ~3.1% of Exxon’s (XOM) current market cap; down from $15.0b in Q4.

- Capital allocation – free cash flow more than covered the dividend, and Exxon (XOM) repurchased $2.1b worth of shares in the quarter, or ~0.6% of shares outstanding; the company’s share repurchase program was increased from $10b to $30b.

- Production – underlying production, excluding entitlement effects, divestments and government mandates, fell 2% sequentially on weather-related headwinds; production “fully recovered” by quarter end and the company remains on track to grow Permian volumes by 25% in 2022.

Management provided a relatively bullish preview of the quarter in an 8k filed on April 4th, leading the Street to raise expectations ahead of Friday’s results. Although the company remains on track to hit annual EPS estimates of $9.38, Q1 results are unlikely to impress. However, the stock still carries a ~4.0% dividend yield and management now plans to repurchase ~8.5% of shares outstanding by the end of 2023.

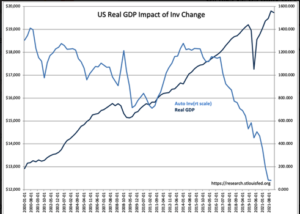

Mixed signals in Real GDP:

GDP was reported as declining and some have jumped to adding their voices forecasting recession. Falling inventories due to issues in air craft and vehicle manufacturing i.e, w/production less than sales, is a negative input for GDP. This link provides a good explanation: https://aneconomicsense.org/2012/01/08/contribution-to-gdp-growth-of-the-change-in-inventories-econ-101/. US Real GDP vs Inv Change uses the auto industry to illustrate this point. In the past this has been one of signs of recession. In today’s supply chain disruptions, a decline in inventory w/o replacement production is a negative for Real GDP and misrepresents the current economic trend. The lack of vehicle and air craft production to offset inventory declines in a period when demand is high misrepresents economic expansion.

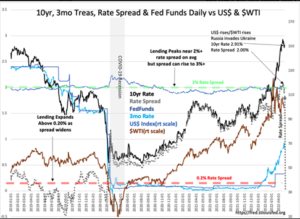

The T-Bill/10yr Treas Rate Spread continues to hover near or over 2.00%. This remains a very strong indicator of economic expansion as capital continues to move from Fixed Income into equity. The term equity includes stocks and business ventures. The earnings reports strongly favor investment in core economic businesses and disfavor the COVID-favored stay-at-home issues. The correction occurring today is sharply focused on issues heavily favored 2yrs ago. Amazon, Teledoc, Netflix have corrected sharply with lower share prices likely as investors warm-up to earnings trends emerging as headline stories in companies such as Exxon, Federal Express and issues like Thor Inds and Camping World with solid but ignored business trends.

The decline reported in Real GDP is a signal of demand requiring more supply. It is not a signal that economic growth is slowing.