“Davidson” submits:

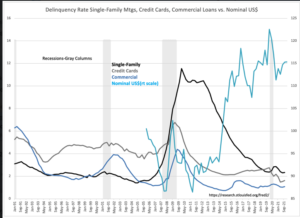

As a macro-indicator of financial stress, US delinquency rates in consumer and commercial accounts is useful even though this data is only reported quarterly. Including the Nominal US$ Broad Goods&Svcs helps to define the current environment in the face of recent sharp declines in market prices. Several observations counter the rash of recession predictions and forecasts of a collapsing US$ as a global currency.

- US delinquency rates continue lower, near recent historical levels indicating little of the stress that precedes past recessions.

- The US continues to attract global capital making the US$ the strongest global currency even with our own issues in plain view. The recent shift higher is the result of capital from the Eurozone on the Russia/Ukraine conflict.

There is no risk in my estimation that the US$ is under threat of replacement by any other fiat currency and no risk of recession due to excess financial speculation. A recession due to government policy can occur at any time as was just experienced with COVID which is an entirely a separate matter than a financial recession.

Anecdotal information leads to the interpretation that the current bout of fear and market sell-offs is connected to inexperienced investors both Domestic and foreign seeking quick profits employing Momentum trading. Several sources build a picture of investor types. We have an established history of Russian, Chinese, So. American and etc capital seeking safe haven in the US for several decades. We also have some insight to speculative real estate activity by Chinese investors and their use of leverage in an over-levered market by US standards. We can see how they over-price in Chinese companies on Chinese and US exchanges. Add to this, the recent wild trading in Gamestop, AMC, Cryptocurrencies and the many recent IPOs spurred by the COVID lockdown which were priced 50x-100+x Revenue to the cheering of the media. From a Value Investor perspective, this was wildly speculative and created market indices dominated by these issues which skewed performances. The media and many advisors title these issues “Growth” when Cash Flows and Net Income were non-existent. Nonetheless, when these issues correct, the same advisors claim the economy is slowing even though they mostly added no economic value.

The current correction of “Growth” is not a financial correction. It is better described as a “Market Psychology” correction. Tracking companies vital to creating economic value i.e. companies which create Cash Flow, Net Income and Shareholder Equity, one sees that the economic expansion from April 2020 continues. The market’s perception with its focus on those issues benefiting from rapid Revenue growth have virtually ignored the 85% of other issues providing core value creation. When speculative-growth corrects, all issues feel some pricing pressure, but those with real Net Income growth recover if that growth continues.

In my estimation, as the highly-priced issues fail to deliver as promised with individuals returning to normal activity, investors should turn to companies ignored the past 2yrs. The volatility we are experiencing today comes from names like NFLX down 25% in one day and others which having been over-priced on expected Revenue growth are suddenly experiencing a normalized environment. At some point, the capital withdrawn from highly-priced issues should find new Momentum price-trends to track in the 85%+ previously ignored.

Economic conditions continue to expand and many well-managed companies in recent reports have adjusted their expectations higher.