“Davison” submits:

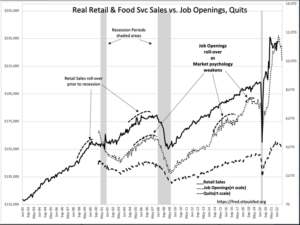

Higher interest rates are having an impact on Job Openings and Quits, both viewed as psychological indicators rather than economic indicators. Real Retail Sales remain steady which is a ‘hard count’ economic indicator. Retail sales may even have an up-tick in the recent data.

The market perception has been turmoil in UK and elsewhere plus a surge in market commentary of rates going too high too fast is creating market instability. Two significant up-days in a row for US equities is likely short covering in anticipation of the Fed not following through a sudden Fed Funds target of 4.25%-4.5% in early 2023. In the UK, forced real estate liquidations are raising concerns of financial collapse of the Lehman/Bear Stearns type of the 2007-2009 sub-prime debacle blamed on the Fed.

In my experience, fears of a greater collapse than previously experienced has been priced into US markets for 5 mos. In addition, the Fed follows T-Bill rates, it does not set rates and has never controlled inflation but once in the past ~70yrs when Paul Volcker raised rates in the early 1980s. Inflation comes from excess government spending and regulation the cure for which is reversal of those actions which have never proven contributors to economic value. Certainly there has been a major turn by money managers towards using T-Bill positions to implement a massive bearish hedge strategy not seen in past periods of pessimism. This has driven T-Bill rates higher which feeds into algorithms as a nearly inverted yield curve. The net effect is fear of decline has reinforced management perception by algorithmic signaling into believing bearish hedges offer guaranteed returns. Problematic with this position is that recessions have never been predicted by the consensus.

Record pessimism is typical of market lows. Economic data does not support the consensus expectation of winning short positions. The Fed just held an emergency meeting to discuss market turmoil. Best guess is they pause due to International requests that the pace of rates had been too fast. This pause coupled with 3Q22 earnings reports showing economic expansion are likely to shift investors towards a more optimistic stance.

Buy equities!