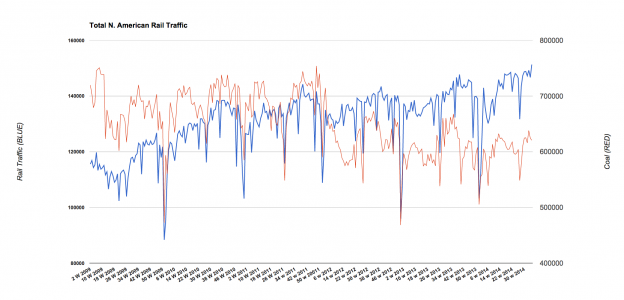

Total N. American rail traffic continued its upward march last week hitting 756k carloads, easily becoming the single best week since I began tracking the series in 2009. Further, for the better part of 2014 rail traffic has sat comfortably above last years high levels. This does explain the 4% GDP reading we just got and the additional surge we are now seeing portends additional impressive GDP numbers going forward. Metal, Stone and Forest products shipment levels are all sitting at or just under the highest levels ever in the series (the high water markers all being set this year) which justifies the residential construction activity we are seeing and should continue to see going forward.

This should, as it has in the past continue to push markets higher ($SPY)

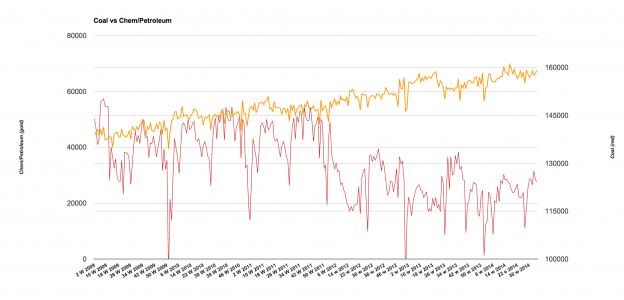

As always I want to refute the “rail traffic is only up because of oil” argument. If you look at the chart below we have see a ~20k-25K weekly reduction in coal shipments primarily due to low natural gas prices thanks to fracking. that fracking has also lead to additional oil activity which has lease to a 15k-20k weekly increase in oil/chemical shipments. So, what I am trying to say here is that fracking, and its effect on what is shipped via rail vs pipeline has at best been net neutral for rails (only recently) and most weeks is still a net negative.