“Davidson” submits:

Oil prices ($USO) are falling as are the prices for copper and other raw materials. Many interpret this as the end to economic expansion. The equity markets have slipped a little and this is taken as confirmation that the end of our ‘Bull Market’ since 2009 is at hand.

Most of the talk about interest rates is simply well off the mark. Most of the talk is that the only reason stocks are higher is due to low rates. Many continue to say that there is little to no economic recovery, hiring remains tepid, retail sales remain awful and on and on and on. The talk is that higher rates will not only reverse all stock market gains but even result financial collapse and the Dow Jones Index is predicted to fall to $5,000 from its current level near $17,000.

The problem with all this hype is that we have had the same general fears since 2009 yet the SP500 has risen from under $700 to $2,000 recently. Is anything different this time from the series of panicky periods the past 5yrs? Actually, No!!

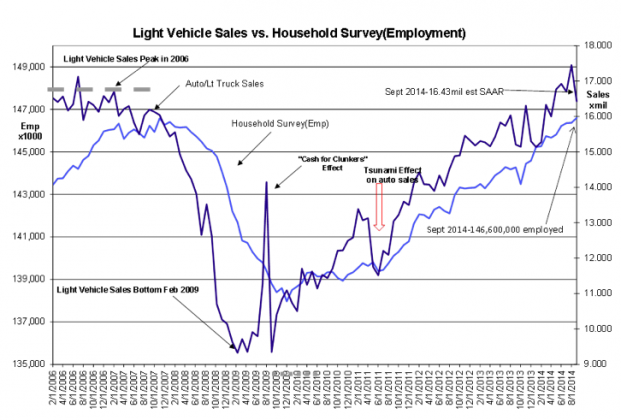

This week we have vehicle sales and employment reported in line with recent trends. Moments ago the Household Survey was released at 146,600,000 or 232,000 higher than August-see the chart. This is not the ‘false’ economic recovery many seem to be focused on. There have been millions of real jobs created since early 2009 and similar millions of vehicles purchased. The trend continues.

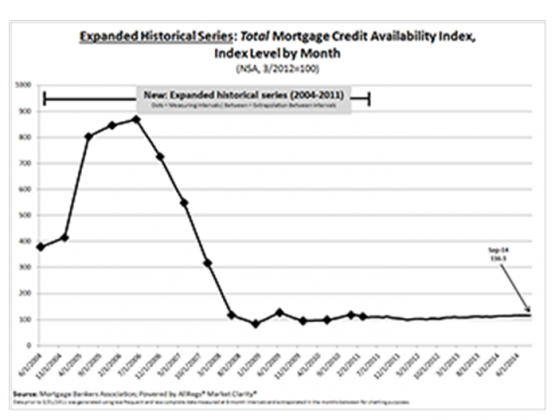

The two lagging sectors in the current economy remain housing and construction which require credit spreads wide enough to permit bank lending. The chart of the MCAI(Mortgage Credit Availability Index) at the bottom shows that while bank lending has increased to 115, it is nowhere near the levels of 2004’s 300-400 which represented a much more robust housing market. The credit spreads need to widen for this to occur which means that the 10yr Treas which is the basis for mortgage rates needs to rise to at least 4%-5% range while the T-Bill rates remain below 0.5%.

At this stage in the economy higher 10yr Treas rates are a good thing and required for continue economic expansion.

Link: http://www.mortgagebankers.org/ResearchandForecasts/mcai.htmMany believe that it is the markets which stimulate the economy and this is the basis of much of what is said in the media. The opposite is true, but those who are short term oriented do not recognize the cause and effect. Being trading oriented means that many misinterpretations occur with meaningless information which should never enter sound investment analysis in my opinion.

The fall of commodity prices in my view is a short term event. It is the result of those who expected hyperinflation from various Fed actions in 2010-2012 suddenly realizing that their earlier positions in oil, gold, copper, land, real estate and etc to profit from hyperinflation has hurt them. They are reversing these trades and it is this which is driving down commodity prices while the US$ has strengthened considerably. I think this trading activity will settle down shortly and the rise in equity markets ($SPY) should continue as investors recognize that the economy is pushing higher.