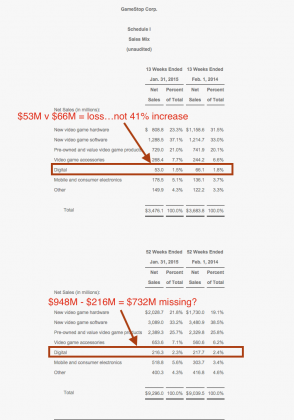

So $GME reported last night and in an attempt to quash the inevitable “is digital eating your business” questions, the company made sure in print and on CNBC they noted “digital receipts grew 30% to $948M” YOY and in Q4 grew “41% to $368M” to let us know they are doing just fine there and in fact seem to be prospering in this area.

So, I naturally decided to check out the claims and here is what I found (click to enlarge):

Note the company is talking about “non-gaap” digital receipts. By “non-gaap” of course we mean “stuff the accounting rules do not allow”. But we’ll run with it. They define “non-gaap” digital revenue as:

“GameStop defines digital receipts as the full amount paid by the customer for digital content at the time of sale and/or the value attributed to digital content when physical and digital products are sold combined.”

I hope for their sake the 10k lays out in far more detail what this is….. when you have an actual number that is ~1/5 the reported number ($216M vs $948M) and no clear reason for that, it raises a whole host of red flags for me. This is especially true when the actual number is actually lower YOY, not 30% higher as claimed. Where could it have come from? Total sales for the company were only $257M higher in 2015 than 2014 so if digital grew the additional $732M over the reported number, that means other categories reported much higher revenues on a gaap basis than they actually achieved using their own non-gaap metrics.

The problem with that is we have ~$500M ($732 total rise in digital vs $257M total rise company wide) missing here….

It gets worse… even if we assume (and it is a big assumption) that EVERY penny of the increases in video game accessories ($93M), mobile & consumer electronics ($215M) and new hardware ($298M) can be somehow attributed 100% to “digital” we still come up only $606M and are missing ($732M -$606M) $126M. I use those categories because they were the only ones that had actual gaap YOY increases (I excluded the small gains in used video sales because they are what they are). So, we have to then assume that both 100% of the increases here inexplicably go to digital and the losses in some of the other are worse than reported.

If you have a massive “non-gapp” adjustment to the positive in one area, you subsequently must have a corresponding write down in another. You just can manufacture ~$700M in sales receipts out of thin air. So until we get that (or get much explanation how this “value” is determined) and fully understand just how bad other areas are, their “digital increase” in meaningless at best and highly questionable at worst.

For those wondering it was not addressed on the earnings call either.

Companies will use “non-gaap” metrics because they claims that those metrics “better represent what is happening with the business”. That is fine and in many cases they do. But, you can’t add >$700M to a category, increasing its sales nearly 5X and then not offset any other category. If management wants us to think digital is growing >$700M is a better indicator of the current state of the business vs what the actual number was then they ought to tell us where the >$700M shrinkage is in the other categories so investors have the whole picture because other categories just got a whole lot worse than the reported gaap numbers indicate…

You just can’t make up sales