Unless you believe the desire to reduce a company’s energy costs is going away, then this company looks like a steal at current levels

Orion Energy Systems, Inc. (OESX) designs, manufactures, markets and implements energy management systems consisting primarily of high-performance, energy efficient lighting systems, controls and related services. Its energy management systems deliver energy savings and efficiency gains to its commercial and industrial customers without compromising their quantity or quality of light. The core of its energy management system is its high intensity fluorescent (HIF), lighting system that the Company estimate cuts its customers’ lighting-related electricity costs by approximately 50%, while increasing their quantity of light by approximately 50% and improving lighting quality when replacing traditional high intensity discharge (HID), fixtures. The Company had sold and installed its HIF fixtures in over 4,500 facilities across North America, representing over 756 million square feet of commercial and industrial building space, including for 115 Fortune 500 companies.

Let’s go through some basics and then look at why this is a good investment and see what that catalyst we are looking for actually is.

Here is the sales/operating earnings history (click to enlarge):

Fantastic growth until last FY (runs March to March) like the rest of the world. There is an important point here. Orion is not losing business to other competitors, they are rather losing business (in FY 2009) to reduces Capex budgets AND the closure of facilities during the recession. Many projects were also delayed to companies downsizing. they gave the example that in some cases they are now dealing with the 4 or 5 purchasing managers at some locations due to employment reductions. This cause delays as it essentially puts the whole process back to the beginning each time. We will get back to how this has been addressed later.

From this we can deduce they are not simply a bit layer with smaller firms.

It is the way that this deal has been structured since October 2008 that is so important for us:

In October 2008, we introduced to the market a new financing program called the Orion Virtual Power Plant (“OVPP”) for our customer’s purchase of our energy management systems. The OVPP is structured as a supply contract in which we commit to deliver a defined amount of energy savings at a fixed rate over the life of the contract, typically 60 months. We collect payments from our customer on a monthly basis across the delivery period. This program creates a revenue stream, but may lessen near-term revenues as the payments are recognized as revenue on a monthly basis over the life of the contract versus upfront upon product shipment or project completion. However, we do retain the option to sell the payment stream to a third party finance company, as we have done under the terms of our former financing program, in which case the revenue would be recognized at the net present value of the total future payments from the finance company upon completion of the project. The OVPP program was established to assist customers who are interested in purchasing our energy management systems but who have capital expenditure budget limitations. For the fiscal 2010 first quarter ended June 30, 2009, we recognized $59,000 of revenue from completed OVPP contracts. As of June 30, 2009, we have signed 36 customers to supply agreements representing future gross revenue streams of $3.6 million. In the future, we expect an increase in the volume of contracts that utilize the OVPP financing program.

We recognize revenue on product only sales at the time of shipment. For projects consisting of multiple elements of revenue, such as a combination of product sales and services, we separate the project into separate units of accounting based on their relative fair values for revenue recognition purposes. Additionally, the deferral of revenue on a delivered element may be required if such revenue is contingent upon the delivery of the remaining undelivered elements. We recognize revenue at the time of product shipment on product sales and on services completed prior to product shipment. We recognize revenue associated with services provided after product shipment, based on their fair value, when the services are completed and customer acceptance has been received. When other significant obligations or acceptance terms remain after products are delivered, revenue is recognized only after such obligations are fulfilled or acceptance by the customer has occurred.

Now, we all know that from the time Lehman collapsed until essentially May of this year, business ground to a halt. Predictably, Orion’s has suffered along with it. The effects of this program in terms of sales is only now beginning to be felt. Because the revenue reporting on this program is different than previously, initial results of a sale will show lower initial revenue as revenues are reported monthly over the life if the agreement (5 years) rather than an upfront payment.

What we now get is an asset that will eventually be sold to a third party, allowing for full immediate recognition of the sale. What it also does in the short term is allow for a far easier sales process for Orion.

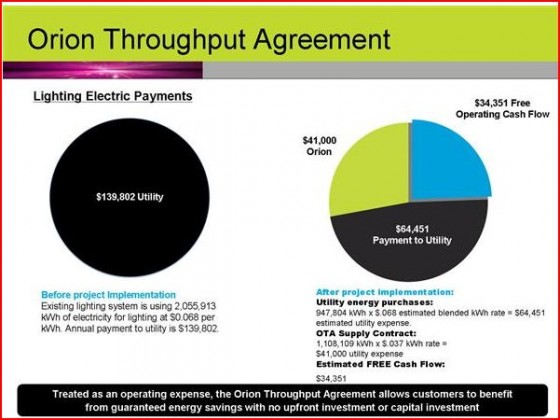

Notice in the graphic above the payments from the companies choosing Orion net out the same in both circles. The way the deals are now structured under the OVPP system, companies can account for the equipment upgrade as an operating expense (like a utility bill) rather than a Capital Expenditure. With capex budgets being slashed across the nation, the importance of this cannot be understated.

It also means that Orion recognizes the cost of the system up front, while it records revenues form it over time. THAT, gives us our opportunity. Until Orion builds up the monthly revenue stream to offset the upfront costs, results will appear to be worse than they really are. In the most recent quarter Orion had $1.1m of unrecognized revenue ($.02 a share in profits) due to this change. That does not disappear but is simply delayed. When they sell it to the third party, it is then recognized. Over time the monthly revenue stream will build, and the results of all the increased sales will be seen. Until then, we have our buying opportunity.

So, how is it working? Currently they have 36 of the contracts and 63% of them came in Q1 FY 2010 (ending 6/30). This means there has been a significant ramp-up in sales volume in just the first quarter.

Market trends:

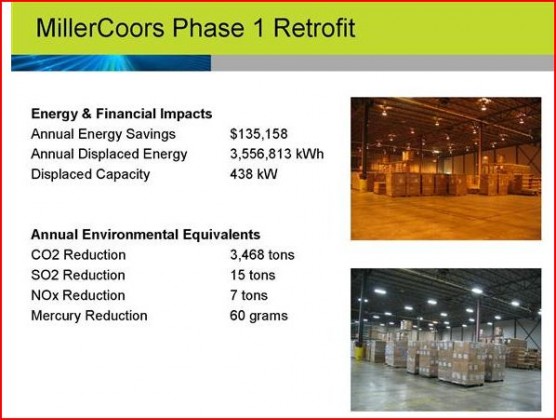

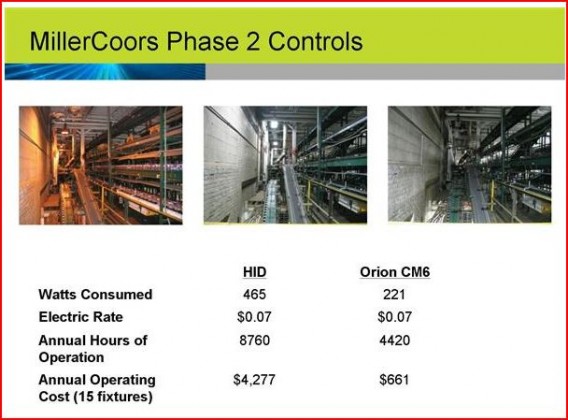

Here is a recent expample of what they can do:

Valuation:

Currently they have $34m in cash, $11.5 in receivables and $21m of inventory valued at FIFO. On the other side they have $4.4m in accounts payable and $1.3m in debt and interest due in the next 3 years. There are 21.7m shares outstanding.

That gives us $1.56 per share in cash, $.53 a share in receivables and $.48 a share in inventory (I only value inventory at 50% of carrying value) for a total of $2.57 a share. We have to subtract $.26 a share for payables and debt/interest giving us a final tally of $2.31

Orion currently sports a $3.15 share price meaning 81% of our purchase price is cash/assets after payables and debt subtracted. You know we love that cheap valuation, optimist future scenario.

I think Q1 was the low point from them and results from here on out ought to steadily improve….

A new product for them regarding outdoor street lighting will do for municipalities what their indoor products do for companies. The potential market here is staggering. It is currently being tested in about a dozen communities. With state and local governments looking to save money anyplace possible, this has the potential to be a blockbuster. I will keep tabs on this..

Please listen to this

Here is the Q1 earnings call

SEC Q1 FY 2010 10Q

One reply on “Subs: New Buy”

[…] This post was Twitted by twitt3rnews […]