Hard to believe this one…had to read it three times to be sure I wasn’t just reading it wrong, sadly, I wasn’t

First, here is the article:

My comments in bold

David Simon seems determined to make Judge Allan Gropper’s life difficult. The mall operator that he runs on Wednesday raised the stakes in the battle for bankrupt rival General Growth Properties Inc. by effectively matching a bid from Brookfield Asset Management Inc. and other shareholders.

That leaves the bankruptcy judge to decide which bid he prefers on April 29, to take GGP out of bankruptcy. Simon Property Group Inc. has the edge on valuation because its offer with hedge fund Paulson & Co. injects the same amount of cash but forgoes warrants demanded by the Brookfield consortium worth hundreds of millions of dollars. However, it also comes with an added risk: antitrust scrutiny.

In fact, Simon has agreed to limit its voting control to 20% in an attempt to avoid the attention of the Federal Trade Commission. That wouldn’t be surprising, given that Simon and GGP are the two largest American mall operators.

So far so good, pretty basic stuff

Why would Simon be willing to take a passive stake? First, it thinks GGP’s assets are reasonably priced. Second, Simon’s real intent might be to secure a seat at the table so it can move for full control later, without the tight bankruptcy schedule and time to weather a potential anti-trust investigation.

What? Think about this. I guess maybe it depends on your definition of “reasonable”. Based on David Simon’s acquisition history, I’m sure the word “reasonable” has ever left his mouth when talking about an investment. He is investing in GGP at these levels because he feels shares are very much undervalued when the quality of the assets is taken into consideration. If shares are indeed “reasonably” priced and not undervalued, then Simon can acquire a “seat at the table” at any time. No need to rush and do it now.

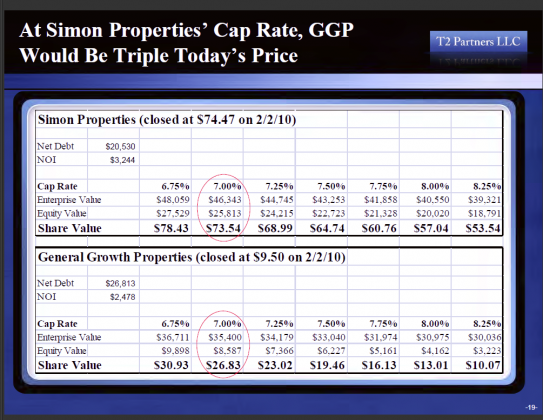

See, REIT’s are valued by this nifty little metric called a “cap rate”. We won’t go into details on determining that and its nuances because I have a chart here that shows it:

What are we looking at? The reason David Simon and every other bidder is willing to put billions (that’s right, with a “b”) into GGP. The chart is from February but the financial metrics still hold. The only thing that has changed is the prices of the stock.

Right now Simon has managed to take itself off the chart with its $87 share price. It does mean that the effective cap rate for Simon right now is ~6.25%. At $16 a share, the effective cap rate for GGP now is 7.75%. That spread, and the insanity of it is the reason billions (still with a “b”) are attempting to invest in GGP. If we close that spread (as it will as Chapter 11 emergence comes closer) by lowering GGP’s cap rate the VALUE of the equity on GGP will climb to the $26 to $30 range.

That is why a host of very smart people are trying to buy in now

For now, GGP investors shouldn’t lick their chops at the prospect of ever-higher bids. Paulson has agreed to buy $1 billion in new shares, with Simon purchasing $2.5 billion. But Simon would also be willing to spend another $3 billion if other investors don’t show up. Simon has said it would sell those additional shares to keep a lid on its stake after GGP emerges from bankruptcy. That could send the stock down sharply.

Note: In Simon’s letter he said:

“Simon would agree not only to seek the disposition of any shares issued with respect to its backup commitment as promptly as practicable, but also to the effective sterilization of such interest for voting and control purposes prior to such disposition. Simon’s voting interest in GGP would generally be limited to 20% of the outstanding shares.”

See? Simon has NO intention of dumping shares on the open market to tank the price and take a large loss. Do we really think David Simon is going to backstop $3B and then watch the value of that collapse because he has told the world he will dump it right away? What they will do is limit their voting to 20% no matter how many shares they hold. In other words, the previous paragraph is utterly incorrect on just about every level.

What is clear is that any offer from Simon for the whole company is a ways off. And if Wednesday’s proposal fails, a full takeover is unlikely. That makes buying GGP at current prices a dangerous maneuver.

Why? Really…why? The author makes the fatal flaw of confusing “price” with “value”. He assumes shares are correctly valued at this level and ONLY worth more if an offer comes in for more that the current price. Absent a total buy, shares will crash. The fact that Simon/Pershing/Fairholme/Brookfield Asset/John Paulson/Elliot and whomever is buying shares now think it is a steal at these levels seems to matter not.

There is a reason Berkowitz and Brookfield are converting unsecured debt to equity rather than cashing out, they see large upside to the equity. I fail to see the reasoning behind the theory that says if Simon’s offer is rejected, shareholders are any worse of than they would be with essentially the very same offer from Brookfield/Pershing/Fairholme. The reality is that if it is rejected it more than likely will be because the group will have agreed to also waive their warrants/raise their price or made some other consession.

We have said here relentlessly that Simon does not have the ability to do an complete takeover by themselves and FTC issues prevent it anyway. That being said, China Investment (CIC), whom signed a non-disclosure and has been going over GGP’s book has $300B to invest. That simply means they could write a check for GGP will sofa change tomorrow should they wish. The success or failure of Simon is not even close to the determining factor of whether or not GGP is purchased.

The author assumes GGP even wants a buyer of itself. The stark reality is management and current investors, knowing the value of the company do not want to sell their shares at current value and would rather hold on to their investment barring an offer today that simply cannot be dismissed.

It is rare I take to task an article like this but the frustration over the WSJ’s coverage of this is showing through. It appears far too often to simply be an extension of any PR firm Simon or anyone else wanting to scare current shareholders into thinking a price crash is imminent and that whatever offer Simon (or whomever else) may put forward ought to be scooped up.

Here are a few examples: Here, here, and here. The coverage when it has come to Simon has been one sided, and worse….wrong..

Remember folks, THIS VERY SAME AUTHOR TOLD US NOT TOO LONG AGO WE SHOULD TAKE THE $9 OFFER AND “NOT ROLL THE DICE“…..

We were wise to ignore him then and wise to do so now…