Seeing a ton of hand wringing out there so time to step back and see where we are at. Some thoughts

Here comes a ton of economic data charts. You’ll notice something…they are all going in the right direction…

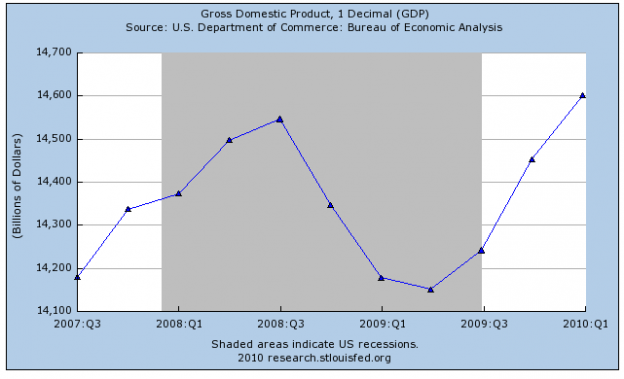

GDP:

Note: Goldman Sachs this morning upped their US GDP forecast for 2010 from 3.2% to 3.7%. The tinfoil hat crowd (ZH) that thinks Goldman is the world’s puppeteer must now conclude this will happen. Too bad it is good news….goes against their conspiracy theories…

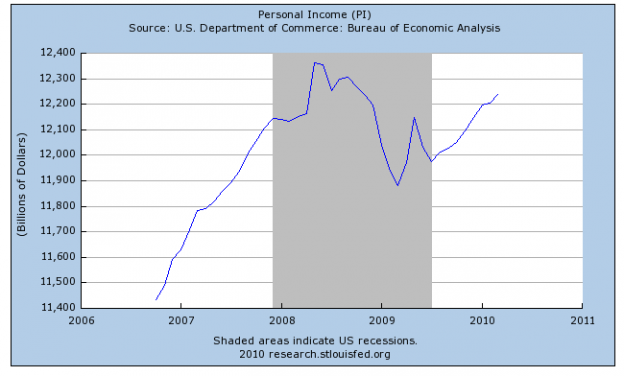

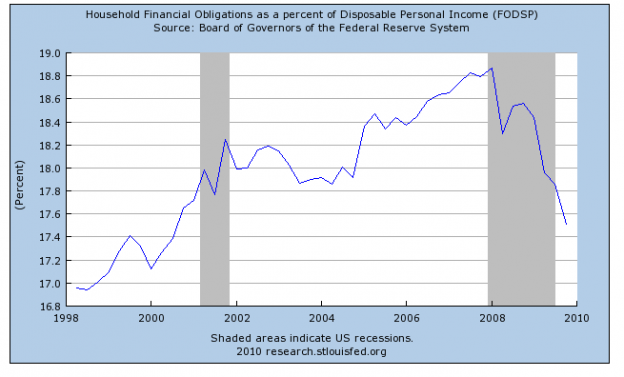

With income rising, is the consumer adding debt or are they continuing to deleverage?

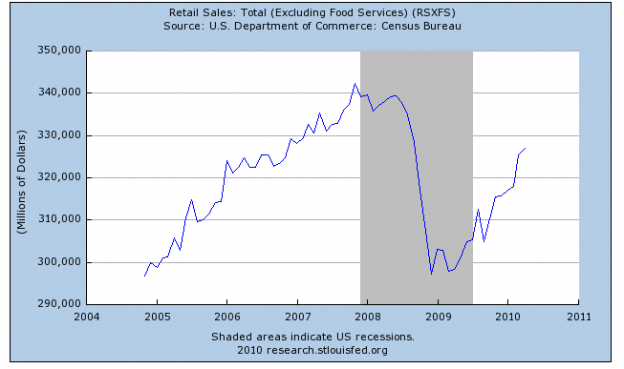

So, with the consumer carrying less debt, lets look at retail sales. If they are rising with a de-leveraging consumer, that is a healthy sign.

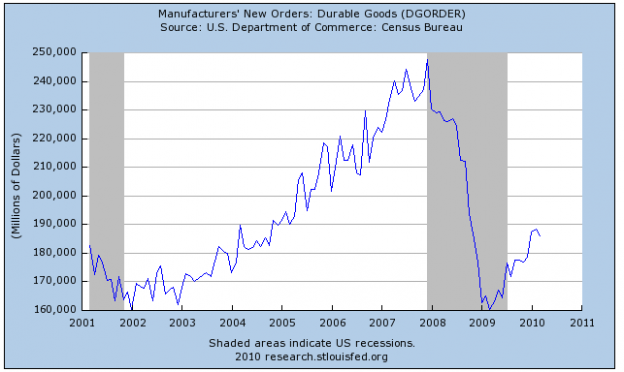

Are businesses spending and is the consumer making investments in bigger ticket items?

Falling oil prices are a positive also..think of them like a stealth tax break for consumers.

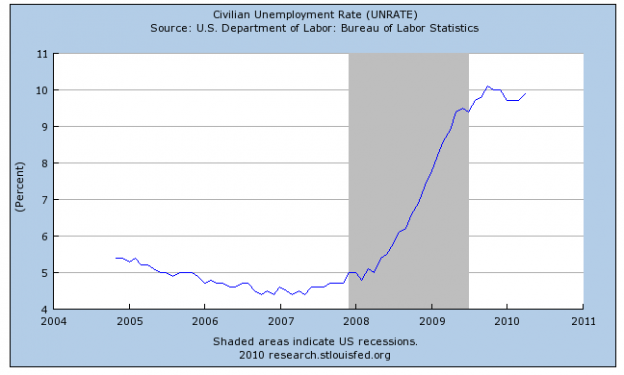

Are more people still being laid off or is the pace slowing?

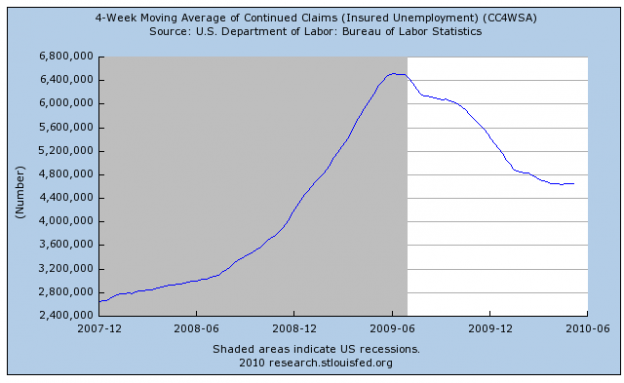

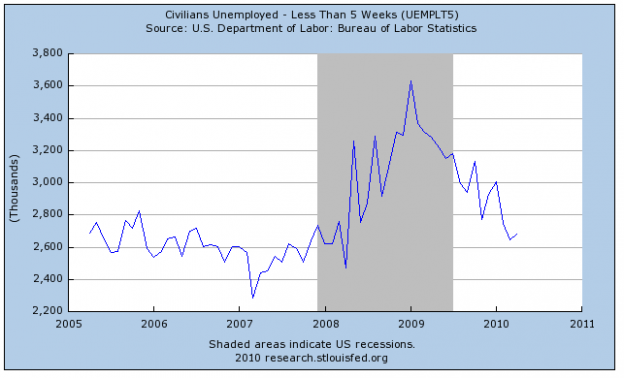

Stubbornly high. However, it is a lagging indicator in recoveries. The last cost employers add is staffing. The fact it seems to have peaked is a positive. Now lets look at the pipeline. If continuing claims are falling then then we can contribute the current rate to more people being positive about the job market and re-entering it. Then we’ll need to look at the people unemployed <5 weeks. This will tell us new claims and what is coming down the road. I use this over initial claims as the 5 week number distills some of the volatility out of the initial numbers. Plus, I want to know who is staying unemployed, not who got laid off today and may have found a job two weeks later. Both these charts are moving in the right direction.

Does this mean everything is rosy and we have nothing to worry about? No. It does mean that we are in far better shape than we were in 2008/2009 when every chart was moving in the wrong direction. That allows the general economy to feel the effects of a Greece far less that they would have previously. This isn’t to say a Greece default would not be a bad thing, it is just to say things now would not come unhinged. After witnessing what happened here post Lehman, I have to thing world leaders are not dumb enough to let it happen again. They may do it kicking and screaming and threaten not to, but they’ll make sure it doesn’t happen. My theory is $$ will race to safety with the uncertainty which actually is the US….what a difference a year makes….

“But, the market has been manic” you say. True and I would not expect that to change anytime soon. With 2009 memories still very fresh in everyone’s mind, there is a very large percentage of people who are now in a “sell first” mentality. Get used to it as it may very well be with us for some time. Add to that the fact that information/news/rumor race to us at a rate never seen before and you have a recipe for extreme volatility. Remember, the market and the economy often are disconnected. If they weren’t, we would never be under or over valued. Since we often are, we know there is a gap between price and value.

This does not have to be bad if you expect it. The patient investor/trader can take advantage of it by keeping an ample cash cushion, not panic selling and being an opportunistic buyer.

It is more important than ever then to be able to take a step back and look at the big picture….that picture now is telling me things are gradually improving. So turn off the TV and focus on those mediums that provide you information and are not looking to drive ratings with drama and excess. Then take that information, develop a plan and work it keeping your emotions in check….

It works..