“Davidson” submits:

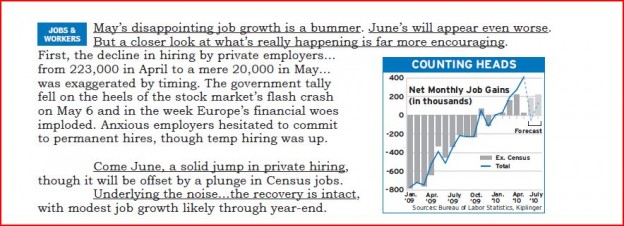

An employment increase of 431,000 was reported this morning vs. an 515,000 expectation. The Household Emp Survey takes less than 1% survey of households and scales this up to 140mill for this report. There is considerable room for adjustment to this initial report. In addition with the census data now being collected we will see this figure corrected 3yr-5yr from now. At the moment the trend is inline with recovery.

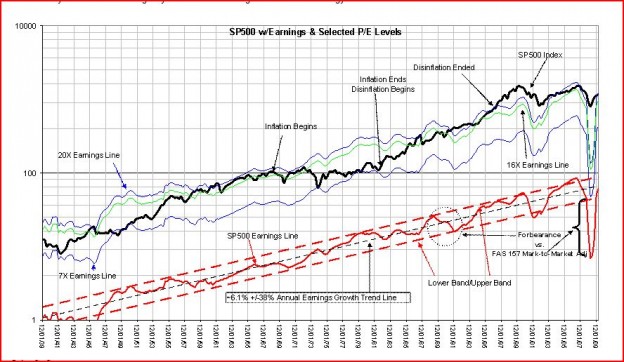

With Standard&Poors indicating that 99% of earnings reports are in for 1Q2010 earnings reports, I have updated the SP500 chart. The SP500 Earnings Trend Line as of 3/31/2010 stands $60.94(RED line) compared to the Annual Earnings Growth Trend Line at $66.42(BLACK dotted line). Howard Silverblatt the keeper of the SP500 data says that the sharp recovery is due in part to the reversal of previous asset write-downs per FAS 157(Mark-to-Market) which has greatly distorted the data. SP500 cannot readily distinguish between actual earnings and re-marked assets. There are still some 7mill individuals without employment vs. peak of 146,306,000 on April 2008 and without these individuals employed the reported sharp earnings recovery this early in the recovery is more likely due to remarked assets than net income derived from sales revenue.

Here is Kiplingers on Employment (click to enlarge):

One reply on “$$ Davidson on Unemployment & S&P Earnings”

[…] $$ Davidson οח Unemployment & S&P Earnings Value Plays […]