“Davidson” submits…

There is no MBA/CFA program anywhere in which this is taught even though the concept when explained is universally acknowledged.

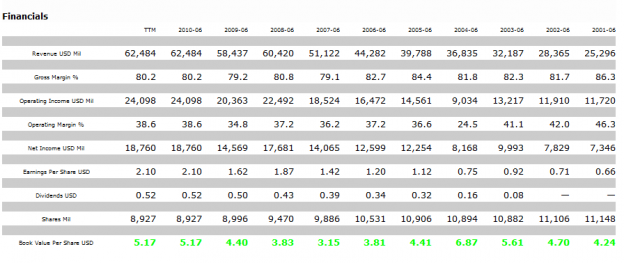

The key to gaining capital appreciation in stocks is simple, i.e. the stock must have growth in the BV/Shr ratio. MSFT is spotty at best and if you were looking at 6/2007 you would have lost close to 20% from 6/2001.

You will find that every test of BV/Shr growth with that of stock price growth over time shows good correlation. For Exxon Mobil the BV/Shr growth rate is ~11.5% and is virtually identical to the price appreciation over a business cycle.

This is Morningstar data.

My Addition:

This would be the reason MSFT stock has essentially gone nowhere in the past 10 years. There has been no sustained increase in BV/share. MSFT BV today is the same as 2006……it share price? The same as 2006. This is no coincidence. For MSFT to be a “value” now, you have to believe it will do something it has not done this decade, grow BV/share for the 5th consecutive year. Will we get a 10%-15% jump in the stock, who knows? But, if you are looking for price appreciation into the 30’s to 40’s, I fear your wait may just a a very prolonged one……

2 replies on “$$ Book Value Growth = Share Growth & Why MSFT Is No Value”

[…] Why Microsoft stock has gone nowhere for the past decade. (ValuePlays) […]

[…] but tends to get overlooked by many investors is the simple book value to share price rule. A good reminder from Todd Sullivan at ValuePlays on this rule. Categories: Uncategorized Comments (0) Trackbacks (0) […]