For some fun (I know…stop laughing) I thought I’d dig through JCP filings to get a better handle on what Ackman/Vornado see in it.

Here is the brief rundown as I suspect this is some sort of RE play (hence Vornado’s interest)

- JCP owns ~41M sq. feet of its retail space (JCP does not break it out so I simply divided the owned by the total and applied that % to the total sq. ft. of space) that generates ~$149 sales per sq/ft. (for all properties, jcp.com sales excluded) for ~$6.1B in revenue from owned RE (not including distribution centers).

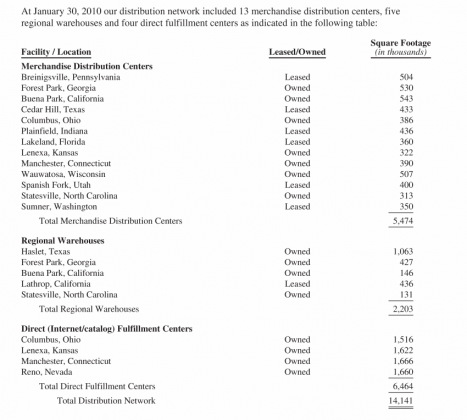

- 11.2M sq.ft of owned distribution space:

- They also own their Plano HQ and the 240 acres around it

- 3 consecutive years of declining revenues/eps

- Interest expense rising/ SG&A constant (FY 2009)

- Cap Ex down $600M since 2007….cash up $500M…debt down $300M (FY 2009)

- EPS down 80% (FY 2009) from 2007

The value in JCP is clearly its RE holdings. Since JCP management and Board has less CRE experience than my 4 kids (all under 7), we have to assume this is the reason for Vornado being included. Two scenarios, outright sale/leaseback of the properties to Vornado (already a JCP landlord in many areas) OR the creations of a JCP Reit/Vornado JV in which Vornado would own >50% and operate.

Why? JCP doesn’t need to own its RE. It makes them no money and in 2009:

Impairment losses totaling $42 million, $21 million and $1 million in 2009, 2008 and 2007, respectively, were recorded in the Consolidated Statement of Operations in the real estate and other, net line item. The 2009 impairment charges include primarily seven department stores and other corporate asset

$42 million, while not seemingly like a huge number for a company valued at $7.8B, is quite a bit when you consider JCP made only $241M in 2009. Owning the RE for JCP as it ages has several issues. First cap ex on it is higher than under a lease, it depreciates and becomes impaired as CRE prices fall. All of these are negative to earnings. I would argue JCP should have taken larger write-downs in 2008-09 but that is a discussion for another day. In 2009 JCP made $304M in lease payments (FY 2009 10-k pg f-24) including overage and personal property leases. This number is well under JCP’s depreciation, impairment charges and debt service on owned properties. In other words, leasing, not owning these would be a net positive operationally.

JCP realizes the value of the REIT structure as the themselves have $178M invested in REIT assets (FY 2009 10k pg f-17). No details of what these investments are in are disclosed.

Real estate and other consists mainly of ongoing operating income from our real estate subsidiaries whose primary investments are in REITs, as well as investments in 14 joint ventures that own regional mall properties, six as general partner and eight as limited partner.

What price then? There has to be some assumptions here so we are going to use base numbers so as to not get confused with fudging anything. All estimates are purposely on the conservative side.

JCP values its land/building at $4.5B (FY 2009 10-k pg. f-11) excluding furniture and equipment. We’ll say ~80% of this is the retail space, not distribution/corporate (again no details in 10-k so we’ll simple use the sq. ft ratio from above). That gives us a rough $3.5B carrying value for the retail stores ($14/share). If we subtract this from JCP market cap of $7.8B it means the total retail operations (including jcp.com) are valued at $4.1B ($18/share). The company has $3B in long term debt not tied to any specific RE holding. Any value of that on the open market would be far greater

The good news is that there is serious land value to be unlocked here for shareholders….serious

Now the bad part…

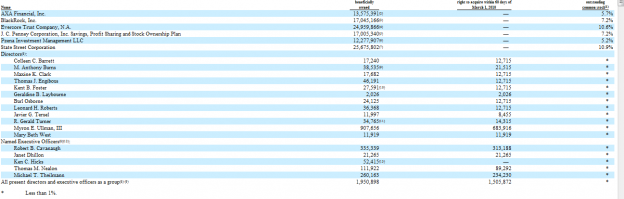

You have all probably heard of management’s “poison pill” action from Monday. In that post I commented on management’s lack of both buying shares on the open market and their ownership in general. After more digging (this information is not in the 10K, filed separately in a 14A) I found it (as of FY 2009): (click all snips to enlarge)

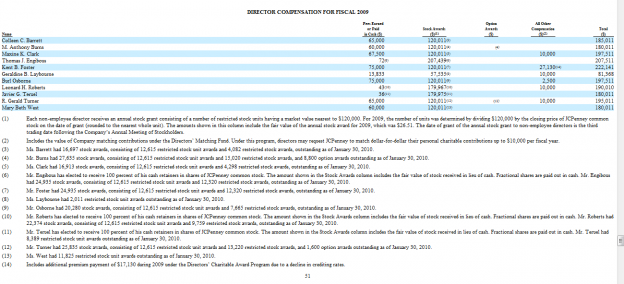

Abysmal, as a group they hold <1%….. CEO Ulman has the most (as he should) but we can see that the vast majority of that is being acquired through the vesting of options/grants/awards, not open market purchases. It is duly noted that his options are tied stock performance while awards are for showing up to work. It is also noted that stock awards since 2007 have totaled $12m+ and options grants >$9M. In fact, I have not seen that during 2009 or 2010 management made ANY open market purchases of stock. But, you’ll say “20k shares at $30 a share is still $600k worth of stock”. Yes it is. However, if we look at the chart below, we see share for the Board are being accumulated through awards of 16k to 25k shares a year in most cases, not even from the exercise of options or god forbid open market purchases. Bottom line, the $60k a year the BOD takes is sweet and the stock awards are a pure gift.

Point: I am not saying JCP is unique here and this stuff is not rampant in corporate USA. JCP’s BOD just happens to be the ones trying to make it impossible for their largest shareholder (and thus largest owner, in case they forgot) to effect change at the company. Because of that we need to really explore what their motives might be. Since they said it was “for shareholders” we have to examine that claim. Due to the fact they are essentially only shareholders of the company due to grants and awards, not open market purchases, I then draw the conclusion that what is of prime importance to them is keeping the gift/grant spigot open vs the performance of the stock.

From the filing:

| Each non-employee director receives an annual stock grant consisting of a number of restricted stock units having a market value nearest to $120,000. For 2009, the number of units was determined by dividing $120,000 by the closing price of JCPenney common stock on the date of grant (rounded to the nearest whole unit). |

Think about it, a Director holding 25k shares and getting another 15k in awards (low end of the range) makes 60% on his/her holdings even if the share price does nothing. Tell me why they would want that to end? Is it any wonder they adopted the poison pill? They do not want the gravy train to stop.

Bottom line for those of you who own shares? When you hear the Board and management talking about “shareholder rights” what they really mean is “the right for us to get more shares for nothing”

Bit of a difference….no?

Also: Two requests to investor relations to discuss the above went ignored.

6 replies on “$$ Looking at JCP For Value and To See What Slithers Beneath”

[…] This post was mentioned on Twitter by Todd Sullivan, MarketFolly.com, Downtown Josh Brown, Tariq Ali, Chris Ciaccia and others. Chris Ciaccia said: Seconded. Todd's the best RT: @marketfolly: Fantastic look at Ackman's potential RE thesis in $JCP via @ToddSullivan http://bit.ly/aGsz7y […]

[…] What does Bill Ackman see in JC Penney? Todd Sullivan checks it out. (ValuePlays) […]

[…] What Bill Ackman may be looking for, i.e real estate, in JC Penney (JCP). (ValuePlays) […]

[…] I still believe JCP is an eventual CRE deal… […]

[…] it just me or does this remind us of $JCP in the early […]

[…] S&P, Durable Goods and Household SurveyCanadian Pacific & Ackman Spar | ValueWalk.com on $$ Looking at JCP For Value and To See What Slithers BeneathTemp Staffing Breaks Historic Pattern | ValueWalk.com on Rail Traffic Also Bucking TrendTemp […]