Ian Cumming has a phrase which he repeated at the 2009 annual meeting that sums his investment philosophy,

“The science is in the “In”. The poetry is in the “Out”.

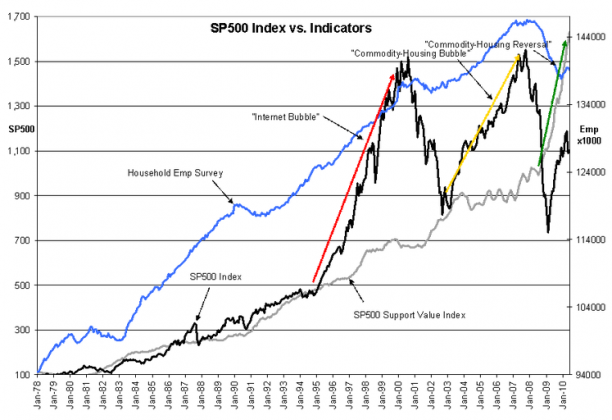

The accompanying chart of the SP500 vs. Indicators provides a visual presentation of this phrase in the context of our recent investment bubbles. Investing is not a mechanical process in which one can buy stocks on simplistic P/E ratios and Cash Flow multiples. Investing requires that one take into account and attempt to measure valuations (the “science”) at one extreme (market lows) and market psychology (the “poetry’) at the other extreme (market highs). While many talk as if investing and market/equity/bond valuations form a body of hard science, i.e. the study of Economics is called the “Dismal Science”, in the end, the price of things have always come down to what people thought they were worth at that particular moment in time.

SP500 Finds Support at the SP500 Support Value Index & When Employment Is Turning Towards Being Positive -“Science”

The “science” portion of investing is represented by a SP500 Support Value Index. This is calculated by taking the SP500 Mean Earnings (long term earnings growth of 6.1%-ask for additional information or look at previous commentaries for SP500 & Earnings Chart from 1939-2010) and dividing by the Market Capitalization Rate (capitalizing the earnings) to produce a SP500 price as if the market adhered to this pricing benchmark. If the SP500 Index is below the SP500 Value Support Index, then the SP500 is considered under-valued, if the SP500 is in line with the SP500 Value Support Index, then it is considered to be at fair value and if the SP500 Index is above the SP500 Support Value Index, then it is considered over-valued. One can see in the chart that 1994 and 2003 the SP500 Index found support at the SP500 Support Value Index level. Today the SP500 Support Value Index has soared well above the SP500 Index due to the inflation component of the Market Capitalization Rate falling from nearly 3% July 2008 to ~1% today.*

*The math of the calculation is SP500 Mean Earnings for October 2010 of $68.75 divided by 4.1% (current Market Cap Rate) to produce a SP500 Support Value Index of ~1,677. If Bernanke causes inflation to rise to 2% the Market Cap Rate will rise to 5.2% and the SP500 Support Value Index will fall to ~1,322.The SP500 finds support thru the actions of value investors who buy in anticipation of future returns using Ian Cumming’s “science”. Value investors like Cumming are often buying stocks and businesses during the period in which the SP500 Index is at or below the SP500 Support Value Index. We can know this by reading annual reports and earnings transcripts in which they describe these actions. These are investors with a good sense of business’s long term economic value, very much like the SP500 Mean Earnings Trend Line. They make investments trusting that the economy will recover as it has historically. These investors have both a good sense of economic continuum and business history.

Additionally, Value Investors are also often Private Equity Investors. Business owners are some of the first to sense changes in economic demand. Employment trends make a good proxy for economic activity and the preferred data series for this is the Household Employment Survey. Typically the SP500 has turned with changes in the momentum of Household Employment Survey. Value/Private Equity Investors are usually among the first to be aware of these turns and are often buying businesses during market and economic low periods.

Value Investors are keenly tuned to both economic activity and valuation. Their investment activity reflects this. It is the basis for Ian Cumming’s use of the term “science”. That the SP500 Index can turn with either economic momentum or the SP500 Valuation Support Index can be seen in the chart.

The SP500 Peaks when Employment Peaks -“Poetry”

The “poetry” portion of investing is represented best by peaks in the Household Employment Survey. Employment momentum has a historical cyclical pattern that once lifting from recession it continues till economic excess and then enters a period of correction. Government changes in liquidity can impede or extend the length of the cycle, but once it has gone to excess, there has been little government can do other than let the corrective cycle play out. Identifying an economic peak requires tracking multiple data series, listening carefully to earnings calls and when the final assessment is made that an economic peak is at hand, one makes a judgment based on the combined sense of multiple inputs. In the final analysis this is more “poetry” than “science” as stocks historically are considerably over-valued at this point from the perspective of SP500 Support Value Index.

Bubbles

The chart has arrows for the “Internet Bubble”, the “Commodity-Housing Bubble” and an arrow for the “Commodity-Housing Reversal”. Each of these reflects a panic of one sort or another: the first two being buyers’ panics and the last a sellers’ panic that has driven inflation from ~3% in 2008 to ~1% today. There are always multiple causes and effects, but I believe there is one underlying belief that has been part of the market that has led many into highly speculative actions and it is the belief in “The Invisible Hand”

“The Invisible Hand”

“The Invisible Hand” first phrased by Adam Smith in his 1776 The Wealth of Nations, is the belief that the market prices all commodities and securities at correct valuations. The belief in the market’s ability to do this can likely be traced back to 5500BC, the time of the Sumerians. Friedrich von Hayak promoted the concept that price conveyed economic data in free markets and promoted free markets with fervor. More recently it has been reflected in the use of mathematics to analyze markets use price data. The belief that market prices reflect rational and fair values has led to Modern Portfolio Theory from Harry Markowitz and The Efficient Market Theory from Eugene Fama. In the past 60yrs these concepts have dominated finance studies and led directly to the use of computers, algorithms and an extensive Hedge Fund industry.

“The Invisible Hand” belief is carried by many, but once the business cycle has returned to recession it is the SP500 Support Value Index that identifies “The Invisible Hand” as myth rather than reality. If investors were long term oriented and aware of the cyclic nature of markets, they would never be caught buying into market bubbles at tops nor would they be selling into market panics near lows. They would carefully take a valuation tool like the SP500 Support Valuation Index and make carefully considered investments.

But, this is not how markets work and it is not how most investors think but for a few who think like Ian Cumming (…and Warren Buffett and so on…). Most investors believe that the markets fairly price the value of the economy. As long as employment is rising they buy stocks and as long as employment is falling they sell. The markets appear only attractively priced at the lows using long term economic trends. In all other periods markets appear to be over priced and correlated to economic activity with most investors apparently believing in “The Invisible Hand”.

For Ian Cumming and other Value Investors “The science is in the “In”. The poetry is in the “Out”.

One reply on “$$ “Davidson” on Poetry, Science and Value Investing”

[…] This post was mentioned on Twitter by Todd Sullivan, BertromavichEdenburg. BertromavichEdenburg said: $$ “Davidson” on Poetry, Science and Value Investing Value Plays: Ian Cumming has a phrase which he repeated at … http://bit.ly/aYv5GD […]