“Davidson” submits:

CNBC, for example, and other media outlets rely on fast-paced staccato-like actionable recommendations by guests in 15sec-30sec spots. Fundamentals do not act in this fashion.

It is difficult not to be aware of the daily pronouncements in the media that one trend or another is the dominant driver of markets. It seems that every moment becomes a clarion call to “Do something!” till it suddenly is not! Then, you no longer hear much about it. Most prognosticators use the markets as their prime investment input. This is based on the belief that markets provide one with ultimate forecasting insight. There is a long held belief that market tends carry hidden meanings, Eugene Fama’s “Efficient Market Theory”. This belief has been incorporated into the term “The Invisible Hand” which has been a cultural myth for several centuries. But, the trends that most CNBC types focus intently upon often evaporate within short periods leaving regular investors wondering what all the fuss was about.

Nonetheless, there is so much media commentary that it is hard to avoid the impact of so many being so convinced that their particular trend requires our immediate attention.

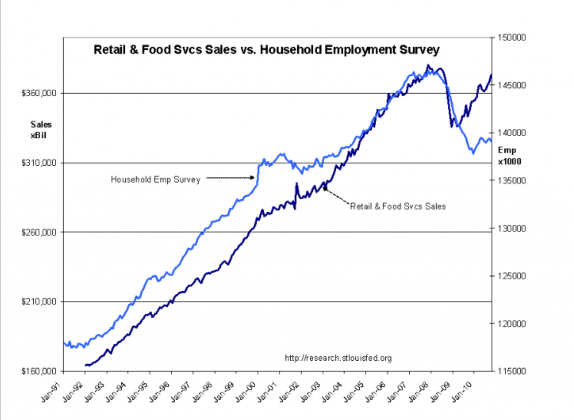

Being prudent investors in my experience involves a far simpler but deeper view of economic patterns which evolve slowly over months and years rather than the peripatetic 30sec actionable event. My commentary directs your focus to economic fundamentals which are shown to correlate with markets over time using various charts. The chart I recently sent regarding Auto & Light Vehicle Sales vs. Household Employment Survey I thought was particularly revealing. Most focus on the 10mil-12mil of unemployed when there remain 139mil employed and consuming individuals who are responsible for the underpinnings of economic recovery. The chart below of Retail & Food Service Sales vs. Household Employment Survey is equally revealing.

Although individual consumption slows during recessions, what is evident is that consumption trends resume fairly rapidly. In the 2002-2003 recession, the consumption slowdown was barely noticeable while the recent recession was coupled with a sharp consumption pull-back. But, as in the Auto & Light Vehicle Sales chart, consumption resumed as a sign of economic recovery well before there was a significant recovery in employment. To understand this, it is helpful to recognize that ~145mil employed individuals support the consumption of ~310mil individuals in the total US population or in other words about 46%-47% of the US population is employed. The fact that recession has caused some to lose their employment does not take away from the 139mil individuals still employed. It is these individuals who once gaining confidence that they will not enter the ranks of the unemployed, resume normal consumption. Higher consumption results in higher employment in the months ahead.

Increases in Consumption = Higher Employment

Business Cycle Time

The likely reason for most missing the economic patterns on which I focus is based on my business cycle time perspective. Being focused on “Business Cycle Time” trains my focus to those basic inputs that evolve slowly and carry in my opinion the greatest long term influences for market prices. Economic fundamentals evolve at a snails pace relative to what is discussed as “actionable” on CNBC. It just does not get much attention, but I think it is the most important.

I think that for this cycle the majority of employment gains are yet ahead of us. The chart of Retail & Food Service Sales support this expectation. For investors this has always spelled opportunity.

3 replies on “$$ Fundamentals Drive the Market…….But Make Lousy TV”

[…] This post was mentioned on Twitter by Todd Sullivan, Tadas Viskanta. Tadas Viskanta said: RT @ToddSullivan: $$ Fundamentals Drive the Market…….But Make Lousy TV http://bit.ly/d0M6iI […]

[…] Fundamentals drive the market, but make for lousy TV. (ValuePlays) […]

[…] links in the story. I especially like the cited work of two of our featured sources — why fundamentals make lousy TV and fourteen reasons that things are better than you […]