Davidson submits:

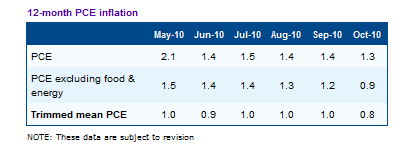

The Dallas Fed released the Oct 2010 12mo Trimmed Mean PCE inflation indicator after the market closed today at 0.8%. Inflation continues to be low and well contained. The corresponding Market Capitalization Rate remains in the 4.1%-4.2% range with a fair value for the SP500 in a range of 1600-1700 should investors become convinced that low inflation is to be with us for a while. Few expect low inflation and have invested accordingly.

Should inflation continue at this pace for the next few years, then the history has been that investors adjust their expectations and I would expect market valuations revised to higher levels. The current low inflation condition has been too short term to expect significant revaluation near term.

Historical valuations vs. inflation make the SP500 significantly undervalued today. I remain quite positive vs. equities.

I hope everyone enjoys the Thanksgiving Holiday!

Dallas Fed:

Apart from yet another sharp increase in the price of gasoline, inflationary pressures in October were as muted as we’ve seen in quite some time. Both the core PCE price index and the trimmed mean registered essentially zero inflation rates in October, each posting annualized rates of just 0.1 percent.

The 12-month core rate fell 0.3 percentage points to 0.9 percent, and the 12-month trimmed mean rate, which had been fairly stable around 1 percent for the past six months, ticked down to 0.8 percent.

To be sure, the headline PCE price index did increase at a 2.0 percent annualized rate in October, but about 90 percent of that gain is accounted for by the price index for gasoline, which jumped 4.7 percent from September to October (or about a 73 percent annualized rate of increase).

So, gasoline aside, are we seeing a downshift in the underlying trend in consumer price inflation? While today’s release certainly points in that direction, one never wants to make too much out of any one month’s numbers. In inflation updates over the past few months, we’ve stated our view that the underlying trend in inflation was stable, albeit at an extremely low level. That view evolved only with the accumulation of several months worth of data. Going forward, we’ll again be looking for patterns that are sustained over multiple months worth of data.

Expect a Smaller Boost from Gasoline in Next Month’s Data

As noted above, rising gasoline prices account for almost all of the increase in the headline PCE price index in October, much as was the case in data for July, August and September. The contribution from gasoline appears poised to abate somewhat in next month’s PCE data.Based on the Department of Energy’s weekly survey of average retail gas prices, November gasoline is tracking at about a gain of 2.1 percent compared with October. The normal seasonal pattern is a roughly 1.0 to 1.4 percent increase in the price of gasoline from October to November. Thus, we should expect a seasonally adjusted increase on the order of 0.7 to 1.1 percent at a monthly rate, much smaller than October’s 4.7 percent increase. A one-month increase in the range of 0.7 to 1.1 percent in turn implies a contribution to the November headline PCE rate from gasoline of between 0.2 and 0.3 annualized percentage points—very modest compared with contributions over the past few months.

Prices for More-Processed Food Items Slip; Dining Out Continues to Firm

Food prices increased at an annualized 0.8 percent rate in October, down from a 3.1 percent rate in September.Prices for items at the less-processed end of the food spectrum increased 3.9 percent at an annualized rate and are up roughly 4.6 percent on a 12-month basis. In contrast, prices for items at the more-processed end fell very slightly in October (–0.3 percent at an annualized rate), breaking a string of three months of fairly solid gains (just under 2 percent annualized, on average). On a 12-month basis, prices for more-processed items are essentially unchanged, down from a 0.3 percent 12-month rate in September.

In contrast to more-processed food items at the grocery store, the price index for dining out—known officially as “other purchased meals”—continues to firm, posting a 2.1 percent annualized increase in October, up from 1.5 percent in September. Dining out—considered part of the core, rather than a component of food—carries a rather large weight in overall PCE (about 4 percent of expenditures), so continued firming here is surely a welcome sign.

Big-Impact Items in the Core

As was the case with September’s data, the negligible change in the core PCE price index for October combined roughly offsetting movements in the prices for core goods and core services. Core goods prices fell even more sharply than they did in September, falling 2.7 percent at an annualized rate, compared with a 1.9 percent rate of decline a month earlier. Core services prices increased at a 1.0 percent annualized rate in October, down from a 1.3 percent rate in September. The 12-month inflation rate for core goods ticked down from –0.6 percent in September to –0.8 percent in October, while the 12-month inflation rate for core services decreased from 1.8 percent to 1.5 percent.Among goods, the components pulling the overall core rate down the most were major household appliances, women’s and girls’ apparel, and a component known officially as “hair, dental, shaving and miscellaneous personal care products except electrical products.” Prescription drugs gave the most substantial positive boost among goods prices. None of those components, however, had what we might consider an extreme impact on the core rate—the exclusion of any one of them would have altered October’s core rate by less than an annualized percentage point.

Core services figure more prominently among the big-impact items in October, in particular some medical care services, financial services and accommodations. The price indexes for hospitals—nonprofit, government and proprietary—combined to shave nearly a full annualized percentage point off the October core rate, but this was roughly offset by a countervailing contribution from the price index for final consumption expenditures of nonprofit institutions serving households. The price indexes for the services of pension funds and the services of “other depository institutions and regulated investment companies” also made significant, though offsetting, contributions to the October core rate. Finally, a sharp drop in the always-volatile price index for hotels and motels subtracted about a 10th of a percentage point from the overall core rate.

Continued Growth in Rents

Rent and owners’ equivalent rent (OER) continued to increase in October.Rent—specifically, renters’ rather than owners’—increased at a 0.7 percent annualized rate. That’s a step down from September’s 1.6 percent but about in line with this component’s average rate of increase over the past six months.

OER increased at a 1 percent annualized rate in October, a sixth straight monthly increase and somewhat faster than we’ve seen, on average, over the past six months. Like renters’ rent, OER has averaged an annualized 0.6 percent rate of increase over the past six months.

Number of Falling-Price Components Increases

Out of the 178 components we track to construct the trimmed mean, 86—nearly half—registered price declines in October, up from 73 in September, and well above the average number seen since fourth quarter 2008.While statements about all-time highs or lows are always a bit tentative in data that are subject to revision, 86 components is (for now) the all-time high for the number of price declines in our component-level data, which go back to 1977.

—Jim Dolmas

November 24, 2010

2 replies on “$$ Inflation Expectations & Market Level”

[…] This post was mentioned on Twitter by Todd Sullivan, The Write Off. The Write Off said: RT @ToddSullivan: $$ Inflation Expectations & Market Level http://bit.ly/hQ5pri […]

[…] Still little sign of inflation. (Pragmatic Capitalism, ValuePlays) […]