Not getting this….

Yesterday’s Headlines….

Q3 GDP Revised Up — U.S. Economy Grew Faster Than Previously Thought

The U.S. economy grew faster than previously estimated in the third quarter, government data showed on Tuesday, but still not enough to address stubbornly high unemployment.

Gross domestic product growth was revised up to an annualized rate of 2.5 percent from 2.0 percent as exports, and consumer and government spending were stronger than initially thought, the Commerce Department said in its second estimate.

Economists had expected GDP growth, which measures total goods and services output within U.S. borders, to be revised up to a 2.4 percent pace. The economy expanded at a 1.7 percent rate in the second quarter.

There are signs activity picked up mildly as the fourth quarter started, but growth will likely remain below the 3.5 percent rate that economists say is needed to reduce a 9.6 percent unemployment rate.

Concerns about the slow growth pace spurred the Federal Reserve early this month to ease monetary policy further through controversial purchases of $600 billion worth of government bonds to drive ultra low interest rates even lower.

The U.S. central bank is expected to cut growth forecasts for this year through 2012 when it releases minutes of the November 2-3 meeting later on Tuesday.

The government revised third-quarter growth to reflect sturdy consumer , government and business spending. Consumer spending, which accounts for more than two-thirds of U.S. economy.

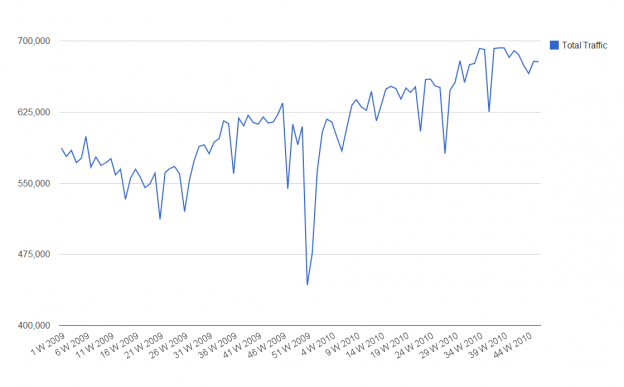

Why are folks shocked? Q2 GDP was 1.7%. Since then temporary employment has continued to rise and rail traffic rose through Q2 and Q3. The latest rail traffic report shows traffic was flat last week:

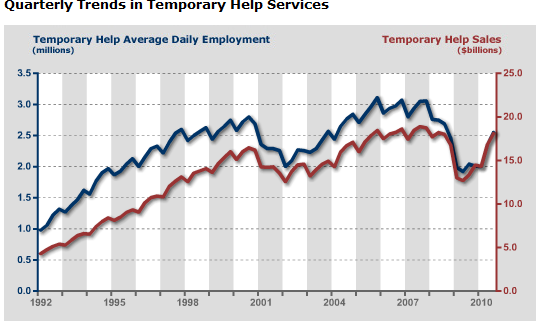

Temporary employment continues at 2008 levels:

These two indicators a base indicators. When firms begin to hire, the first thing they do is add temp help. Future NFP improvements will show up here first. If anything is being manufactured or imported, it shows up in rail numbers. If these numbers are rising, the GDP has to be rising along with it. It just has to….these indicators can’t rise in a vacuum, they are a direct result of increasing underlying economic activity.

The math is simple. If Q2 GDP was 1.7% and rail and temp employment are increasing from their Q2 levels, Q3 will be higher. If that rise is significant (it was) then the GDP rise will be significantly higher. The day preliminary Q3 GDP was released I said:

Now, I do not have a crystal ball nor am I some “wicked awesome predictor” to use some Boston slang. I simply follow the data of what I consider the two best predictors of economic activity. I am long/bullish because those fundamental data points tell me things continue to improve in the US economy and based on the magnitude of rail/temp data improvement, I knew that the final GDP # would be better than the initial 2% that was predicted (vs 1.7% Q2).

I also know that fundamentals drive the market over time. Short term price swings will be driven by news events (witness the last 5 days) but, over time, fundamentals win. Use the panic sell offs to add to positions and watch what matters and ignore those with agendas (for instance Roubini, Rosenberg, Krugman are all intellectually dishonest and should be viewed with extreme skepticism).

I ignore housing (it will suck for years, accept it and move on), weekly jobs numbers (go with 4 week averages, data more accurate), melodramatic headlines (good content doesn’t need it), a host of other “weekly numbers” that don’t really tell us much other than what happened since Monday/ I also read everything I can from those who disagree with me on my outlook (those who, IMO are honest about it). The point is you need to pick your data as there are millions of data points and trying to follow them all will paralyze you. Some are broader and encompass dozens of others metrics, others are very specific. Pick the ones that fit your style/personality and focus on those. For instance, clearly a very active trader will focus more on weekly /daily data than I will with my longer time frame. Doesn’t mean either of us is right or wrong, just that we have found what data is important for us to follow.

I don’t think most folks who look at data and then form a thesis were surprised at the revised GDP, I think those who focus on headlines or have a thesis they fit the data to were……that is a big difference. If you are looking to one of those for information/guidance, you may want to look at it with a much more critical eye. If you follow data and were shocked by the GDP number, you may want to revisit what you follow or how you interpret it, you may be subconsciously seeing it through the “thesis first” filter.

Have a wonderful Thanksgiving……

2 replies on “$$ Rail, Temp Employment and GDP…..Why Were People Surprised?”

[…] This post was mentioned on Twitter by Todd Sullivan, Matt Mullins. Matt Mullins said: Good analysis, Todd. RT @ToddSullivan: $$ Rail, Temp Employment and GDP..Why Were People Surprised? http://bit.ly/gvX9T3 […]

[…] Why is anyone surprised by better than expected economic stats? (ValuePlays) […]