JOE earnings beat the street on every metric and Berkowitz will join the Board, getting his 4 directors on and the 4 he wanted out are gone. Britt Greene is also out as CEO (we can assume the new one will be of Bruce’s liking). Now that is over we need to look forward. I am still bullish on RE going forward and think JOE gives us an attractive entry point into the N. Fla market especially with Berkowitz on the Board just as HHC gives us one in Las Vegas, Texas and Maryland as well as commercial exposure in Vegas and Hawaii.

The St. Joe Company (NYSE: JOE) today announced a Net Loss for the full year ended 2010 of $(35.9) million, or $(0.39) per share, which included pre-tax charges of $27.1 million, or $0.12 per share after tax. This compares to a Net Loss of $(130.0) million, or $(1.42) per share, for the year ended 2009, which included pre-tax charges of $163.1 million, or $1.07 per share after tax.

For the fourth quarter of 2010, St. Joe had a Net Loss of $(2.7) million, or $(0.03) per share, which included pre-tax charges of $10.7 million, or $0.12 per share after tax. This compares to a Net Loss of $(58.7) million, or $(0.64) per share, for the fourth quarter of 2009, which included pre-tax charges of $84.0 million, or $0.56 per share after tax. Pre-tax charges for the fourth quarter of 2010 included $8.0 million, or $.05 per share after tax, for impairments on unconsolidated affiliates, real estate and other assets; $1.6 million, or $.06 per share after tax, for costs resulting from the Deepwater Horizon oil spill; and $1.1 million, or $0.01 per share after tax, of restructuring and other charges.

St. Joe’s President and CEO Britt Greene stated, “In 2010, St. Joe successfully navigated the challenging business landscape and positioned the Company well to take advantage of the many exciting growth opportunities in Northwest Florida and to create meaningful long-term value for shareholders.”

2010 Highlights

- Celebrated the opening of the Northwest Florida Beaches International Airport with commencement of service by Southwest Airlines

- Launched VentureCrossings Enterprise Centre adjacent to the new airport

- Executed the Through the Fence/Master Access Agreement at the Northwest Florida Beaches International Airport District

- Leased a strategic airside parcel with immediate runway access at the new airport

- Completed the development plan for the initial phase of Breakfast Point and the re-programming of RiverTown’s first phase

- Expanded the builder programs in certain of our residential communities

- Successfully conveyed to the Florida Department of Transportation (FDOT) 2,148 acres as part of 2006 sale, facilitating future highway construction

- Expanded the service area of one of our existing mitigation banks

- Renegotiated and extended the Pulpwood Supply Agreement with Smurfit-Stone Container Corporation

- Relocated the Company’s corporate headquarters to Northwest Florida

- Segment Results

Residential Real Estate

During the fourth quarter, St. Joe sold 13 homesites across its resort communities at an average price of $120,000, and 27 homesites across its primary communities at an average price of $50,000. For the full-year, the Company generated $8.7 million primarily from the sale of 41 resort homesites at an average price of $159,000 and 42 primary homesites at an average price of $52,000.

Commercial Real Estate

In the fourth quarter, St. Joe sold 1.7 acres in Bay County for $425,000, or $254,000 per acre. This parcel is adjacent to the Company’s Breakfast Point community and will be developed as a medical office facility. For the full-year, St. Joe sold 18.4 acres for $4.4 million, or $237,000 per acre, including a 10-acre sale to Wal-Mart for $2.5 million.

Also in 2010, as part of the Company’s commercial strategy to generate recurring revenues, St. Joe entered into build-to-suit leases with CVS on a 1.7-acre site in Port St. Joe and a Hardee’s franchisee on a 0.8-acre site in Panama City Beach. The Company also entered into a ground lease on a 2.1-acre site located near the new airport with Express Lane, which will construct a gas station, convenience store and restaurant.

In VentureCrossings, St. Joe has commenced development of the Company’s headquarters building and a long-term covered parking facility, and the Company is in the pre-development stages for a light industrial building.

Rural Land Sales

In its Rural Land Sales segment during the fourth quarter, the Company sold 266 acres for $1.5 million, or $5,500 per acre, and also transferred title to FDOT on 1,826 acres, generating $17.1 million of revenue. Additionally, during the fourth quarter St. Joe received $0.8 million of revenue from the sale of 12 mitigation bank credits.

For the full year, the Company sold 606 acres of rural land for $3.0 million, or $4,900 per acre. St. Joe also sold 21 mitigation bank credits for $1.4 million, or an average of $67,000 per credit, and generated $0.4 million from an easement transaction. Additionally, the Company recognized $20.6 million from previously deferred sales and conveyed 2,148 acres to FDOT as part of FDOT’s purchase of land from the Company in 2006.

Forestry

Forestry revenues during the fourth quarter of 2010 were $7.8 million, primarily from the sale of 312,000 tons of sawtimber and pulpwood. For the full-year, forestry revenues were $28.8 million, an increase of $2.2 million over 2009, due primarily to increased pricing of sawtimber and pulpwood.

Liquidity and Balance Sheet

At December 31, 2010, St. Joe had cash of $183.8 million, pledged treasury securities of $25.3 million and debt of $54.7 million, $25.3 million of which is defeased debt. The Company’s $125 million revolving credit facility remained undrawn at December 31, 2010.

Capital expenditures for the full year 2010 were $16.1 million, compared to $18.4 million for the same period in 2009. In addition, St. Joe incurred cash overhead costs of $56.7 million for the full year 2010, compared to $57.6 million for 2009. Cash overhead costs in 2010 included $4.9 million for litigation costs and $4.2 million for legal and environmental clean-up costs resulting from the Deepwater Horizon oil spill.

On February 8, 2011 the Company announced that it had engaged Morgan Stanley & Co., Inc. to assist it in the evaluation of financial and strategic alternatives to enhance shareholder value. St. Joe intends to consider the full range of available options including a revised business plan, operating partnerships, joint ventures, strategic alliances, asset sales, strategic acquisitions and a merger or sale of the Company, but there can be no assurance that the exploration of strategic alternatives will result in any transaction.

Land Holdings and Land Use Entitlements

On December 31, 2010, St. Joe owned approximately 574,000 acres, concentrated primarily in Northwest Florida. Approximately 403,000 acres, or 70 percent of the Company’s total land holdings, are within 15 miles of the coast of the Gulf of Mexico.

Now onto Einhorn:

Here are 3 slides from his VIC presentation that were a focal point of his valuation of the company

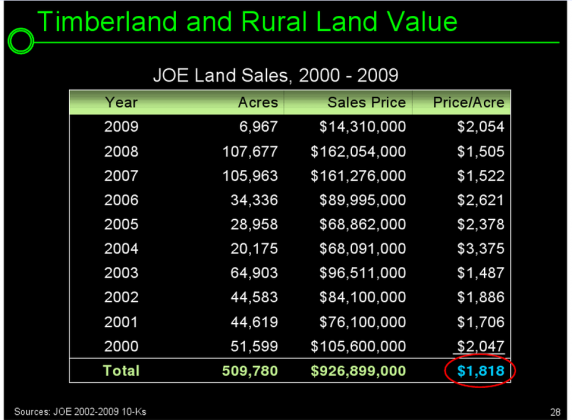

Below he takes ten years of JOE’s land sales to come up with an average # for land valuation. Problem? Do you know what the sales price of rural land in 2000 has to do with land values today? NOTHING…..

If you want proof simply try to sell your home today at 2006 levels and lets see what happens or flashback to 2006 and make a seller an offer at 2000 levels. The only RE values that matter are today’s and what buyers think they will be tomorrow. Yesterday’s values matter not. But, it is a fun exercise.

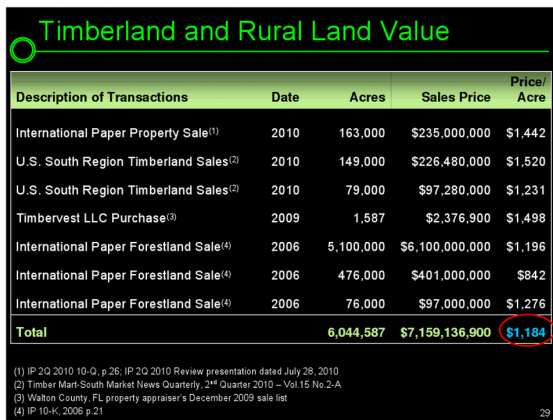

On slide two he uses land sales for other Timber Co’s. to come up with a acreage value. This also is not realistic as again 2006 land sales are irrelevant. Not only that, but the citing from Einhorn leaves out a MATERIAL factor in the first one from International Paper. Einhorn simply lists the sales price and acreage and then says the land sold a “x” per acre.

If we go to the IP 10Q: (Emphasis mine)

On July 22, 2010, the Company announced that it had signed an agreement to sell 163,000 acres of properties located in the southeastern United States to an affiliate of Rock Creek Capital (the Partnership) for $200 million. A minimum of $160 million will be received at closing, with the balance, plus interest, to be received no later than three years from closing. In addition, the Company will receive 20% of the Partnership’s net profits after it achieves certain financial returns.

I’d say that is a little more than a little omission. IP sold off some land to raise cash but is holding an interest in the results of said timber land, that in no way qualifies the transaction to be listed as an outright “land sale” on Einhorn’s presentation. Of course the sale price will be lower if the buyer has to fork over 20% of future profits to the seller. I am also shocked that no one out there seems to have actually looked at his comps and citations to see of they are valid, they aren’t. This in fact reminds me of Hovde and GGP in December of 2009 in his used of comps that were invalid.

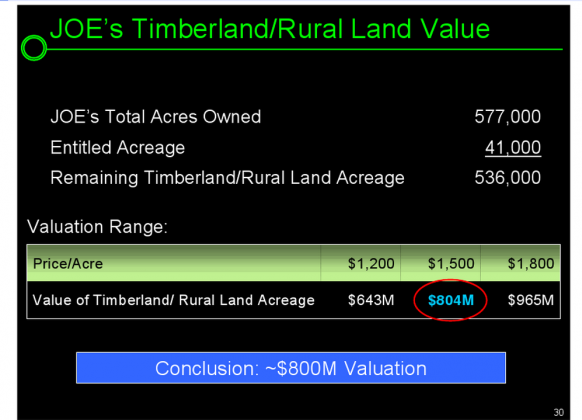

Using that data he “splits the difference” so to speak to come up with a number (below) from the two slides. So, what is JOE selling rural land for now?

For the full year (2010), the Company sold 606 acres of rural land for $3.0 million, or $4,900 per acre

Hmmm… that is more than a little bit north of the $1500 an acre Einhorn comes to (erroneously). In a worst case scenario, he should have used the $2000 an acre from 2009. We should just take the “most recent sales” data, which is, you know, how RE is comped and sold. Doing it the right way we get a value of the rural land of $2.5B (530k acres x $4900/acre) which is more than the value of the entire company right now. This is giving the value of the entitled acreage is nothing and you’d have to assume that the price of Florida beach RE does not rise……ever….

Of course we must also note: “Average sales prices per acre vary according to the characteristics of each particular piece of land being sold and its highest and best use. As a result, average prices will vary from one period to another” ( From 10K pg 45). what this means is you simply cannot say acre “A” sold for “x” so everything left it worth what is left times “X”. To the point we have made in the past is that Einhorn’s thesis was wrong because that is precisely what he did. I did the same thing above (with far more accurate sales data) and got a value 3X higher than he did. I would say since I am using numbers from 2010 and he an average of 2000-9 mixed with dubious comps (discussed above) mine is the more accurate valuation.

I have listed my complaints with Einhorn on this in the past and all of them still hold. In fact, recent airport activity (above) further bolsters just how wrong he was on that aspect of his presentation. I am troubled by his selective use of the IP comp above though w/o an accurate disclosure of what type of sale it was. If you know anything about RE investing you would know that the transaction does not belong on the same page as a straight forward RE land sale. To be clear, I am not accusing him of hiding anything, the citations are there for those who actually decided to check them out, just that his inclusion of this transaction is not valid.

This along with what we have discussed I think has to severely discount or even dismiss Einhorn’s thesis entirely. I have to think that were it not Einhorn’s name on it, many people would have ripped into this a while ago. This is a case of reputation over accuracy?.

34 replies on “JOE Earnings and Revisiting Einhorn’s “Valuation” & Ommission”

Wow, amazing! Good work!

Is a short squeeze scenario still on the table with Berkowitz on the board?

sure

Todd:

So do you think that a writedown is not going to happen?

JOE is a time bomb (up or down) until the SEC announces the results of its investigation.

Todd,

It is nice to have you back!

Ty

Todd Sullivan

Sent from my EVO

We have seen this story before. How soon we forget Einhorn vs. Allied Capital. In 2002 Einhorn gave a speech on why he is shorting Allied Capital stock. Everyone calls Einhorn a fool and critizies him included the company. Allied goes on to raise 1 billion in new capital. In 2009 Allied Capital fails.

Like I said we have seen this story before.

Or is the the Volkswagon short in which David got hit very hard??

Time will tell

This is hardly the same case as Allied. In his book David outlined how he found rampant cases of outright fraud and corruption within the company and it’s various subdivisions. His case for JOE isn’t allegations of cooking the books so much as a dispute in land valuations.

David portrayed himself as a type of vigilante justice system in the Allied case but exactly who is he “protecting” by claiming JOE’s carrying their land above fair value? It isn’t like they’re defrauding the SBA or some other entity ala the BLX case.

So is the consensus here that there is no hole in the balance sheet that needs plugging? No capital raise and/or writedown required?

I do not think so……

Einhorn never made a public presentation on his reasons for shorting Volkswagon. He did with Allied and Joe. Many other hedgies got caught short in that trade as well. Volkswagon was a profitable company at the time with desirable cars. JOE is unprofitable with undesirable scrub land.

With Joe I see a company with 577,000 acres of land that lost $52 million in 2010. The land in valued at approximately $1.7 billion today. So how is this company a value here when at $26 i am paying a premium for land help within a money losing operation?

I know the argument is that the land values will recover and Florida is great. But has anyone ever been to NW Florida besides me? It is not a desirable place to live. The education level in low and might as well be in the middle of Alabama. The argument that JOE is going to build an aerospace corridor there is a pipe dream. The work force education and talent can’t support that.

For those that thing casinos are coming again obviously have not visited Florida and do not know the power the Seminole Indian tribe holds in Florida state government. Not going to happen.

At best JOE develops some sleepy beach towns on the Gulf in 20 years, but even then you are overpaying in today’s prices.

I am not short JOE, but I will pick up some shares at much more attractive prices once the Fairholme affect wears off.

Time will tell…..

I don’t understand your point on the International Paper sale.

IP sold 163,000 acres for $200 million and additional profit participation.

Einhorn lists the sale as 163,000 for $235 million, $35 million more than $200 million in cash listed. He footnotes the IP presentation from July 28 from IP, where IP lists the value of the profit participation at $35 million (page 38, see the 8-K from 7/28/2010). Thats how he gets to $235 million in his presentation which does include the additional upside.

That was for the following Q…. IP’s profit participation is ongoing

I didn’t take it that way.

On page 38, IP lays out the agreement with Rock Creek and says that the sold 163,000 for a cash value of $200 million and a potential value of partnership interest of $35 million for a total value of $235 million. I take that to mean the all-in value for the entire life of the transaction. I don’t see any reason to assume that the $35 million represented the amount received the previous quarter.

Actually it was $160 mil upfront, $40m within 6 months and then 20% of

profits

Todd, Looks like David Einhorn replied about numbers on IP sale.

http://seekingalpha.com/user/873461/comments

Right……..pretty sure that is not him

That is what I was trying to say, Eihorn’s $235 million figure included the value of the 20% of profits since IP estimated the value of their interest at $35 million.

Right, that is the number from the IP presentations for Q3 only…. IP still

retains the 20% interest.

Why do you think it is for Q3 only and not the value for the entire lifetime? What does that $35 million represent if not the present value of the entire stream of proceeds?

Maybe i’m not understanding your point.

If the $35 million represents just Q3, and IP receives 20% of profits after thresholds, does that mean that the land generated at least $175 million of profits for Rock Creek during just the 3rd quarter? That for a raw land purchase of “$160 mil upfront, $40m within 6 months” (its actually scheduled to be received no later than three years from closing). Thats quite the deal for Rock Creek.

I can’t envision any scenario where that $35 million represents anything but the value over the life.

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9NTQ5NjR8Q2hpbGRJRD0tMXxUeXBlPTM=&t=1

page 21

“plus ongoing profits interest”

Boom Shaka-laka!

On March 4, 2011, the Board of Directors (the “Board”) of The St. Joe Company (the “Company”) authorized and adopted Amendment No. 1, dated as of March 4, 2011(“Amendment No. 1”), to the Shareholder Protection Rights Agreement, dated as of February 15, 2011 (the “Shareholder Rights Agreement”). Amendment No. 1 amends the definition of “Expiration Date” under the Shareholder Rights Agreement to mean March 4, 2011. Accordingly, the rights (the “Rights”) which were previously dividended to holders of record of Common Stock of the Company as of the close of business on February 28, 2011 expired upon the expiration of the Rights Agreement and no person has any rights pursuant to the Rights Agreement or the Rights.

The above summary is not intended to be complete and is qualified in its entirety by reference to the complete text of Amendment No. 1, a copy of which is filed as Exhibit 4.2 hereto and is incorporated by reference herein.

Source: http://www.sec.gov/Archives/edgar/data/745308/000095012311022242/b85419e8va12bza.htm

Exactly and on page 38 of that presentation when discussing the transaction, IP includes the potential value of those interests at $35 million to arrive at $235 million total, which is what Einhorn used and footnoted in his presentation.

I can’t envision a scenario where IP expected Rock Creek to generate at least $175 million in profits so that IP’s 20% stake kicked off $35 million in gains for just for the third quarter.

Exactly and on page 38 of that presentation when discussing the transaction, IP includes the potential value of those interests at $35 million to arrive at $235 million total, which is what Einhorn used and footnoted in his presentation.

I can’t envision a scenario where IP expected Rock Creek to generate at least $175 million in profits so that IP’s 20% stake kicked off $35 million in gains for just for the third quarter.

With a JV between HHC and JOE, would the benefit be cost reduction in operating expenses? I can’t imagine HHC would be in a position to transfer any cash in a deal.

HHC would get a huge swath of Florida cheap and JOE would get superior

mgmt from HHC. JOE shareholders would get diversified away from Fla RE

market And yes, there would be substantial cost savings

Todd Sullivan

Sent from my iPad

Todd, what is your response to the Barron’s article, “St. Joe Project: More Sinner Than Winner”, which was in the March 5, 2011 edition? They seem to be making the case that JOE should be trading at $10 per share.

I think it would be obvious…..I think it is drivel

Todd Sullivan

Sent from my EVO

[…] JOE Earnings and Revisiting Einhorn’s “Valuation” & Ommission Good article on the bull case for JOE. The battle between David Einhorn and Bruce Berkowitz continues…. […]

Today’s Barrons article reinforces everything I have said below: http://online.barrons.com/article/SB50001424052970203737204576176842353837176.html?mod=BOL_hpp_mag

“land assets are not that spectacular. Fairholme’s problem is that it owns roughly 30% of the company, whose assets are worth between $14 and $18 a share, and there seems to be very little buyer interest in their properties.”

“Panama City, near much of St. Joe’s holdings, isn’t one of the state’s most attractive cities, and it has reinforced its downscale image by courting the college “spring break” crowd this year.”

“The Panhandle is a depressed region in a depressed state”

Like I said the aerospace corridor is a pipe dream and there has only been ONE successful development.

Drive through 3-4 JOE developments yourself and you will see nothing but a ghost town. Doctored photos released by Fairholme can’t overcome the facts.

I am fully aware of Einhorn’s thesis….I was there when he presented

it. Barron’s said nothing new ( they rarely do which is why I do not

subscribe…no value added) but parrot his thesis.

If it was all fully developed, there would be no value. I think he,

and you are wrong. Airport traffic is surging And I have a very hard

time believing beach front land is worth a couple grand an acre

Todd Sullivan

Sent from my iPad

It is not a question of weather or not I am wrong…. It is a question of weather or not the 25 million shares held short are wrong.

An yes you are right. The ocean front land is not worth a couple grand an acre. But this represents a small fraction of JOE holdings. Walk 100 yards inland and the value of the land drops exponentially.