Got the following question from a subscriber on this post:

What exactly is meant by “The SP500’s Mean Earnings capitalized by the Prevailing Rate have a price of 1718 vs. this morning’s price of 1307”, and what is the math behind using the PCE/Prevailing Rate to arrive at 1718?

“Davidson” answers:

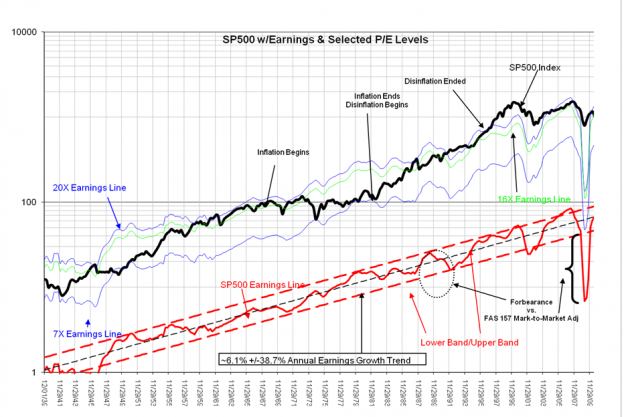

To answer the subscriber’s question: Stocks are the public portion of the general economy and by looking at the SP500 since 1978 (the span of the Dallas Fed PCE inflation indicator) one can analyze the SP500 Mean Earnings over this period and compare the mean earnings’ yield in relationship to the rate of return of GDP growth. It is simpler to break this up into Real GDP and inflation component factors. One needs to create a Real GDP trend that spans across multiple business cycles. When one does the analysis, the Real GDP trend can be represented in a very gently declining growth trend line which is now valued at 3.14%. Inflation is more variable and I use the 12mo trimmed Mean PCE value the most recent reading is 0.9%.

To calculate the Market Cap Rate(The Prevailing Rate) convert the rate percents to decimals. i.e. 3.14% becomes 1.0314 and 0.9% becomes 1.009. Then multiply these factors(growth factors are multiplied), i.e. 1.0314×1.009 = 1.0407 or 4.07%. 4.07% is the Prevailing Rate-Mkt Cap Rate.

Next step is to take the SP500 Mean Earnings which is calculated monthly-see the black dotted line in the chart below-and is currently $69.92 and divide this value by the market cap rate in decimal form which is 0.0407. $69.92/0.0407 = 1718.

The market is driven most times by belief in the most bizarre valuation techniques, some even taught by our educational system. The SP500’s Mean Earnings Yield only comes close to or equals the Mkt Cap Rate-Prevailing Rate during market lows. Today the market remains well below the Mkt Cap Rate pricing level of ~1700. The reason most likely for this current difference is the fear of future inflation via Bernanke’s actions. The current SP500 implies a Mkt Cap Rate of 5.3% or ~2.1% inflation. But, that fear will in itself likely prevent much inflation from occurring. If I am correct, inflation will prove to remain low and the market will in the next 2yrs reprice the SP500 much higher.

Only time will tell, but the current market is quite cheap.