I love reading these things, without fail you can almost always find something interesting that may give a glimpse into what is coming down the road

Policies and Procedures with Respect to Related Person Transactions

The Board of Directors recognizes that related person transactions can present a heightened risk of conflicts of interest. Accordingly, as a general matter, our directors and executive officers are to avoid any activity, interest, or relationship that would create, or might appear to others to create, a conflict with the interests of jcpenney.Our written Policy on Review and Consideration of Related Person Transactions (Policy) is included as Appendix C to our Corporate Governance Guidelines. For purposes of SEC rules as well as our Policy, a “related person transaction” is any transaction in which the Company was, is or will be a participant and the amount involved exceeds $120,000 and in which any related person had, has or will have a direct or indirect material interest. The term “related person” means (a) any person who is, or at any time since the beginning of the Company’s last fiscal year was, a director or executive officer of the Company or a nominee to become a director of the Company, (b) any person who is known to be the beneficial owner of more than 5% of any class of the Company’s voting securities, and (c) any immediate family member of any of the foregoing persons. We review all relationships and transactions in which the Company and a related person are participants to determine whether such persons have a direct or indirect material interest. To identify potential related person transactions, we request certain information from our directors and executive officers. We then review the information provided for any related person transactions. The Corporate Governance Committee reviews and determines whether to approve or ratify any related person transaction that is required to be disclosed. Any member of the Corporate Governance Committee who is a related person with respect to a transaction under review may not participate in the deliberations or vote respecting approval or ratification of the transaction.

The Board of Directors has considered the following transactions in connection with the Policy:

William A. Ackman is the Founder, Chief Executive Officer and Managing Member of the General Partner of Pershing Square Capital Management, L.P. (Pershing Square), a registered investment adviser. Mr. Ackman is a member of our Board of Directors and, together with Pershing Square and its affiliated entities, beneficially owns more than 5% of the Company’s common stock. In addition, Mr. Ackman serves as Chairman of the Board of The Howard Hughes Corporation (HHC), a real estate development company in which Mr. Ackman and his affiliated Pershing Square entities have economic exposure to approximately 27.5% of HHC’s common stock, including a 13.8% beneficial ownership interest. HHC, through an affiliated entity, is the landlord for one of the Company’s leased store locations. During fiscal 2010, the Company made payments under this lease totaling approximately $242,000. The lease is currently expected to continue through fiscal 2011 and beyond. In fiscal 2011, the Company expects to make payments under the lease of approximately $231,000 plus any 2011 property taxes assessed and paid indirectly through the landlord. Mr. Ackman does not have any direct or indirect material interest in this lease arrangement.Steven Roth, who is a member of our Board of Directors, is Chairman of the Board of Vornado Realty Trust (Vornado) and the beneficial owner of approximately 5% of Vornado’s outstanding common shares, and is also the Managing General Partner of Interstate Properties (Interstate). In November 2010, Vornado purchased certain land and improvements from the Company at its Springfield Mall location for approximately $8.3 million. Additionally, the Company, through its subsidiaries, pays rent, common area maintenance fees, utility expenses, and property taxes to Vornado and Interstate, and their affiliated entities, with respect to a number of store locations. During fiscal 2010, such payments totaled approximately $17.2 million. The leases are currently expected to continue through fiscal 2011 and beyond. In fiscal 2011, the Company expects to make similar payments with respect to such store locations of approximately $15.7 million, plus any 2011 property taxes assessed and paid indirectly through the landlords. Mr. Roth has no direct or indirect material interest in these transactions.

In 2009 JCP made $240M in lease payments (FY 2010 10-k pg f-24) including overage and personal property leases so it looks like Vornado is a landlord to ~7% of JCP properties that are leased and 2010’s was estimated about $260M. More on this at the end….

Now, on to other matters at hand:

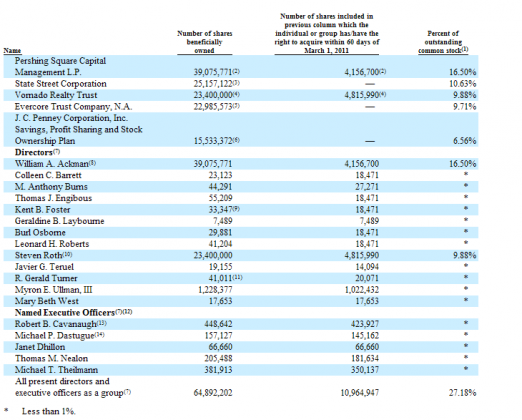

This is still frustrating (see below) because if we do some simple math we find that save for Ackman/Roth, current management and directors own only .8% (that’s “point eight” % ) of the company’s stock and still have not bought a share on the open market in over two years. I want my management and directors buying shares on the open market especially when we consider how low JCP shares have fallen from their $80 2007 peak. Further, I still am at aloss as to understand why this group is against those now on the Board doing so. I would have liked to see the poison pill (sorry “shareholders rights plan”) adopted by management to thwart any further purchases from Ackman/Roth on the table to be dismissed but I guess we’ll have to go with the small progress we have made here.

Onto the voting matters:

The Board of Directors, as part of its continuing review of corporate governance matters and in dialogue with stockholders, after careful consideration and upon recommendation by the Corporate Governance Committee, has adopted and now recommends stockholder approval of a proposal to (i) amend subsection (d) of Article Sixth of the Company’s Restated Certificate of Incorporation, as amended (Charter), to eliminate the supermajority voting provision therein with respect to the removal of directors and repeal Article III, Section 12 of the Company’s Bylaws, as amended (Bylaws), relating to the removal of directors, (ii) amend Article Eighth of the Charter, which addresses stockholders’ ability to act by written consent, to eliminate the supermajority voting provision therein with respect to the ability of stockholders to amend such Article, (iii) amend Article Ninth of the Charter to eliminate the supermajority voting provision therein with respect to the ability of stockholders to amend certain sections of the Bylaws and (iv) repeal in its entirety Article Seventh of the Charter, which requires a supermajority vote to approve certain business combinations between the Company and an interested stockholder. A supermajority voting provision is generally one that requires a voting threshold greater than a simple majority.

Supermajority voting provisions are intended to facilitate corporate governance stability by requiring broad stockholder consensus to effect changes. In addition, they provide anti-takeover protection for the Company. For example, Article Seventh of the Charter was intended to protect the Company from potential self-interested actions of large stockholders and to encourage bidders seeking to acquire the Company to negotiate with the Board of Directors. However, many investors and others have begun to view supermajority voting provisions as conflicting with principles of good corporate governance. These investors also assert that supermajority voting provisions cause boards and management to be less responsive to stockholders. While supermajority voting requirements can be beneficial, the Board of Directors nevertheless has determined that there are compelling arguments for eliminating the supermajority voting provisions. Supermajority voting requirements essentially provide veto power to minority stockholders. Moreover, a lower threshold for stockholder votes can increase the ability of stockholders to participate effectively in the Company’s corporate governance.

The Board is committed to good corporate governance. The Corporate Governance Committee consulted management and the Company’s outside advisors when it considered the various positions for and against supermajority voting provisions. Based upon the analysis and recommendation of the Corporate Governance Committee, the Board has determined that adopting a resolution approving amendments to the Charter and Bylaws to eliminate supermajority voting provisions is in the best interests of the Company and its stockholders.

Approval of the management proposal to amend the Charter and the Bylaws requires the affirmative vote of at least 80% of the shares of jcpenney common stock outstanding as of the record date. If you abstain from voting on this matter, your shares will be counted as present for purposes of determining a quorum and the abstention will have the same effect as a vote against the proposal.

This is a move in the right direction. The 80% threshold is insane and allows for a minority shareholder group to hold the entire company and the rest of the shareholders hostage. A simple majority (where allowed by law) is the reasonable way to go.

The first three proposals dealt with the removal of directors and lowering the vote threshold from 80% to a simple majority. Number four is the one we care about:

4. Repeal Article Seventh of the Charter in its Entirety.

Article Seventh of the Charter (stockholder approval of certain business combinations) currently provides that the vote of at least 80% of the combined voting power of the then-outstanding shares of all classes and series of stock of the Company entitled to vote generally in the election of directors is required to approve certain business combinations with interested stockholders (as defined in the Charter). The Company is proposing to eliminate Article Seventh in its entirety to remove these voting requirements. However, the Company will still be subject to Section 203 of the Delaware General Corporation Law (DGCL) which, under certain circumstances, requires a vote of 66 2/3% of the outstanding voting stock (excluding stock owned by an interested stockholder) for approval of a business combination with an interested stockholder, each as defined in the DGCL.

This is the best news in the whole filing. Essentially it would free up the company to enter into transactions with both Vornado and Howard Hughes if some type of RE sale/leaseback were done for JCP’s owned RE or if they decided to simply spin it into a REIT either could act as a JV parnter. Is something likely? Who know but one has to think were it not even being talked about or had not even been broached there would be little reason to include this in the filing…no? Maybe we are just being asked to vote on it in a “just in case” scenario. I am ok with that also as at least it shows finally a degree of open minded thinking on the part of management to other possibilities with the business, something that initially was in stunning short supply.

Either way this is good as it provides opportunity….If you own shares, you have to vote though…