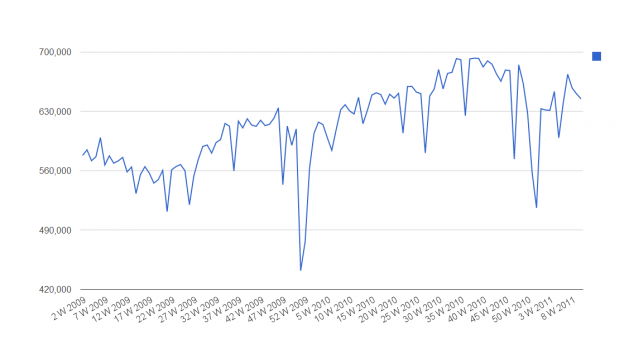

Total N. American rail traffic at the close of week 10 was 2.2% higher than 2010 and 30% higher than 2009. Given the state of the economy in the spring of 2009, the degree of increase over that year should be discounted (a bit, not in its entirety).

The YOY increase of 2% concurs with our “slow and steady” improvement outlook for 2011 over 2010 for the general economy.

Going forward, for the near future we have to expect some volatility in the results as both imports from and exports to Japan are expected to be affected. I would expect results to fall to perhaps under last years levels. But, one cannot extrapolate from those readings, should they occur, that the US economy is faltering. Typically we would view declining rail traffic as a bad omen for future growth but in this case we have to discount any potential fall due to Japan. What we may instead see is delayed demand and a few weeks of below par results and then a surge as Japan begins to get itself back online. We also must keep in mind the rebuilding effort in Japan will lead to considerable import increase for that country which will increase US rail traffic for those industries.

Our “worst case” scenario here is below average upcoming rail traffic that simply does not recovery down the road. That would mean not only were we affected by Japan but going forward growth is slowing. I think that scenario, while possible is highly unlikely.

2 replies on “Rail Traffic Still Increasing”

[…] Rail traffic continues to show growth. (ValuePlays) […]

[…] Last week we spoke about the possibilities for disruption to results due to Japan. It will take some time to see how this shakes out. Remember boats that left Japan just before the quake won’t reach our shores for another week (or are only just starting to). Any disruption will be felt in the boats that have not left since the quake and that will be felt in the upcoming weeks. Now, we can expect a surge of exports as Japan rebuilds, but since we are still a large net importer from Japan, we should see a dip in results. However, I still maintain that as the rebuilding gets underway in full force, rail traffic will surge as imports resume to prior levels and exports to help rebuild remain elevated. […]