Thoughts on Ackman’s latest Alexander and Baldwin ($ALEX)

From the 10K (click to open pdf):

Description of Business: Founded in 1870, Alexander & Baldwin, Inc. (“A&B” or the “Company”) is incorporated under the laws of the State of Hawaii. A&B operates in five segments in three industries: Transportation, Real Estate and Agribusiness. These industries are described below:

Transportation: The Transportation Industry consists of Ocean Transportation and Logistics Services segments. The Ocean Transportation segment, which is conducted through Matson Navigation Company, Inc. (“Matson”), a wholly-owned subsidiary of A&B, is an asset-based business that derives its revenue primarily through the carriage of containerized freight between various U.S. Pacific Coast, Hawaii, Guam, China and other Pacific island ports. Additionally, the Ocean Transportation segment has a 35 percent interest in an entity (SSA Terminals, LLC or “SSAT”) that provides terminal and stevedoring services at U.S. Pacific Coast facilities. The Logistics Services segment, which is conducted through Matson Integrated Logistics, Inc. (“MIL”), a wholly-owned subsidiary of Matson, is a non-asset based business that is a provider of domestic and international rail intermodal service (“Intermodal”), long-haul and regional highway brokerage, specialized hauling, flat-bed and project work, less-than-truckload, expedited/air freight services and warehousing and distribution services (collectively “Highway”). Warehousing and distribution services are provided by Matson Global Distribution Services, Inc. (“MGDS”), a wholly-owned subsidiary of MIL. MGDS’s operations also include Pacific American Services, LLC (“PACAM”), a San Francisco bay-area regional warehousing, packaging, and distribution company.

Real Estate: The Real Estate Industry consists of two segments, both of which have operations in Hawaii and on the U.S. Mainland. The Real Estate Sales segment generates its revenues through the development and sale of land and commercial and residential properties. The Real Estate Leasing segment owns, operates and manages retail, office and industrial properties. Real estate activities are conducted through A&B Properties, Inc. and various other subsidiaries and affiliates of A&B.

Agribusiness: Agribusiness, which contains one segment, produces bulk raw sugar, specialty food-grade sugars, molasses, green coffee and roasted coffee; markets and distributes roasted coffee, green coffee and specialty food-grade sugars; provides general trucking services, mobile equipment maintenance and repair services in Hawaii; and generates and sells, to the extent not used in the Company’s operations, electricity. The Company also is the sole member in Hawaiian Sugar & Transportation Cooperative (“HS&TC”), a cooperative that provides raw sugar marketing and transportation services. HS&TC was consolidated with the Company’s results beginning December 1, 2009.In December 2010, the Company entered into an agreement to lease land and sell certain assets used in the coffee business to Massimo Zanetti Beverage USA, Inc. (“MZB”), including intangible assets. The assets will be sold at book value, or an approximate price of $15 million. The transaction, which is not expected to result in a gain or loss, is subject to certain material contingencies and, assuming the satisfaction of those conditions, is expected to close in the first quarter of 2011. The assets to be purchased by MZB include machinery, furniture, fixtures, equipment, materials and supply inventory, and coffee inventory. The Company will retain ownership of the land, buildings, power generation, and power distribution assets.

Here are the 2011 fact sheets that are available

Matson Navigation Company, Inc. (click to open pdf)

A&B Properties, Inc. (click to open .pdf))

Hawaiian Commercial & Sugar Company (click to open pdf)

Alexander & Baldwin, Inc. (click to open pdf)

Kauai Coffee Company, Inc. (click to open pdf))

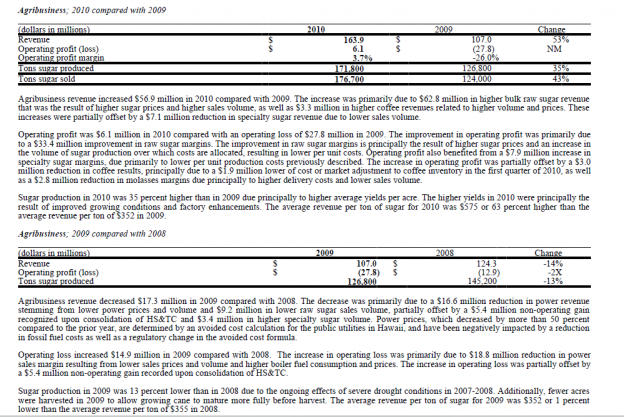

Agribusiness:

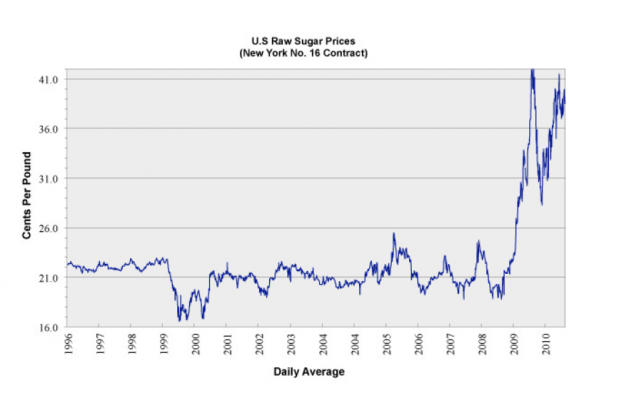

The results here are nothing short of dismal. There are two main crops, coffee and sugar. Lets first look at the prices of those commodities:

Common sense tells us that with the prices of both essentially going “hockey stick” for the past 3 years (last decade in the case of coffee) earnings from this division ought to be strong and increasing. Further if I told you the company was a de-facto monopoly on Hawaii producing 60% of the coffee and 80% of the sugar on it (100% in 2010), you’d say they must be printing money. But they aren’t, in fact results have been dismal (click to enlarge photo below): If we go out further, since 2004, even with the above conditions, the unit has produced an operating LOSS of $11.6M. I use 2004 as it captures 2005’s C. America/Dominican Republic trade agreement and full implementation 2008’s NAFTA (For those wondering if I am “cherry picking” data, if we eliminate 2004, operating losses for the Ag division increase).

How is this possible? Let’s look. For some reason ALEX has a power generation and transportation business wrapped into it “agriculture” subsidiary. It would seem the purpose is to burn bagasse from the sugar cane end generate electricity to run operations while selling any excess to the grid. This business has had volatile results but even if we strip these loses out from 2009, the company’s still experienced a loss from operations in both 2008 and 2009 during a time when sugar and coffee prices were both soaring. In 2010 operating profit grew $33M (from $27M loss to $6M gain) yet all of that was simply due to the result in Sugar margins. This means the coffee business continues to generate nothing and the power business contributes nothing either. We have a company who has a segment that sells two commodities, both of which are at historic highs and they are barely scratching out a profit with 3.7% margins.

If margins are that low, maybe we have more than a bit of bloat?

From the 10K:

As of December 1, 2009, the Company began consolidating the results of the Hawaiian Sugar & Transportation Cooperative (“HS&TC”) because the Company became the sole member. Since HS&TC is a wholly-owned consolidated subsidiary, revenue recognition on raw sugar and molasses sales occurs when HS&TC delivers the sugar and molasses to the Company’s third-party customers on the U.S. mainland. Prior to consolidation, the Company recognized revenue when the raw sugar was delivered to HS&TC, which occurred as sugar was produced and delivered to the sugar warehouse on Maui, where title and risk of loss passed. As a result of the HS&TC consolidation, the timing of revenue recognition differs between 2009 and 2010 and results in year-over-year variances.

Of the Company’s 2009 sugar production, approximately 73 percent was sold to Hawaiian Sugar & Transportation Cooperative (“HS&TC”) under a marketing contract. The remainder was sold as specialty sugar. HS&TC sells its raw sugar to C&H Sugar Company, Inc. at a price equal to the New York No. 16 Contract settlement price, less a discount and less costs for sugar vessel discharge and stevedoring. This price, after deducting the marketing, operating, distribution, transportation and interest costs of HS&TC, reflects the gross revenue to the Company. In 2009, HS&TC entered into a new contract for the delivery and sale of raw sugar with C&H Sugar Company, Inc., which replaced the contract that was set to expire in December 2009. The new contract was executed in October 2009 and has 3-year term.

Why? Why is the company selling its sugar to itself to market? HS&TC then turns around and sells it to C&H Sugar (no connection as far as I can tell). Couldn’t we just cut out the middle guy and scrap a whole layer of costs? Well, maybe we can’t. Maybe there are hundreds of customers and we just need this layer to handle all the sales processes that go on? Um….nope:

Approximately 91 percent of the bulk raw sugar produced by HC&S in 2010 was purchased by C&H Sugar Company, Inc. (“C&H”). C&H processes the raw cane sugar at its refinery at Crockett, California and markets the refined products primarily in the western and central United States. The remaining 9 percent of the raw sugar was used by HC&S to produce specialty food-grade sugars, which are sold by HC&S to food and beverage producers and to retail stores under its Maui Brand® label, and to distributors that repackage the sugars under their own labels. HC&S’s largest food-grade sugar customers are Cumberland Packing Corp. and Sugar Foods Corporation, which repackage HC&S’s turbinado sugar for their “Sugar in theRaw” product line.

Hawaiian Sugar & Transportation Cooperative (“HS&TC”), a sugar grower cooperative in Hawaii (of which HC&S currently is the only member), has a supply contract with C&H ending in December 2012. Pursuant to the supply contract, the cooperative sells raw sugar to C&H at a price equal to the New York No. 16 Contract settlement price, less a discount and less costs of sugar vessel discharge and stevedoring. This price, after deducting the marketing, operating, distribution, transportation and interest costs of HS&TC, reflects the gross revenue to HC&S. Most of Kauai Coffee’s crop is being marketed on the U.S. Mainland as green bean coffee. In addition to the sale of green bean coffee, Kauai Coffee produces and sells roasted, packaged coffee

under the Kauai Coffee® trademark. Kauai Coffee’s customers include specialty and commodity brokers, hotels, and large regional roasters.

Okay, so how much work is required with essentially one customer who is under a three year contract? Is there really a reason for HS&HT to exist?

So, what could the excuses be? Price volatility? Well, coffee has had a constant ride up and while sugar dipped in ’09 before rocketing back up, I have a hard time believing one price dip is responsible for for 7 years of lousy performance. Maybe the coffee/sugar biz on Hawaii is tough due to shipping costs, weather, water issues etc. Well, if it is an inherently bad business, why are you in it? If after 7 years the operating business is going to have a negative return, perhaps you should exit it? The only final reason could be that it is a decent business (it does average >$130M in annual revenues over the past 5 years) then either the cost structure is too high or it is dismally run. I vote for the latter.

Transportation and Logistics are consistent if not very unspectacular performers. Logistics has margins stuck at 2% and has at least turned a profit for the last 4 years. Transportation has seen margins fall for the last few years (given the global recession, this is in part understandable) but again, considering the near monopoly they have on the island, one might think margins would higher, far higher. The problem with the low margins is any problem lead to losses as ALEX has already pre-announced for Q1. It is also worth noting they blame “unprecedented problems in the Middle East”. Um… now I know Hawaii isn’t really the center of the news universe but, I mean, “unprecedented””? Where the hell have they been for the last oh, 40 years?

If Middle East violence is going to throw your business into a loss, you may want to rethink the model cause I’m pretty sure the prior is here to stay. Even still though, this is a division that does ~$1B a year in revenues so there is value there.

Real Estate,

This seems to be the area they are good at. They have a strong leasing and development business in Hawaii with 30% and 50% margins respectively and fantastic properties. They have been acquiring/selling parcels on a regular basis for the last several years and doing so profitably. It is also a division totally unrelated to all the others and does business with Brookfield Homes (recently spun from Brookfield Properties).

From a Hawaiian I know:

One of the original ‘Big 5’ companies in Hawaii that dominated the business landscape when sugar was King in the Islands. The largest and most important facet of their business is of course Matson Navigation – virtually all of our goods are imported and Matson just announced that we will be raising rates and accessing a fuel surcharge and are pinning the reason on the unrest in Libya. We (residents) have no recourse, since they virtually control all transportation of goods in and out of Hawaii.

Matson was successful in shutting down an Interisland ferry start up – Superferry. That would have taken some of the interisland transportation of vehicles and goods from Matson.

Always felt that management were extremely overpaid for what is basically a utility type business. Generous stock options to execs as well as directors. The Board is comprised of the usual suspects in Hawaii.

- Connie Lau – sharp lady who is CEO of HEI (HE) electric utility in Hawaii. Husband’s family founded and runs Finance Factors in Hawaii.

- Walter Dods – Retired Chairman and CEO of First Hawaiian Bank, he sits on numerous boards and is also advisor to Hawaiian Telcom (phone company in Hawaii).

- Michael Chun – Headmaster of Kamehameha Schools Oahu campus. KSBE is the largest private school program in the nation with the largest endowment that rivals Yale, Harvard and Stanford’s endowment.

- Alan Doane is the former Chairman/CEO of ALEX.

Politically, the directors and management are very tied into the Democratic machine in Hawaii. This is a major component for any and all business in Hawaii.

The real estate holdings in Hawaii tend to be concentrated on the higher end developments on Maui, Hawaii, Kauai and Oahu. They do have some prime condo property rights on Oahu. They are also operates of various business parks and shopping centers.

Check out the fact sheets above…. ALEX is top heavy…Teldar Paper top heavy. I can’t think of the last time I saw so much senior management at a company that only made $92M last year.

The company has a share repurchase plan to buy back 2M shares this year. That is good because grants and options now have in excess (2.5m) of that coming on the market. Translation? Shareholders are directly funding these “ghost payments” to insiders. As we can see here executives are exercising and cashing out of the grants/options as fast as they can. I have no problems with options or grants, it does give management more of a stake in the company. This assumes of course they actually hold at least a small portion of them. ALAX insiders can’t dump them fast enough. The last share repurchases were done in 2008 and shareholders have been diluted due to options since. This new repurchase plan, assuming it is completed will do nothing to reduce share count, it will just hide on the surface what is happening to shareholders. Another way to look at it last year the company granted options on 425k shares at an average price of $33. That is a quick $14M dilution tab for shareholders. Now with the shares at $50, the company is going to spend $22M to buy them back……..getting the picture?

This company has tremendous value (great assets and business position) because it is so poorly run. It is not a company that you or I could make good money on because in order to win at this, you need to be able to effect change. You have to become a large shareholder to do it. Current management is too entrenched and the shareholder base too apathetic for natural change to occur. The shareholder based need to be excited and shown “what could be” in order for change to occur. Going for a ride is the only play.

So….what to do? What might Ackman’s plan be?

1- He will not be public on this one IMO. Hawaiian’s, as I have been told countless times distrust outsiders. That and when one considers the union aspect, one has to be sure current management has already indicated to them Ackman will be responsible for job losses there should any of his ideas come to fruition. He will be publicly quiet and work behind the scenes. Unless, he hits a stone wall.

2- Wholesale changes need to be made at the Ag. division. There is just no other way. Either restructure it so it has a chance to make money or sell it to someone who can make money with it. Maybe rather than making nothing growing on it, we could lets the RE division develop parcels of it and let them enter into a JV with a developer to do it (HHC anyone?????). Either way, something has to chance. If after 7 years we still show an operating loss under near perfect operating conditions, it is safe to say that when those perfect conditions go away, the losses will be huge.

3- The whole “bloated pig” management structure isn’t working. Sorry to be using technical “B-School” terms here. We really do not need 25 VP’s or 5 transport companies. Consolidate operations. The good news here is that it might not mean union jobs, just less people to oversea operations so Ackman might get union backing on a plan like this.

4- Buy now? No. IF Ackman does not go public, the public will get bored with this pretty quick and start selling. I would expect the price to begin to drift back in due course. IF it does, then would be the time should you want to go for a ride on this one.