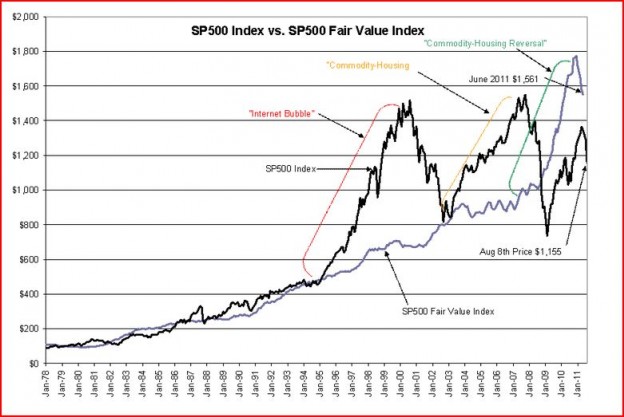

Dallas Fed released the 12mo Trimmed Mean PCE for June 2011 at 1.5% with adjustments for previous months-see their report at http://dallasfed.org/data/pce/index.html. The historical relationship between this measure of core inflation and SP500 is calculated by dividing the “Prevailing Rate” (Real long term GDPx12mo Trimmed Mean PCE) into the long term SP500 Mean Earnings-see the chart below. Today the calculation provides a SP500 Fair Value Index of ~1561.

Calculation:

SP500 Mean Earnings = $71.50 = SP500 price of $1561

“Prevailing Rate” 0.0458The one significant change in the markets of the past 20yrs in my estimation is the dominance of Hedge Funds which are now reported to control $2Tril+ in equity. With 5x leverage this would equate to $10Tril while the SP500 carries a market capitalization of ~$12Tril. Well over 1/2 of the daily trading activity is reported to be from hedge funds and many of these are mathematically driven or momentum driven. This means that they follow the market trends rather than work with economic fundamentals. The market often falls in response to negative headlines often ignoring positive underlying fundamentals. Hedge Funds exaggerate the trend. Once the markets are responding to economic fundamentals, Hedge Funds again follow the trend and in this instance accentuate or exaggerate on the upside. At the moment hedge funds are exaggerating the negative headlines and the markets have fallen in response.

I view the market which is well below the SP500 Fair Value Index at $1,155 (as of Noon Aug 8, 2011) as fundamentally cheap by this measure. Markets at the moment appear to be ~35% undervalued. Inflation does not appear to be much of a threat and the “Prevailing Rate” is not expected to rise much from the current level.

4 replies on ““Davidson” on S&P 500”

[…] Todd Sullivan: “Davidson” on S&P 500 […]

[…] By this measure the S&P 500 is substantially undervalued. (ValuePlays) […]

[…] CommentsTuesday links: valuation verdict | Abnormal Returns on “Davidson” on S&P 500Morning News: August 9, 2011 | Crossing Wall Street on “Davidson” on S&P 500Top […]

[…] …un contributo tratto dal sito che torvate cliccando QUI […]