Again, this turn out to be more of the same when it comes to $BAC and its litigation exposure. More open ended claims of massive liability. I am not saying that there is intentional deception here, just selective writing for maximum drama and page views. Let’s look at it:

Here is the conclusion of the piece (click here for whole article). Bold emphasis is mine

This case is on a relatively fast track, with an October 2012 trial date.

Given the $50 billion claim looming over it, Bank of America will most likely try to settle this litigation. The settlement value appears to be in the billions. Firing your main witness — Mr. Mayopoulos — and escorting him out the door no doubt only increases the cost.

The case shows how regulators’ actions can be supplemented by private actions. And if the plaintiffs win, this case may be the exceedingly rare event of directors and officers, particularly Mr. Lewis and Mr. Price, actually having to pay money personally to settle a securities fraud claim. If so, the two men would join the relatively few executives from the financial crisis who have been personally penalized.

Whatever the outcome of this case, it appears that Bank of America shareholders were sacrificed in December 2008 so that the Merrill deal could be completed. The bill may now be coming due for Bank of America.

“In the billions” is the settlement value. Now, given the suit is for $50B (BTW, I can sue my breakfast for that much so do not let the amount of the suit deter you from analytical thinking) a reader will naturally go to $5B? Maybe $10B? Without any guide and given the damning tone of the article, why not?

But, lets go and try to find what reality is. I tend to think that is of more importance.

Here is a report on all securities class action settlements from 2001-09 and 2010 Securities Class Action Settlements (click to open pdf). It has specific information of “credit crisis” lawsuits and we’ll assume this would be one. We’ll also do the data as if it isn’t a “credit crisis” claim so readers can make their own conclusions

For this exercise we will assume:

- $BAC is guilty

- $BAC will settle

- $BAC shareholders today are not benefiting from Merrill deal (they are)

- No other factors contributed to $BAC’s price fall during that time frame (can you spell Countrywide?) so the $50B in claims being 100% related to Merrill is 100% legit (it isn’t)

Now, if they will settle, we want to know “when” and for “how much”.

For settlements in 2010, the average time from filing to settlement was 4.1yrs (for all securities suits). The average amount of the settlement as a % of the amount claimed by those filing was between 2% and 3%. That means in this case $BAC, assuming everything above in 2015 or 2016 would be on the hook for anywhere between $1B to $1.5B. Considering during that time frame they will have generated over $120B in pre tax/provision earnings (assuming no improvements from now to then), this amount at the high end comes to a whopping 1.2% of earnings.

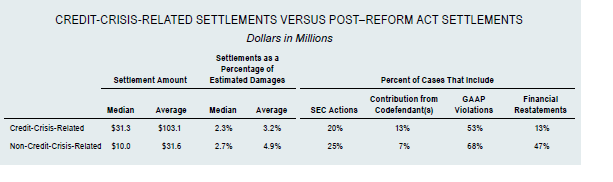

This assumes it settles withing the average. “Credit Crisis” suits are settling at a far slower rate:

Credit-crisis-related cases generally were filed between 2007 and 2009 and have settled at a slower rate than traditional cases…. Of the nearly 200 credit-crisis cases filed, only 15 have settled based on our review

Also:

As shown, credit crisis cases have settled for higher amounts but lower percentages of estimated “plaintiff-style” damages compared with non-credit-crisis cases. While

This means it is realistic to assume $BAC may not be on the hook for anything on this until even after 2016. Here is the data:

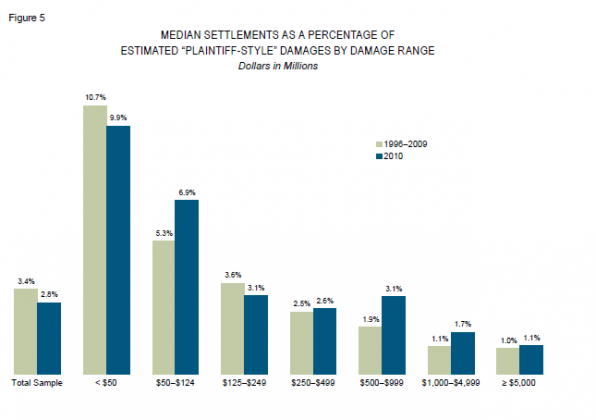

If we assume it isn’t a “credit crisis” claim, then one would expect it to settle faster but for a lower amount. For all securities claims, the larger the damages claim, the smaller the % of the settlement amount the final tally is. In 2010, the % ranged from 2.6% for $500M in claims to 1.1% for claims over $5B (figure 5 below). Because of this it is reasonable to expect the $BAC settlement will be at the lower end of the 1% to 3% range or less that $1B.

Here is the data for all securities litigation:

So, if we take the two classes of litigation we essentially have two outcomes, ~$1.5B at the higher end but not settling until 2016 or later or $500M- $1B settling before 2016. Either scenario, doesn’t do any real damage to $BAC given their reserves and current cash flows

Now, I am also fully aware that “Bank of America May be Exposed to $1B Settlement Later This Decade” is not NEARLY as eye catching a headline as “A $50 Billion Claim of Havoc Looms for Bank of America” ………. but it is REALLY more accurate…

5 replies on “NY Times Misleads on Latest Bank of America Litigation”

[…] NY Times Misleads On Latest Bank Of America Litigation / StockTwits […]

[…] NY Times Misleads On Latest Bank Of America Litigation / StockTwits […]

[…] against them and be forced to pay the whole amount they are being sued for. Wholly irrational…..For more on securities suits and settlements as a % of losses claimed see this post . For more on $BAC litigation, simply do search on the blog for “$BAC” (use the “$” sign) […]

[…] Been doing more work on this after today’s earlier post. We have established a 1%-3% settlement rate on Securities Class Actions and an ~4 yr. time frame. […]

[…] doing more work on this after today’s earlier post. We have established a 1%-3% settlement rate on Securities Class Actions and an ~4 yr. time frame. […]