“Davidson” submits:

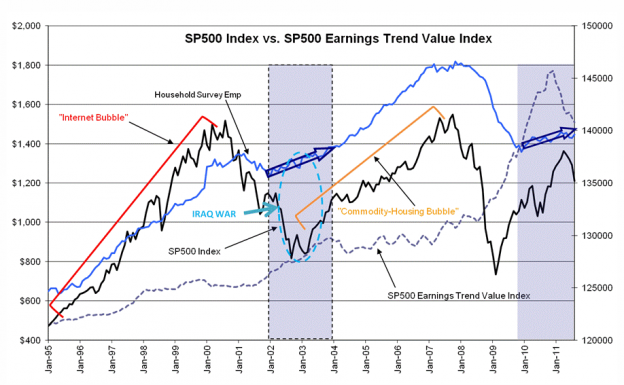

Today’s market is very much like that of that of the Iraq War in 2003. During that period the world was awash with fears that the world as we knew it was about to collapse as the US went to war in the center of the oil producing nations. Oil, I need not remind all, is the “life blood” of the global economy and the irrational belief that Mid-East nations would stop producing as a result of the US intrusion was so palpable that the markets swooned nearly 30%-see the LIGHT BLUE circled area in the chart. The economy as shown by the trend in the Household Survey was in an uptrend which did not waver. Today’s market is quite similar with a respected former US Secretary Treasury joining the chorus that the world has entered a recession and is on the verge of financial collapse based on the current fears of Europeans being unable to solve their debt problems and the US rolling into recession. The problem with this thinking is that it just does not square with the facts!!

The actual facts indicate that the US economy is in a typical recovery and that global trade which has expanded the past 2 ½ yrs continues to expand at a robust pace. Markets have a history of ignoring facts during periods of panic and this certainly is one of those periods. Yes, fear does drive the market over shorter periods, but in the end it is the economy which drives market prices and market psychology.

I remain quite optimistic that the current period of paranoia will pass and the markets will eventually reflect that the current pace of economic activity is in an uptrend. The economy trumps all!! The end of the world as we know it is not near!

Be optimistic and enjoy the holiday. We deserve it!

2 replies on ““Davidson” : Current Market Not 2008….More Like 2003”

[…] It’s not 2008, it’s 2003. (ValuePlays) […]

[…] It’s not 2008, it’s 2003. (ValuePlays) […]