“Davidson” Submits:

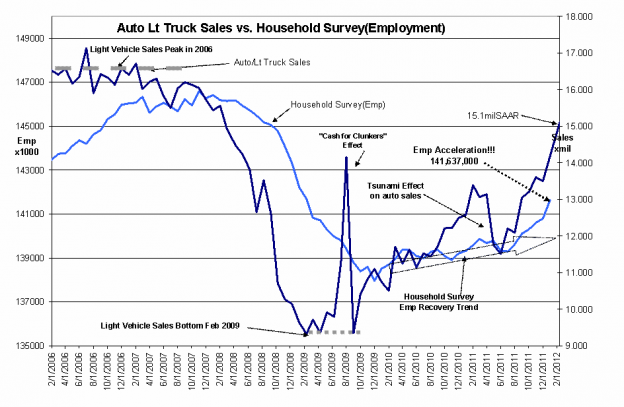

February 2012 light vehicle sales were released today. The final tally was a Seasonally Adjusted Annual Rate (SAAR) of 15.1mil rate. Historically this is the rate for a normal economy since the emid-1980s. Employment is rising sharply which is the source of light vehicle Supply/Demand. Yet, with good news literally pouring forth from multiple economic measures since early 2009, the majority opinion seems to believe that the economy is ready to slip again into recession or at best is sputtering along. If this is sputtering along and the $SPY is priced over 1300, then where will it be priced when housing has fully recovered and vehicle sales are above 16mil SAAR?

History indicates that the market should be much higher. Be patient! Psychology is turning and should turn much more positive as housing blooms.

Ben Graham once said, “The investor’s chief problem — and even his worst enemy — is likely to be himself.” The majority of investors always seem to sell at the lows and buy at the highs. The majority of investors turn pessimistic when the media is pessimistic and only become optimistic when the media turns optimistic.

Value investors are optimistic when all about them are bemoaning the future. I cannot be more positive than I am today.

2 replies on “Light Car/Truck Sales Up…..Expect Employment to Raise Also”

[…] couple of interesting points here. Auto’s again made a multi year high which backs the other data points we are seeing that auto demand continues to […]

[…] a couple of interesting points here. Auto’s again made a multi year high which backs the other data points we are seeing that auto demand continues to […]