I’ve been being asked for the past two years why I have been so sure we are not entering a recession. For those who have forgot, since the recession ended in late ’09, we have for most of that time been tipping into a double dip or in one or worse. There is always some arcane reason why. Economists will trot out increasingly obscure and seemingly correlated ratios that prove their point that in fact we either soon will be or already are in recession. The mantra seems to be “things aren’t great so they must suck”.

Every time there is a blip in the data (apparently things can only go up in a straight line?) the usual cast is trotted out to tell us why we should take all our money out of the bank, buy guns and canned milk and hit the bunkers. You know who they are, Roubini, Rosenberg, ECRI etc..etc…etc… These are the guys who in ’07-’08 were warning of a recession caused by housing and then it happened. They were VERY right then (H/T for that). Because of that, I guess we have to ignore the VERY real fact that they have been VERY wrong since. Look back, the recession ended in late ’09. For near three years now they have been singing the same song (see above) and have been 100% wrong.

If we want to look at Roubini we are past the 3 years mark as he was calling for S&P 600 in March ’09 (I think that was within days of the market bottom) and for the economy to continue to get far worse (it in fact began to turn around only months later).

Rosie has been no better as in the summer of ’10 he declared the US was in fact in a depression, not a recession…..neither of which was remotely accurate.

ECRI said last December after making the September “recession is immanent” call “if we are not in recession by the 1st half next year, then clearly we are wrong” (min 1:30)

Yet, just last week they backed their recession call…….

But, weren’t we “tipping into one” last September? Notice at 1:30 of the video he conveniently glosses over the September call and resets the clock to December?

I’m a pretty simple guy when it come to this stuff. There are two correlations going back as far a FRED keeps the data (it is an amazing data source) that say when they are increasing, we have never had a recession……..ever.

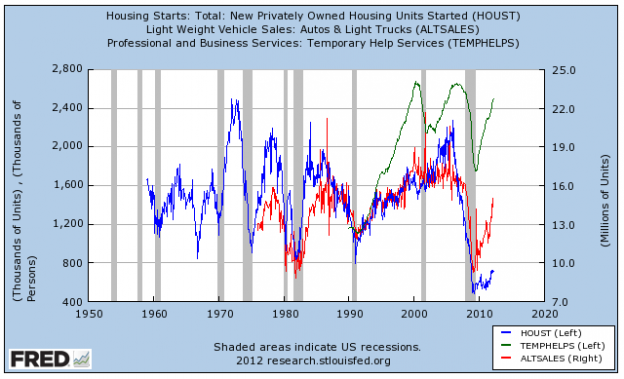

Since the early 90’s, we have added a third that is useful because like the other two, if it is increasing we have not had a recession and, it is nice because it is far less volatile than the others. So it works as the first two may drop for a few months in a row (for various reasons) but if the third is continuing to rise, we are good. Here it is (recessions are shaded):

Auto sales, housing starts and temp employment.

Why? The first two are the 1st and 2nd industries that are the largest employers in the US. If they are rising, so is employment. If employment is rising, we don’t have recessions. Temp employment is added as it covers the remainder of those not employed by the first two. Now, the bears will instantly talk about the “underemployment rate” or the “real employment rate”. I’ll simply say this:

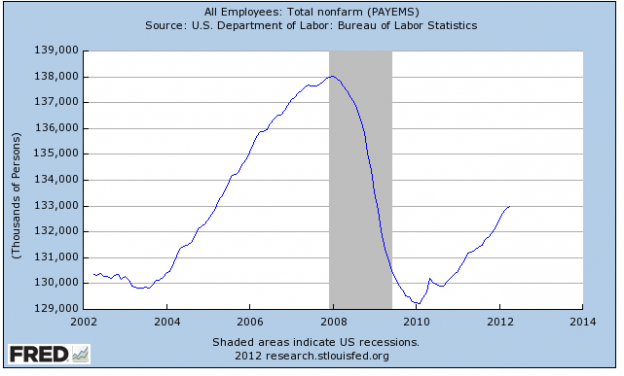

From the lows in ’10 there are 4M more people working today than there were then. Bottom line. THAT is why we have not “double dipped”.

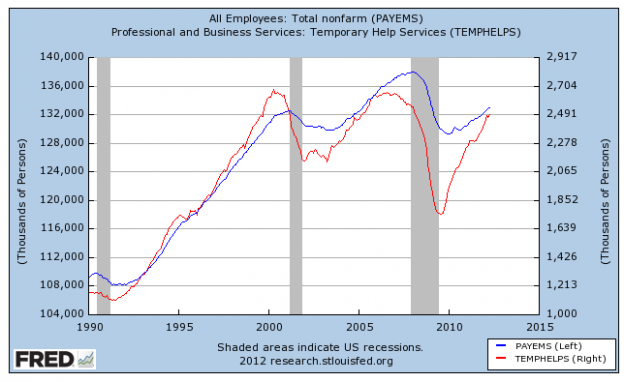

Now, ECRI in the video above makes the point that “employment usually increases right up until a recession starts” …he is right (see above) which is why I do not use it as one of the three indicators. If we look below, temp employment breaks BEFORE total employment and the start of the recessions (there is only temp data that covers the last three recessions) . The break in temp employment will tell us that total employment is going to fall down the road.

If we look at the graphs together, we see that temp employment, auto and housing starts all peak then begin to fall around the same time (before total employment falls). So, while ERCI is correct in what they are saying about total employment, if they have been watching the surge in temp help this year, they’d know any employment peak/downturn well down the road. That invalidates the “recession” call…..at least for the next 6-8 months. Now, could “this time be different”? Sure……but the point here is that this was a call initially made 9 months ago…..

If we really want to get technical the number of employed is even higher than the 4M as it does not cover those folks who work for cash under the table and are 1099’d and yes, there are LOTS of them. The doubters will say “yes, but this recovery is below past recoveries”. So, there are 4M more people working today than there were two years ago (and the number is climbing). That means growth…..that does not mean recession, the key word there is “recoveries”. How does “not great recovery” now equal “recession”? Can’t it just mean “we are recovering but not as well as we would like”?

Now, eventually they will be right. We will always have recessions, always have, always will and there isn’t anything anyone can do to stop them. The thing is when you are making these macro forecasts, there needs to be a time limit in which you have to just say “shit, I was way wrong”. As far as I am concerned, 3 years is easily past that deadline. Now, if either of them had said “in the next three years we will have another recession”, then the jury would still be out. But when you claim we are “in one”, “tipping into one” or “in a depression” and years later neither has happened…..time to admit the error.

But, but, but they will say, what about Greece? Well in the 50’s we had the Cold War that was going to end the word, the 60’s Vietnam/Race Riots, the 70’s had oil, hyperinflation & the Middle East turmoil, the 80’s started with a recession IMO worse than this one & LTCM, the 90’s saw the Gulf War etc etc….the point is there is always something to be concerned about….always. But just because there is something to be concerned about does not mean “all is lost” or its gonna hit the fan tomorrow.

Do I know what is going to happen next year? No (psst…. neither does anyone else). The sole point I am making is that when the inevitable blip in the monthly data comes along, and the three amigos above are trotted out, please just remember what they have been saying for the past three years…..and what has actually happened.

3 replies on “Recession ??”

[…] Todd Sullivan: Blah blah blah, there's always a recession coming. (ValuePlays) […]

[…] Sullivan also covers the entire topic with plenty of charts. This should be a splash of cold water for those objective enough to look […]

[…] Sullivan also covers the entire topic with plenty of charts. This should be a splash of cold water for those objective enough to look […]