Trainwreck…..

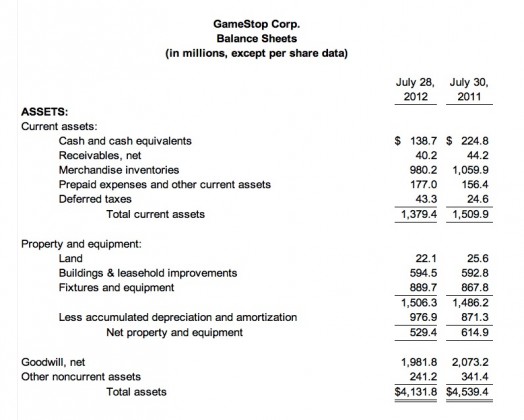

Let’s start with yesterday I said “Take a look at $GME’s balance sheet. They carry a shade over $2B in Goodwill…..which is just a shade under the company’s current market cap of $2.2B. That is a Goodwill write-down red flag….. a major one. The test for Goodwill is what the asset could receive on the open market. What $GME is telling you is the acquisitions they have made are worth what the entire company is being valued at. I call BS

Put it another way, $GME is telling you their business ex acquisitions is only worth $200M (the diff between goodwill and their market cap).”

Then jump to the bold below under guidance:

Now, $GME is still maintaining FY guidance despite Q1 and Q2 coming in worse than expected. The ONLY way they can possibly accomplish this is to basically empty that bank accounts in buying back shares. That does leave a gaping hole next year….

GameStop Reports Second Quarter 2012 Results

Quarterly dividend increased 67% to $0.25 per shareNew businesses account for 10% of gross sales and drive significant margin expansion

GRAPEVINE, Texas–(BUSINESS WIRE)–Aug. 16, 2012– GameStop Corp. (NYSE: GME), the world’s largest multichannel video game retailer, today reported sales and earnings for the second quarter ended July 28, 2012.

Second Quarter Results

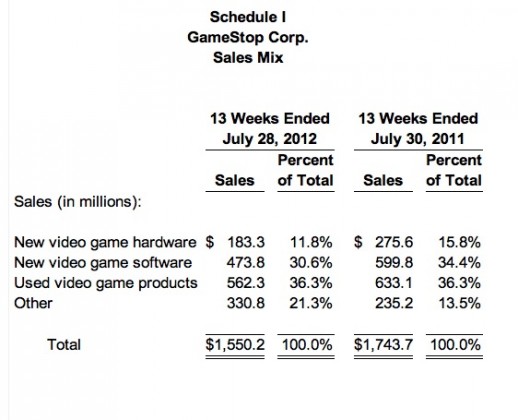

Total global sales for the second quarter of 2012 were $1.55 billion compared to $1.74 billion in the prior year quarter, a decrease of 11.1%. Consolidated comparable store sales decreased 9.3% compared to the prior year quarter. As expected, slow traffic due to a lack of new game releases caused sales of new software and hardware to decline sharply. While outperforming the new category as well as the overall market, pre-owned sales decreased 11.2%.

Other category sales, up 40.6% during the quarter, were primarily driven by new business channels. Digital receipts increased 27% to $134 million. Mobile sales, made up of tablet and pre-owned iDevice products, were $29 million, on track to reach the company’s 2012 forecast for mobile sales of $150 to $200 million.

Paul Raines, chief executive officer, stated, “We continue to see solid sales growth as well as strong margins in our new retail offerings and digital channels. We are focused on staying ahead of the curve as the competitive landscape evolves and we manage through the trough of the console cycle. Finally, the ongoing share buyback and increase in dividend demonstrate our confidence in the future of GameStop and our commitment to improving total shareholder returns.”

GameStop’s net earnings for the second quarter were $21.0 million compared to net earnings of $30.9 million in the prior year quarter. Diluted earnings per share were $0.16, compared to diluted earnings per share of $0.22 in the prior year quarter.

Capital Allocation Update

During the second quarter of 2012, GameStop repurchased 7.6 million shares at an average price of $17.96, or $136.4 million worth of stock, compared to $34.6 million in the prior year quarter. As of today, $301.0 million remains available for share repurchase under the current stock buyback authorization.

GameStop’s board of directors also declared a quarterly cash dividend of $0.25 per common share payable on Sept. 12, 2012 to shareholders of record at the close of business on Aug. 28, 2012. This dividend represents a 67% increase over the quarterly dividend paid in the first two quarters of 2012.

Earnings Guidance

For the third quarter of fiscal 2012, GameStop expects comparable store sales to range from -10.0% to -5.0%. Diluted earnings per share are expected to range from $0.28 to $0.36.

Based on the current number of shares outstanding, the company is maintaining its previously announced full year diluted earnings per share guidance range of $3.10 to $3.30. Full year comparable store sales are expected to range from -10.0% to -2.0%.

Given the recent decline in the company’s stock price, GameStop’s net book value of equity exceeds its market capitalization. As a result, the company is performing an interim impairment test of its goodwill and other intangible assets as required by the provisions of Financial Accounting Standards Board Accounting Standards Codification Topic 350. Management believes any impairment would be related to the company’s international reporting units, which have goodwill and other intangible assets recorded on the financial statements at a carrying value of $920 million. Any impairment charge resulting from this test would be material to the company’s financial statements. However, any such potential impairment charge would be non-cash and would not impact the Company’s on-going business operations, cash flows or financial condition.

Note: Current guidance only includes the effect of the shares purchased thus far in fiscal 2012.

Same store sales down in excess of what was projected, SSS guidance for the rest of the year ratcheted down lower (again) than projections, cash falling, current liabilities not falling, etc etc etc

Now, here is the key point. The main reason results aren’t materially worse is because of the buybacks. Buybacks aded $.02 to earnings in the current quarter and $.06 YTD. Without them, earnings for Q2 would have been 14% lower and 9% lower YTD. Here is the problem with that, they are running out of cash to keep this up without taking on more debt. The company has made $.71 YTD and expects $.32 (middle point of guidance) in Q3 for a total of $1.03. That means Q4 must deliver $2.17 to hit the middle point of their annual guidance.

That will be quite a trick seeing as they made $1.61 last year. They are below results from ’11 YTD ($.71 vs $.78), have guided Q3 well below the $.39 they earned in Q3 last year but are magically going to grow Q4 EPS 35%. Anyone want to explain that to me?

That is a near $100M drop in cash (lower AR also) YOY that has gone to share repurchases. Now, that is good for shareholders temporarily as it has buoyed the stock price and EPS this year. BUT, reality has to now hit and shareholders have to look and say, “what happens when they can’t buy more back?”. Quick answer is EPS plummets. The company bought back $136M in Q2…….that matches what they have left in the bank. There will be a small amount of cash coming in during Q3 as they still are profitable (by a bit) so they will actually have a bit more than indicated above. The key point is >$125M a quarter in buybacks is coming to an end soon without the company adding debt to do so.

Let’s go a step further…sales and sales mix.

Remember the basic short thesis is the physical game model is going away (or nearly away). As it does, there will be less trip to $GME locations, less trips to $GME locations mean less used games sold which is still the company’s bread and butter no matter what they say.

Here is the proof:

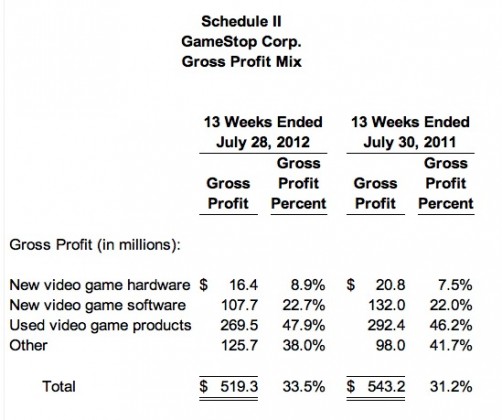

Used games still make up >35% of the shrinking sales pool. No matter what the company says about new initiatives and sales channels, people walking into the stores and buying used video games is still what drives sales and even more so, profit:

While ~35% of sales, used video games are more than ever a bigger piece of the profit pie now at 47%. So, again as store traffic continues to dwindle, we can expect the used game segment to continue to fall. As more games move to digital, this segment will continue to fall. Thus the reason $GME needs to wander into different directions (see yesterday’s post linked in beginning for more on that) in a desperate effort to find alternative revenue sources.

Going off on a tangent here but this is the reason you simply cannot run a stock screen and invest based on the ratios it spits out. By every metric $GME is “cheap”. BV, PE etc all say $GME is a bargain. BUT, when you look at the direction the components of those ratios are going, they are going the wrong way. When profits are falling today’s low PE goes up as the “E” falls. Today’s low P/BV goes up when massive goodwill writedowns (they will be here) wrecks the BV part of the equation.

Ratios and screens are a decent place to start…….to start….you then have to dig, its the only way

3 replies on “GameStop Same Store Sales Crater and Admits Writedowns Are Coming”

[…] Selections] The long case on Dreamworks (DWA) [Whopper Investments] A look at the trainwreck that is Gamestop (GME) [Value Plays] A response to the above GameStop piece [Motiwala Capital] Why are global macro […]

[…] is from a post I did in Mid august: Same store sales down in excess of what was projected, SSS guidance for the rest of […]

[…] is from a post I did in Mid august on […]