Been getting a lot of email from nervous readers today about the following article:

In a tax fight that could jolt the real estate business, Howard Hughes Corp is challenging the U.S. Internal Revenue Service over a $144.1 million tax bill stemming from land sales at Summerlin, an enormous planned community in southern Nevada.

The dispute centers on an accounting practice – known as the “completed contract method” – that the IRS has scrutinized for years. A Tax Court trial is scheduled for November 5 in Las Vegas.

The IRS contends, according to court records, that Howard Hughes improperly deferred taxes on income from sales of residential lots at Summerlin, which sprawls across 35 square miles on the western fringe of Las Vegas.

The company should pay taxes as it books the lot sales and not wait until the project is nearly finished, the IRS said.

But Howard Hughes says its use of the method is permissible under an IRS exemption for home construction, and that developers pay up-front costs and do not know their ultimate taxable gains until a project is almost finished.

Both the company and the IRS declined to comment.

Dallas-based Howard Hughes is a spinoff from General Growth Properties. Though Howard Hughes is the company in court, General Growth is liable for tax payments if the IRS wins, according to the spinoff agreement.

General Growth declined to comment.

Activist investor William Ackman is chairman of Howard Hughes. Ackman’s hedge fund, Pershing Square Capital Management LP, owned 3.6 million Howard Hughes shares as of June 30.

The IRS said in September 2009 that companies using the completed contract accounting method to defer income from land sales for years, or even a decade or more, could trigger an audit.

The IRS has other Tax Court challenges pending with property developers over the completed contract method, or CCM.

“Taxpayers’ misuse of the CCM is a growing trend within the residential construction industry,” the IRS said in a September 2009 internal memo, one of several posted on the IRS website.

HIGH STAKES FOR INDUSTRY

An IRS win in Tax Court could mean property developers would need to pay taxes on a “percentage-of-completion” accounting method, a less-favorable approach for businesses.

The IRS is “taking a pretty hard-line position, saying that you just are not entitled to the completed-contract method,” said David Auclair, principal at accounting firm Grant Thornton.

“This is a big issue for land developers and commercial real estate,” he said.

Homebuilders also use the completed contract method. In July, California-based Shea Homes LP went to trial with the IRS over this issue.

The company could owe up to $61 million in federal and state taxes, Shea said in Securities and Exchange Commission filings.

Wilkes Graham, senior vice president at Compass Point Research & Trading LLC, said a court loss for Howard Hughes and General Growth would not deal a blow to their shareholders.

But, he said, the challenge to the accounting method will be watched by other companies.

“It’s a bigger deal overall,” he said. For companies using the completed contract method, “those entities would be at risk” if the IRS wins, he said.

Howard Hughes got a tax bill in February 2011 for allegedly under-paying taxes in 2007 and 2008 on Summerlin, a project that the company does not expect to sell out until 2039.

Hurt by the recent financial crisis, Summerlin’s acreage sales are starting to recover this year. The development’s land covers an area half the size of the District of Columbia.

As a developer, Howard Hughes builds the infrastructure at Summerlin – roads, sewer and water, electricity. The company makes money when it sells developed properties to home builders.

A Tax Court loss by Howard Hughes would hurt the development industry just as it is starting to recover.

Developers beginning new projects may need to pay taxes sooner, adding an up-front cost for the businesses, said Richard Shavell, a vice chairman at the Associated Builders and Contractors, an industry group. “If the IRS wins, they could cause a lot of uncertainty,” he said.

They want to know “does $HHC have anything to worry about?”. For the answer we have to go back to March of 2011 and my little spat with $SPG’s David Simon. We were arguing over whether or not his offer for $GGP when it was still in Chapter 11 was identical to the offer $BAM made. I said it wasn’t and the main reason it wasn’t was because of the treatment of the Spinco, then GGO, now HHC.

Here is the applicable sections (bold type) and here is the whole post:

From the “Cornerstone Agreement”

“On or prior to the Effective Date, the Company shall incorporate GGO with issued and outstanding capital stock consisting of at least the GGO Common Share Amount of shares of common stock (the “GGO Common Stock”), designate an employee of the Company familiar with the Identified Assets and reasonably acceptable to each Purchaser to serve as a representative of GGO (the “GGO Representative”) and shall contribute to GGO (directly or indirectly) the assets (and/or equity interests related thereto) set forth in Exhibit E hereto and have GGO assume directly or indirectly the associated liabilities (the “Identified Assets”); provided, however, that to the extent the Company is prohibited by Law from contributing one or more of the Identified Assets to GGO or the contribution thereof would breach or give rise to a default under any Contract, agreement or instrument that would, in the good faith judgment of the Company in consultation with the GGO Representative, impair in any material respect the value of the relevant Identified Asset or give rise to additional liability (other than liability that would not, in the aggregate, be material) on the part of GGO or the Company or a Subsidiary of the Company, the Company shall (i) to the extent not prohibited by Law or would not give rise to such a default, take such action or cause to be taken such other actions in order to place GGO, insofar as reasonably possible, in the same economic position as if such Identified Asset had been transferred as contemplated hereby and so that, insofar as reasonably possible, substantially all the benefits and burdens (including all obligations thereunder but excluding any obligations that arise out of the transfer of the Identified Asset to the extent included in Permitted Claims) relating to such Identified Asset, including possession, use, risk of loss, potential for gain and control of such Identified Asset, are to inure from and after the Closing to GGO (provided that as soon as a consent for the contribution of an Identified Asset is obtained or the contractual impediment is removed or no longer applies, the applicable Identified Asset shall be promptly contributed to GGO), or (ii) to the extent the actions contemplated by clause (i) are not possible without resulting in a material and adverse effect on the Company and its Subsidiaries (as reasonably determined by the Company in consultation with the GGO Representative), contribute other assets, with the consent of each Purchaser (which such Purchaser shall not unreasonably withhold, condition or delay), having an economically equivalent value and related financial impact on the Company (in each case, as reasonably agreed by each Purchaser and the Company in consultation with the GGO Representative) to the Identified Asset not so contributed.”

1- Portions of the GGP IPO went to settling liabilities at HHC

2- The Howard Hughes claims were settled prior to HHC being spun off from GGP

3- Master Planned Communities tax liability1 & 2- In essence this treatment, spinning the assets of HHC while settling the liabilities of it (at the time the Hughes Heirs liabilities were not adjudicated by the court, the end amount was unknown) allowed HHC to emerge a very healthy entity. BFP agreed to indemnify HHC shareholders from those claims. The Hughes claim was settled in Sept. 2010 for $220M (estimates had the claims near $500M, Mr. Hudson did a fine job on this article BTW). That $220M would have come out of HHC shareholders pockets under the SPG plan rather than being paid by GGP as it was. The initial SPG deal would have spun BOTH the assets and liabilities of HHC. If the Hughes Heirs decided to take that $220M in stock, at emergence they would have owned 15%-20% of HHC (or up to 50% if they got the whole $500M) OR had they wanted cash, HHC would have been forced to do a secondary offering severely diluting current shareholders. Either way the results we have seen to date (~100% gain) would not have happened and the very real possibility of us dumping HHC post emergence would have existed as it value proposition would have not existed.

3- The MPC segment had a potential $300M tax liability when the plan was announced. Again, under the final SPG plan this liability would have been transferred to HHC when it was spun.

That was rectified under the GGP plan:

(b) MPC Taxes. Notwithstanding any provision of any of the Investment Agreements or any provision of this Agreement or any of the other Transaction Documents to the contrary, GGP shall be liable for 93.75% of any MPC Taxes payable in cash by Spinco or any of its Subsidiaries; provided, however, that, except as provided herein with respect to interest or penalties, GGP’s liability pursuant to this Section 2.01(b) shall be capped at the lesser of (i) $303,750,000 and (ii) the then effective Excess Surplus Amount (if any) (the applicable amount described in clause (i) or clause (ii) is referred to herein as the “Indemnity Cap”). In the event that any Suspended Deductions are utilized by Spinco or any of its Subsidiaries to offset taxable income or gain realized by Spinco or any of its Subsidiaries other than taxable income attributable to sales of MPC Assets sold prior to March 31, 2010, GGP’s current and future liability, if any, pursuant to this Section 2.01(b) shall be reduced by an amount equal to 93.75% of the incremental Taxes that would have been payable in cash by Spinco or any of its Subsidiaries had such Suspended Deductions not been so utilized. In the event that any Tax Attributes other than Suspended Deductions are utilized by Spinco or any of its Subsidiaries to offset and reduce taxable income or gain generated with respect to sales of MPC Assets sold prior to March 31, 2010, GGP shall be liable for 93.75% of any Income Taxes payable in cash by Spinco or any of its Subsidiaries that would not have been so payable had such Tax Attributes not been so utilized. In addition, notwithstanding any provision of the Investment Agreements or any provision of this Agreement or any of the other Transaction Documents to the contrary, GGP shall also be liable for one hundred percent (100%) of any interest or penalties attributable to any MPC Taxes which interest or penalties accrue with respect to periods ending on or before the date that Spinco assumes control of all Tax Proceedings relating to MPC Taxes pursuant to Section 6.03 (it being understood and agreed by the parties hereto that, for purposes of this Agreement, all penalties are deemed to accrue as of the date that the applicable penalty has been asserted or claimed by the IRS) and GGP’s liability for such interest or penalties shall not be limited by or subject to the Indemnity Cap. Spinco shall use commercially reasonable efforts to utilize the Suspended Deductions as expeditiously as possible and will not take any action, the principal purpose of which is, to cause GGP’s aggregate liability pursuant to this Section 2.01(b) to be materially greater than it would have been had such action not been taken.

In order to place Spinco and GGP in the same economic position as they would have been had certain post-Effective Date determinations been made as of the Effective Date, the Indemnity Cap shall be re-calculated and adjusted to reflect any such determination using the Adjusted CDND as provided in the Investment Agreements. Additionally, to the extent any promissory note was issued by Spinco in favor of GGP pursuant to Section 2.01(a)(ii), then, in order to place Spinco and GGP in the same economic position as they would have been had the recalculated Indemnity Cap been used for purposes of calculating such note, (i) the principal amount of such note will be reduced based on the new calculation using the Adjusted CDND, and (ii) to the extent applicable, any interest payments made by Spinco to GGP on such note prior to such re-calculation shall be refunded in respect of such reductions and accrued but unpaid interest in respect of such reductions shall be eliminated. Consistent with the foregoing, this Section 2.01(b) shall be retroactively applied using the recalculated Indemnity Cap and any resulting amounts payable thereunder shall be promptly paid by GGP.

So, we had a potential $500M liability of the Hughes Heirs and a $300M tax liability that was covered under the BFP plan that was not addressed in the Simon plan. $800M in liabilities for a company that emerged with a $1.35B market cap is more than a little substantial.

This is why is in HHC’s 10Q they say:

In the ordinary course of our business, we are from time to time involved in legal proceedings related to the ownership and operations of our properties. Neither we nor any of our Real Estate Affiliates are currently involved in any legal or administrative proceedings that we believe are likely to have a materially adverse effect on our business, results of operations or financial condition.

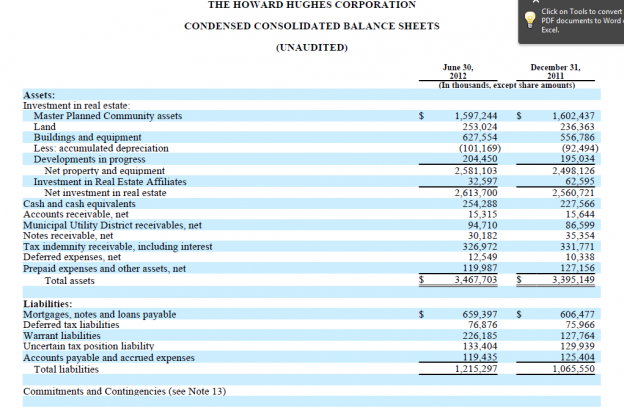

Here is the balance sheet with the Tax assets of >$300M:

So, a long winded way of saying, NO,….nothing to worry about.