“Davidson” submits:

In a recent commentary I noted that the past few years have seen substantial rises in farm land prices. My opinion is that this is simply part of the fear of financial assets which has developed the past 10yrs and in response investors have favored “hard assets”, i.e. oil, gold, commodities of every sort and even a return to real estate investments large and small. It is my observation that the tremendous volatility of markets since 1995 has been brought to us by the dominance of markets by Hedge Funds. Since 1995 this has made a simple interpretation of markets impossible for most investors and they have turned mainly to assets which they can touch and also to fixed income securities which pay a highly visible rate of return. Part of this phenomena has been the rush to also own assets which are the basis of food production, i.e. farm land. We have this behavior in our historical record. It has always ended badly for those who were overly committed to single themed investing!!

Those who become overly committed to any asset which rises well beyond its historical trend have always experienced negative consequences. At this time farm land has seen pricing well above the historical trend with the past few years reflecting quite sharp rises as investors and farmers alike bid higher and higher prices. Real estate is an asset which is thought to be “precious”, “unique” and in very limited supply. While society can always grow more corn, produce more of everything imaginable and build more trophy buildings, one item that can never be created is natural farmland. Crop land is truly unique and has evolved ever so slowly over 10s of millions of years into the few highly fertile patches we use today. Periodically, the perception of “They are not making any more of it!” overcomes the basics of economic returns. This is evident in 2012’s average rises in farmland prices vs. 2011 as shown in the chart from the National Agricultural Statistical Service-see Land Values: Farm Real Estate Value by State, US. Link:http://www.nass.usda.gov/Charts_and_Maps/Land_Values/farm_value_map.asp

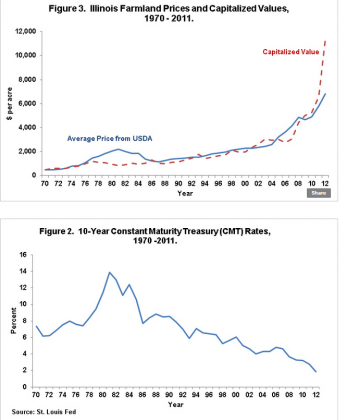

From the Land Values chart one can readily see that the food growing states have witnessed a huge rise in farm land values since 2011. Taking Illinois for example shows that prices began to soar in 2004 and now stand ~200% higher today or ~14.5% growth each year to ~$6,700 per acre-see Figure 3. Link: (previous price growth was ~4% from 1974-2004 is the pace of inflation over that period) Current prices are justified by the very low 10yr Constant Maturity Treasury(CMT) rates-see Figure 2.

Price rises similar to today were last seen in the early 1980s when it was believed that we would experience financial collapse due to uncontrollable inflation. The fear was palpable! Gold soared as individuals converted equity(sold stocks) and other assets into gold coins which were newly minted by the millions. We have quite similar fears today. Farm land prices have soared well beyond historical trends as prominent investors have bought land to counter the perceived coming financial collapse due to hyper-inflation with its associated US$ debasement. The fact that so many prominent investors think that portfolio risks from a future financial collapse can be offset by investment positions in hard assets of every type has been present in the markets for several years now. One can see this in prices soaring well beyond the historical trends of copper, gold, coffee, cotton, tin, nickel and farm land. When too many investors crowd into a single investment to such an extent as to cause its price to soar beyond its historical ability to generate a return, then it becomes an investment fraught with risk!

The current cash rent is reported to be ~3.1% vs. the historical avg. of 5.5%-6% from 1982 thru 2004. This will not last! 10yr Treasury rates will not remain below 2%. In my analysis the 10yr Treasury should rise once the current fear has diminished and return to levels closer to the value of historical Real GDP+Inflation(the Prevailing Rate). The current level of Prevailing Rate = 4.8%. If one uses the inflation trend from 2004-2012 to calculate a fair farm land acreage price, one gets ~$3,060 not the $6,700 seen today. A correction to $3,060 would bring cash rents much closer to historical norms.

In every other previous financial collapse, we have modified our behavior, become more conservative financially and recovery followed. Normalization occurs over several years, not in days!! As investors recognize that “the end of the world” has once again been “miraculously”, even “magically”, been avoided, they come back to equities as they come to recognize that “hard assets” are not the panacea they once thought.

My perception is that “hard asset” prices being above historical trends is a positive for future equity prices. As corporations continue to generate earnings in the process of satisfying society’s many needs, the current “hard asset” owners will eventually recognize that equites as the favored asset class to own.

Buy stocks because the returns justify! Optimism is warranted in my opinion.

Excerpt from Farmdocdaily:

“Capitalized value = cash rent / CMT 10-year rate.

“This formula assumes that cash rents and interest rates remain the same as current values throughout the future.”

“Capitalized values were significantly below prices during the early 1980s (see Figure 3). In 1980, for example, USDA estimated the average land price at $2,041 and the capitalized value was $933 per acre. The lower capitalized value indicated that farmland prices were above fundamentals suggested by cash rents and interest rates. Subsequently, farmland prices decreased in each year from 1981 to 1987.”