Companies in the course of the business will build up tax assets that can be used to offset GAAP income. These can be loss carry-forwards, R&D credits and book/tax timing differences, such as accrued liabilities etc. Now, these “assets” don’t have an infinite shelf life. If you do not produce GAAP profits, you lose them.

From the earnings call (emphasis mine):

Turning to earnings. Our GAAP results this quarter include the impact of a onetime, noncash charge of $149 million to establish a valuation allowance against our federal and state deferred tax assets. As a result, we posted a third quarter GAAP loss per share of $1.55. While this is a noncash item and excluded from non-GAAP results, I just want to provide some context.

Deferred tax assets on the balance sheet represent the value of tax deductions and credits to offset future tax liabilities. These assets include net operating loss carry-forwards, R&D credits and book/tax timing differences, such as accrued liabilities. U.S. GAAP requires companies to regularly assess the realizability of deferred tax assets by evaluating certain criteria. These criteria include whether the company has a cumulative 3-year historical pretax GAAP loss, as well as the timing and likelihood of near-term GAAP profitability.

After performing this analysis in Q3, we determined that a valuation allowance was required as near-term realization of these assets is unlikely. But just to be clear, our deferred tax assets have expiry dates many years into the future. And so we do anticipate being able to use these assets at some point to offset perspective tax liabilities.

The 10Q said it just a bit differently (pg 28):

The Company regularly assesses the need for a valuation allowance against its deferred tax assets. In making that assessment, the Company considers both positive and negative evidence related to the likelihood of realization of the deferred tax assets to determine, based on the weight of available evidence, whether it is more-likely-than-not that some or all of the deferred tax assets will not be realized. In evaluating the need for a valuation allowance, the Company considers its cumulative loss in recent years as a significant piece of negative evidence. As a result, in the third quarter the Company determined that the negative evidence outweighed the positive evidence as of October 31, 2012 and recorded a one-time, non-cash charge to income tax expense in the third quarter of fiscal 2013 in the amount of $149.1 million to establish a valuation allowance against a significant portion of its July 31, 2012 deferred tax assets balance. Additionally, the Company recorded $25.9 million related to the quarterly change in the valuation allowance for the three months ended October 31, 2012.

Salesforce is telling investors not to expect a GAAP profit in the near future (I’ll say at least two years). This is essentially due to the massive stock options/awards they grant management and the fact they are barely profitable ignoring this. But that is a post for another day. As they rush to cash the option/grants in (in many cases now 4 years before expiration), it is a cost to shareholders. $CRM would prefer to pretend it isn’t an expense to shareholders and omit it by focusing on “non-GAAP”. We should note here that it was not always that way. When the company was reporting increasing GAAP EPS they were more than happy to report GAAP income and made no mention of non-GAAP (from 2009). It was only when earnings began falling on a GAAP basis (the next earnings release when the gave FY2011 guidance) they decided they’d better find another way to report EPS. Thus the birth of their non-GAAP metrics. It is often referred to by the technical term “putting lipstick on a pig”.

I’ll let Buffett explain: “If stock options aren’t a form of compensation, what are they? If compensation isn’t an expense, what is it? And, if expenses shouldn’t go into the calculation of earnings, where in the world do they go?”

Now, GAAP disagrees with $CRM and says they are an expense and this is why $CRM has not turned a profit since June 2011 and according to what they say above, has no plans to anytime soon. If they did think they would, there would be no reason for the “substantial” (their words) deferred tax asset write down.

Here is their reasoning:

Salesforce on the use of “non-GAAP” measure in net income (pg 50 10Q): (click to open 10Q)

We define non-GAAP net income as our total net income excluding the following components, which we believe are not reflective of our ongoing operational expenses. In each case, for the reasons set forth below, we believe that excluding the component provides useful information to investors and others in understanding and evaluating the impact of certain non-cash items to our operating results and future prospects in the same manner as us, in comparing financial results across accounting periods and to those of peer companies and to better understand the impact of these non-cash items on our gross margin and operating performance. Additionally, as significant, unusual or discrete events occur, the results may be excluded in the period in which the events occur.

• Stock-Based Expenses. The Company’s compensation strategy includes the use of stock-based compensation to attract and retain employees and executives. It is principally aimed at aligning their interests with those of our stockholders and at long-term employee retention, rather than to motivate or reward operational performance for any particular period. Thus, stock-based compensation expense varies for reasons that are generally unrelated to operational decisions and performance in any particular period.

It is really, really important to remember that they only decided this when GAAP numbers turned south on them. Additionally, when isn’t executive comp an “ongoing operational expense”?

So Benioff &Co. are telling us that the use of non-GAAP (pretend) financials is to make it easier for us to compare $CRM financials with their peer group…like $ORCL? Here is the problem with that. Oracle does not report “non-GAAP” net income. They do this crazy little thing and report GAAP financials. Nowhere in their 10Q do they mention “non-GAAP” earnings that omit “stock based comp” nor do they provide footnotes on the income statement that back out stock based comp. Why? Probably because they A) are profitable anyway B) are not massively diluting shareholders C) management is not treating the company like a bottomless ATM. I say “like an ATM” because in the past two years $CRM management has sold $203M in stock ($500M in three years) and over that time frame, have not bought a single share.

In fact, they address it directly:

Oracle on Stock based comp (pg 45 10Q): (click to open 10Q)

Stock Options and Restricted Stock-Based Awards

Our stock-based compensation program is a key component of the compensation package we provide to attract and retain certain of our talented employees and align their interests with the interests of existing stockholders. We historically have granted only stock options to our employees and any restricted stock-based awards outstanding were assumed as a result of our acquisitions.We recognize that stock options and restricted stock-based awards dilute existing stockholders and have sought to control the number of stock options and restricted stock-based awards granted while providing competitive compensation packages. Consistent with these dual goals, our cumulative potential dilution since June 1, 2009 has been a weighted average annualized rate of 1.7% per year. The potential dilution percentage is calculated as the average annualized new stock options or restricted stock-based awards granted and assumed, net of stock options and restricted stock-based awards forfeited by employees leaving the company, divided by the weighted average outstanding shares during the calculation period. This maximum potential dilution will only result if all stock options are exercised and restricted stock-based awards vest. Some of the outstanding stock options, which generally have a 10-year exercise period, have exercise prices higher than the current market price of our common stock.

At August 31, 2012, 20.7% of our outstanding stock options had exercise prices in excess of the current market price. In recent years, our stock repurchase program has more than offset the dilutive effect of our stock-based compensation program; however, we may reduce the level of our stock repurchases in the future as we may use our available cash for acquisitions, to pay dividends, to repay or repurchase indebtedness or for other purposes. At August 31, 2012, the maximum potential dilution from all outstanding and unexercised stock options and restricted stock-based awards, regardless of when granted and regardless of whether vested or unvested and including stock options where the strike price is higher than the current market price, was 10.3%

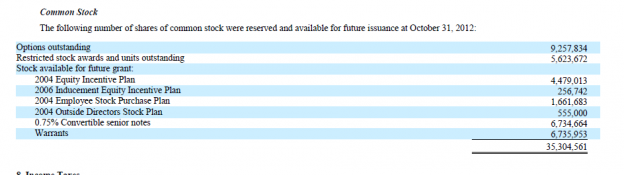

This is even more interesting (and damning to $CRM). $ORCL (remember, Benioff wants us to compare financials with them) has kept to maximum total dilution to 10.3%. Sooooooo, lets look at $CRM shall we? From $CRM 10Q pg 27:

That is 35.3M more shares on a current undiluted base of 142M…. or a potential 25% additional dilution.

Here is what happens. All these “dilutive” but shares are essentially hidden now. Why? To include them in EPS now would make EPS losses appear smaller, this makes them “anti-dilutive”. For instance if I lose $1 on 10 shares out, I lose $.10/share. But if I have un-exercised options of another 10 shares and include them, then I have a $1 loss on 20 shares out of $.05/share. It makes losses appear smaller than they really are and so companies are not allow to include them.

But, what happens if some day $CRM Forrest Gump’s itself to a profit? Well then all those hidden shares come into play and become VERY dilutive VERY quick to “potential” earnings at $CRM.

This is eventually going to catch up with everyone….it always does. When it happens, it is going to be a very bad day for those holding shares.

Benioff likes to compare his products and his revenue growth to the competition at every opportunity. If only he match their accounting and concerns for shareholders. Now, I know that people will say “but management holds shares also”. Go look t the form 4’s for the past two years. Management is in virtually every instance exercising options and immediately liquidating every share. Most of these options are being exercised 2 years before expiration and some as long as 4 years prior to expiration. The point here is that while Joe the Shareholder will get killed, management won’t as they have already cashed in to the tune of $500M the past three years. And, even if the price gets cut in half, it only hurts that year’s options. Then next year they’ll pocket a fresh batch of options worth millions at lower prices.

Look at CFO Smith. In October of last year he exercised option and held 88k shares. That is now down to 19k a year later and in the past two years he has exercised and cashed in options/grants to the tune of $40M

Look at COO Hu. In December 2010 he held 50k shares. As of his last round of sales this month? 4K

Look at Director van Veenedaal. In February of this year he held 74k shares….now? 5k

It just goes on and on……a steady liquidation of shares held by insiders…….they know what is going on and where this is going

3 replies on “Salesforce Discloses It Will Not Earn a GAAP Profit Anytime Soon”

[…] Salesforce Discloses It Will Not Earn a GAAP Profit Anytime Soon ValuePlays […]

[…] is priceless, even for $CRM. Fresh off announcing they have no plans to earn a GAAP profit anytime soon (neat trick for a company valued at $25B) comes this latest slight of hand. $CRM announces a 4 for […]

[…] is priceless, even for salesforce.com, inc. (NYSE:CRM). Fresh off announcing they have no plans to earn a GAAP profit anytime soon (neat trick for a company valued at 25B) comes this latest slight of hand. CRM announces a 4 for 1 […]