“Davidson” submits:

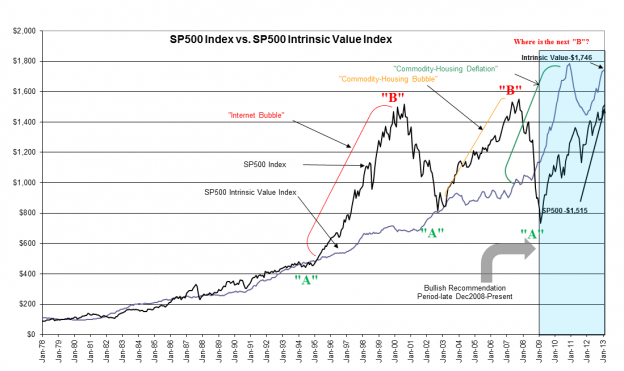

There is always a difference between what one can measure as a business return and the price investors are willing to pay in the investment markets. I use the long term average mean earnings trend line for the SP500 ($SPY) and capitalize this using a long term Real GDP growth rate(3.15%) combined with the current 12mo inflation gauge(1.5%) produced by the Federal Reserve Bank of Dallas(Dallas Fed 12mo Trimmed Mean PCE) to estimate what the SP500 should be worth to the long term value investor. I call this the SP500 Intrinsic Value Index-see chart below.

Since 1995 when Hedge Funds emerged as a significant investment option, the relatively close tracking of the SP500 and SP500 Intrinsic Value Index diverged significantly. The SP500 soared far above the Intrinsic Value Index twice, once in 2000 and again in 2007. Having been a constant student of the marketplace, I attribute these divergences to Hedge Funds which invest using computer model algorithms and employ a trading approach called Price Momentum. If stocks rise on good news, the implication is that “The Efficient Market” knows more than the best of informed investors and that like “The Invisible Hand” so often mentioned in the media, the market somehow knows how to price securities more efficiently and more correctly than the best of informed investors. Investors who utilize computer models and believe that markets know values best are known as Momentum Traders. These investors believe that markets have some “Magical” quality of being able to price investments correctly when informed investors cannot. The markets are believed to be the ultimately informed entity with all known and privately known information incorporated into securities pricing. I do not believe this!

The method I employ in advising clients is based on Knut Wicksell’s 1898 “Natural Rate”. Like Wicksell who is deemed by the Dallas Fed as the “Father of Modern Monetary Policy”, I think that securities are priced by the average return available to all investors in the general economy. The average return translates into the rate of growth of our GDP. Because GDP has 2 components, Real GDP and Inflation, AND because inflation has always been an unpredictable quantity, I use a long term Real GDP trend(this trend has never changed rapidly over the last 80yrs) combined with the current 12mo Trimmed Mean PCE to capitalize the mean long term earnings returns in the SP500, i.e. SP500 Intrinsic Value Index. If one reads the many commentaries well known investors provide in the media, one will come to understand that when the SP500 is priced in line or below the SP500 ($SPY) Intrinsic Value Index, value investors, like Warren Buffett, are moving cash into investments. And, when the SP500 is well above the SP500 Intrinsic Value Index these same value investors indicate that stocks are overvalued. One must be a student of history and an avid reader to make these connections.

Working with the SP500 Intrinsic Value Index developed in 2006 I came to the conclusion that it represents the level at which informed value investors allocate cash to equities seeking 5yr-10yr returns better than the economy and even better than that expected for the SP500. Just as today when Warren Buffett is involved in a large transaction to buy all of H.J. Heinz, the SP500 Intrinsic Value Index continues to register that the SP500 as undervalued. The SP500 is undervalued by ~15% today in today’s inflation environment. Buffett says that he continues to evaluate investments for his cash hoard. The media on the other hand continues to issue daily commentary that investors should be cautious simply because the market has risen better than expected the past 5mos. There is always an edgy quality to any market which has had a rise in excess compared to expectations and this is reflected in the commentary of those who believe that only the market knows best. We do not hear this from individuals like Warren Buffett and Wilbur Ross who by their investment successes have demonstrated that they know how to value markets and see the current market as still undervalued.

Today’s SP500 15% discount I interpret as due to continued pessimism by most investors that current economic activity does not justify current market prices. Many economists and other experts in the media bemoan the “poor employment levels”, the inability of individuals to buy homes and other goods while at the same time ignoring the full recovery in auto sales. Some within the past week have even indicated that the US had already entered a recession and that the only factor keeping equity prices higher has been the actions of the Federal Reserve. The economic information I send each week serves to disprove the many negative assertions endlessly repeated in the media. The divergence between media opinion and the current economic trend is a prime example of market psychology at work.

One can measure business returns, but one cannot predict what the market will pay. Market psychology remains overly pessimistic even with ~130% rise in the SP500 from March 2009. This is, I think, due to Momentum Traders not being able to discern a price trend with which they can identify as “Bullish”. But, our market history indicates that once the “good news” becomes prevalent enough, we should see a more determined turn in market psychology and at that point I fully expect the SP500 to exceed the SP500 Intrinsic Value Index level as observed historically.

How high will this market go? Economic history indicates that we still have perhaps ~5yr-6yrs left of improving economic activity till we return to historical norms of home building and commercial construction. This will result in improved employment levels closer to historical norms as well and should result in appropriate levels of consumption of goods and services. I expect that investors of all types will again repeat their behaviors. Just as Warren Buffett, Wilbur Ross and other value investors are investing cash for equity positions today, they will at some point indicate that equities are overvalued. Likewise, Momentum Traders who remain subdued today and confused about market valuations are expected turn much more positive and drive equity prices to excess over the next 5yrs-6yrs. In predicting how high developing positive market psychology can drive any market or individual equity leaves much room for error. We have no means to price the effect of market psychology on stock prices at some future date. Since it is “Good News” which results in investor enthusiasm, it is simpler to track the economic trends which are the underpinnings of “Good News”/”Bad News” and estimate the 12mos-18mos period in which the market is likely to top. We should not worry about being able to “Call the Top” which is impossible even though many claim to be able to do this. A simple ballpark identification will suffice because market tops tend to be made slowly over the period rather than exist as a point in time.

Today’s SP500 remains undervalued based on historical valuations. Economic activity is good, improving and appears to have yet 5yrs-6yrs left in the current upcycle.

One reply on “Estimating Future Business Returns is Not the Same as Pricing the Market”

[…] By: valueplays […]