Despite the fact that the street was “disappointed” that the ADP number “missed” the 200k “expectations” and came in at 158k (if you factor for the sharp upward revisions of previous months the net was about 3k), every employment indicator continues to tell me the economy is in recovery and the fundamentals of it continue to improve.

Note: ADP said construction growth was ZERO for March. I’ll say right now that will be revised higher next month. Why? Homebuilders are hiring as fast as they can and light truck sales were up 13% in March and there is a direct correlation between that number and construction hiring.

“Davidson” submits:

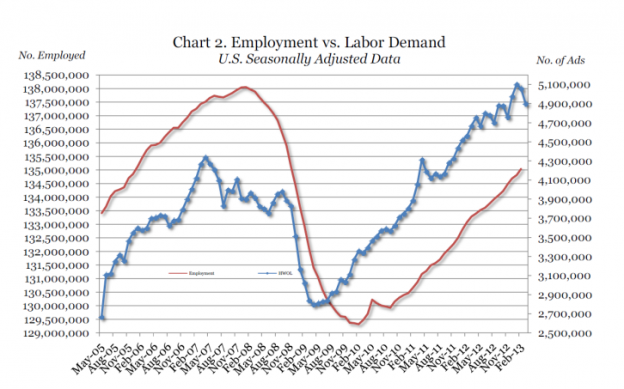

Similar to the American Staffing Index reported yesterday, The Conference Board’s Help Wanted Online Index(BLUE Dotted LINE) has been a good indicator of future hiring trends(RED LINE) in our economy and subsequently the strength of economic activity. The HWOL trend historically leads the employment trend by 6mos-12mos. It is the trend which is most important and not one month’s value vs. the previous month. The drop of 158,000 for March 2013 is well within the trend started May 2009(See the chart below).

The extension of the HWOL trend bodes well for continued economic expansion and higher equity prices in the months ahead. There have always been “Cyprus” and “North Korea” type issues throughout history. As long as economic activity was expansionary, history shows that issues of this type can scare investors which often depresses markets temporarily. Just as often the scare passes without long term effect because economic expansion has always proven to have been the much larger dynamic.

Economic expansion has always been historically translated into higher equity prices ($SPY). There is no reason to believe that this time should be different.

Optimism continues to be warranted in my opinion