Travel day today and probably offline most of this week (of course you know that means something big happens!!!)

“Davidson” submits:

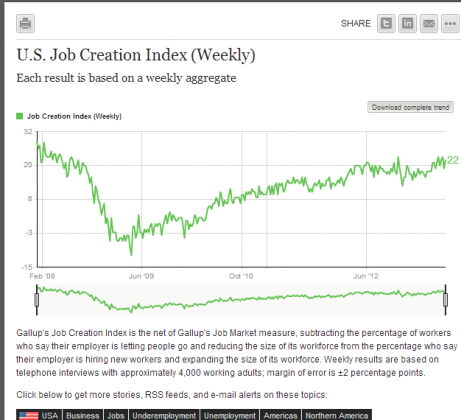

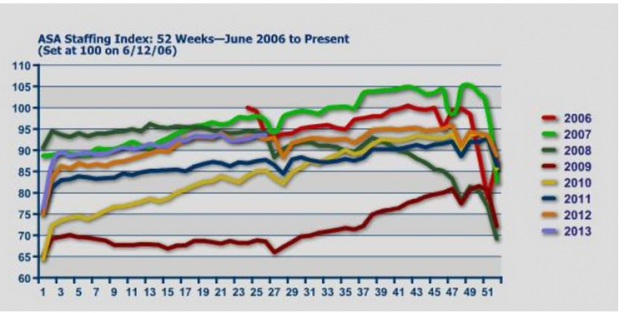

Economic data creeps slowly in trends. It is economic activity which drives stock prices over the business cycle. The most important data concerns the direction of employment which reflects the current and future health of the economy. The Light Weight Vehicle Sales trend is a very good indicator for the US economy and estimating future employment trends. However, associated with vehicle sales are a series of labor demand reports of which the ASA Staffing Index and the Gallup Job Creation Index are shown below. Both of these economic measures provide support to other economic data series in estimating that the US economy is expanding. The links will take you to the Internet sites where they are published.

All the trends which I monitor do not let one predict with precision next month’s or next year’s GDP or next year’s stock prices as to level or when that level will be reached. It is my opinion that efforts to predict when future prices of any security may occur miss understanding the psychological component of the marketplace. Market prices are if anything heavily dependent on individual perceptions which are so varied as to justify calling the market a “Tower of Babel”. Most investors fail to achieve the gains long sought because most do not understand the importance of the psychological component of market prices.

“Market Psychology” evolves across the business cycle from pessimistic to optimistic. Market pricing lows when most are pessimistic are in my opinion dominated by Value Investors, i.e. Warren Buffett, Wilbur Ross and etc. It is my opinion that Value Investors cause markets to bottom with their investment activity. Later as investors become optimistic, market pricing reflects various perceptions most of which reflect a host of misunderstandings and in the two most recent market peaks (2000 & 2007) resulted in extremely over-priced securities. Investors want to take advantage of other’s misperceptions, but do not want to be caught by them. Recent history suggests that over-pricing will likely occur when the economy next peaks – I expect this will be 5yrs-6yrs from now. Economic slowing has always been reflected in the economic data with enough time to make prudent portfolio decisions. For now, all the economic data like the two indices shown +today indicate we are in and remain in a period of economic expansion which has always led to higher equity prices and lower bond prices.

The economic data continues to support higher future stock prices. Optimism is warranted!