Another underfollowed but highly accurate economic gauge for the economy is the architectural billings index (ABI). While highly predictive I do put this in a secondary tier of indicators because it is a “softer data” point (participants are simply asked if biz up/down/same vs hard #’s) than the temp employment, auto sales rails traffic and housing starts which are “hard data” (actual #’s measurement).

That makes it a bit of a sentiment indicator but because of the industry it measures, it is of importance, nor does it diminish its correlation to the overall economy. Further, because it is thinly followed, that makes it intriguing to me.

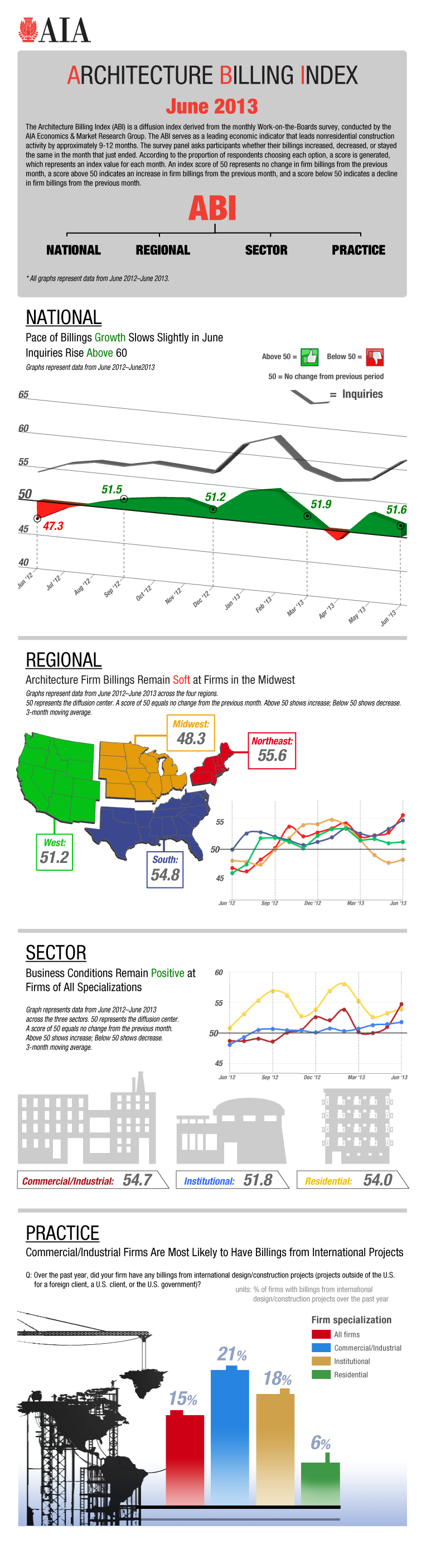

Washington, D.C. – July 24, 2013 – The Architecture Billings Index (ABI) remained positive again in June after the first decline in ten months in April. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the June ABI score was 51.6, down from a mark of 52.9 in May. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.6, up sharply from the reading of 59.1 the previous month.

“With steady demand for design work in all major nonresidential building categories, the construction sector seems to be stabilizing,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “Threats to a sustained recovery include construction costs and labor availability, inability to access financing for real estate projects, and possible adverse effects in the coming months from sequestration and the looming federal debt ceiling debate.”

Key June ABI highlights:

• Regional averages: Northeast (55.6), South (54.8), West (51.2), Midwest (48.3)

• Sector index breakdown: commercial / industrial (54.7), multi-family residential (54.0), mixed practice (52.4), institutional (51.8)

• Project inquiries index: 62.6

The regional and sector categories are calculated as a 3-month moving average, whereas the index and inquiries are monthly numbers.

About the AIA Architecture Billings Index

The Architecture Billings Index (ABI), produced by the AIA Economics & Market Research Group, is a leading economic indicator that provides an approximately nine to twelve month glimpse into the future of nonresidential construction spending activity. The diffusion indexes contained in the full report are derived from a monthly “Work-on-the-Boards” survey that is sent to a panel of AIA member-owned firms. Participants are asked whether their billings increased, decreased, or stayed the same in the month that just ended as compared to the prior month, and the results are then compiled into the ABI. These monthly results are also seasonally adjusted to allow for comparison to prior months. The monthly ABI index scores are centered around 50, with scores above 50 indicating an aggregate increase in billings, and scores below 50 indicating a decline. The regional and sector data are formulated using a three-month moving average

The ABI as an indicator of economic activity