Plenty of people today talking about the pending home sales news. The headlines can be summarized as such “Pending Home Sales Fall as Rising Mortgage Rates Slow Market”..

So, those housing bears will jump all over this claiming that “the end of the housing recovery is in sight” and that all is lost.

Except, one has to wonder………don’t home sales fall every summer? Don’t they fall every summer in both rising and falling markets?

The answer would be, “YES THEY DO”

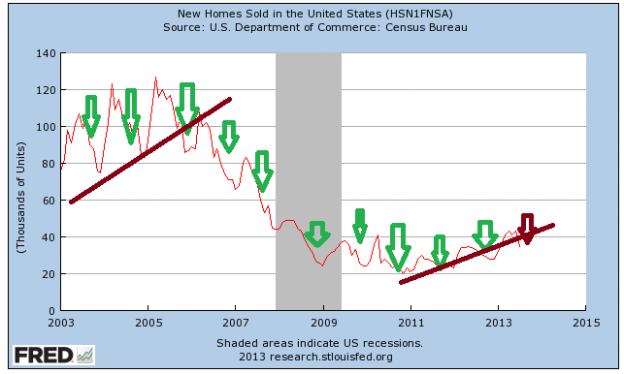

Here is the data from the St. Louis Fed:

Note every year home sales fall in summer. I went to 2003 to capture both the bubble, the crash and current. Not the sales behavior is the same. You can go back further if you want but if I did that the visual wasn’t as good. Trust me, nothing changes. Home sales always fall in the summer

So, what is important then? If we know sales fall every summer then the only way we know if we are in a rising or falling market would be??? YOY sales data.

Pending home sales fell 1.3% to an index score of 109.5 in July from 110.9 in June, based on the latest report from the National Association of Realtors. Still, pending sales are 6.7% above July 2012 levels, and July marks the 27th consecutive month of year-over-year gains for pending sales.

So, we are in a normal yearly activity decline in home sales in the middle of what continues to be a multi year recovery.

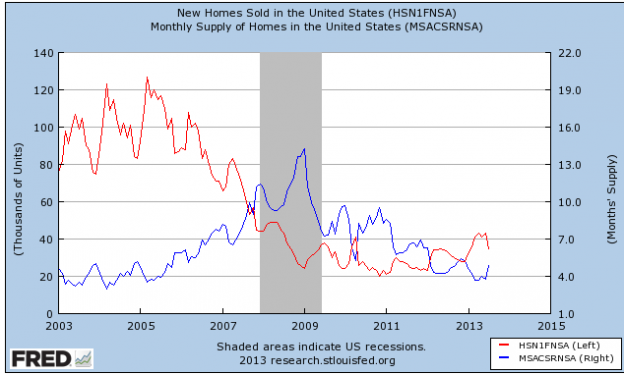

The biggest obstacle for housing isn’t mortgage rates (discussed previously here), it is the following chart:

Inventory is the problem.

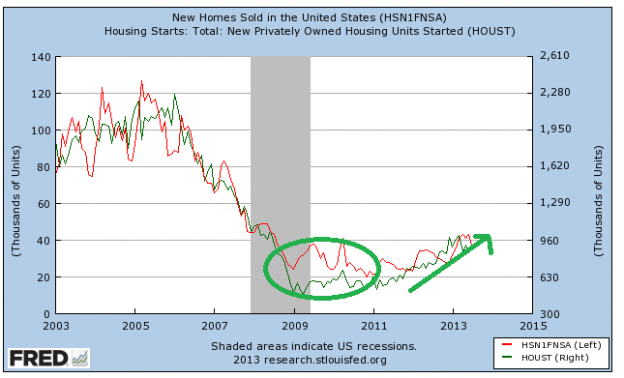

Builders are trying to catch up, note the ramp up in new home starts since mid ’11. They are trying to compensate for the large gap from ’09-’11 when construction was essentially non-existent for a Country that added over 9MM people from ’08-’11:

Builders are being cautious, still reeling from the crash experience. Still, they would like to increase production but a hurdle no one is talking about currently is lot supply. Deeded and entitled land right now is scarce and that is limiting what builders can do as prices for those lots ready to build are skyrocketing. More on that here, here and here. Further, not matter what anyone says, lending is still very tight…especially for “land loans” for builder. That lending area is only now even beginning to open up:

Lending Still Tight According to the NAHB quarterly Acquisition, Development, and Construction Financing survey, more than 85 percent of respondents were shopping for acquisition and development (A&D) loans in 2005 and 2006. As terms tightened and willingness to lend dried up, that share dropped to less than 25 percent in 2009 through 2011. Some very small improvement began in 2012, and the share is up to one-third most recently.

Before the financial markets collapsed, most builders and developers shopping for funds found availability steady or improving. Conversely, from 2008 to 2009, more than three-quarters of builders looking for A&D funds found availability getting worse. Given the time it takes to obtain approvals and install infrastructure, the near cessation in the development pipeline three to five years ago has resulted in a limited supply of lots today.

Financing conditions are marginally better than they were but remain much tighter than the mid-2000s. Builders and developers have opened new sources, and the NAHB continues to develop a broader array of choices. During the boom, more than 90 percent of credit came from banks and thrift institutions. That share has fallen below two-thirds in 2013 as private investors and equity funds replace banks. But, the diversity of sources will take some time to generate the stream of lots needed to answer growing housing demand.

Rising prices do magical things though. They allow underwater borrowers to get above water and sell should they want to, it entices buyers on the sidelines to get off their ass and buy, when you couple rising prices with rising interest rates it encourage banks to lend more and the virtuous cycle continues.

Bottom line is this trend on housing still has years ahead of it