“Davidson” submits:

The basis of my investment advice is the perspective of past business cycles, how the data develops “data point by data point” to form economic trends and finally how these trends become reflected in market prices. The fundamental concept is simple, but compiling the data and doing the analysis is the bulk of the work. The perspective is an investment history of hundreds of years, but the up-cycle can vary from a few years to longer than 10yrs. The goal is to capture a significant part of the investment up-cycles as long term capital gains and avoid the down-cycles. Importantly: Economic data develops over years. It creeps along! One cannot trade it, but I believe it to be very investible if one has patience and a time frame of 10yrs+.

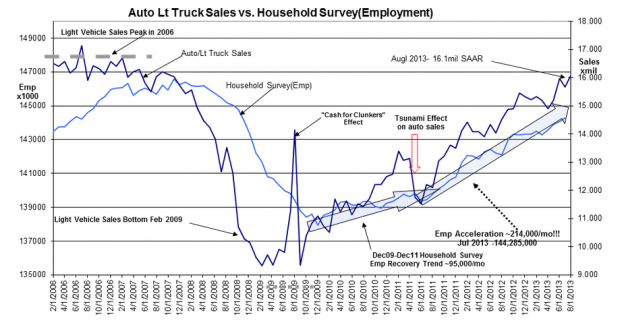

Light Weight Vehicle Sales were reported at an estimated 16.1mill SAAR (Seasonally Adjusted Annual Rate) pace yesterday. This level surprised nearly all forecasters, but was simply an extension of the trend in place since March 2009-see chart. The Los Angeles Times, Los Angeles Times Auto Sales Post Double Digit Sales, reported, “Automakers sold 1.5 million vehicles last month, a 17% gain. U.S. car companies report tight inventories on some models.” Manufacturers have been adding to capacity by adding 3rd shifts which means higher employment. I am expecting the reports on employment to affirm the hiring trends which have been in place since July 2011.

Light Weight Vehicle Sales in my observations are one of the most useful indicators of economic activity for our economy. Individuals throughout the US require privately owned vehicles to maintain and advance standards of living. For this reason the pace of vehicle sales provides a good measure of the trends in the overall economy and future employment. Vehicle sales trends lead the trends in employment by 18mos-12mos. Increases in employment is what drives increases in personal income and the many sub-categories of Retail Sales, New Homes Sold, Residential and Commercial Construction and etc. For investors, the trend in vehicle sales is an excellent forecasting tool for stocks ($SPY) and bonds.

Light Vehicle Sales have always been a good forecasting tool for stocks and bonds.Optimism is warranted for higher stock market prices at least for the next few years. My best estimate remains that stock markets should peak in ~5yrs and that investors should commit additional funds to take advantage of this cycle. LgCap Domestic and Intl stocks are recommended but bonds except for specific situations are not recommended.

By all measures we are in a typical economic recovery. The term “typical” encompasses the fact that government entities have been clumsy in dealing with a financial crisis of its own making. The most important part of “typical” is the natural recovery process which occurs as each of us doubles down in our efforts to maintain and improve individual our standards of living. While financial collapses and recoveries are never identical, the elements of cause and effect are basically very similar. To be able to identify these similarities and invest appropriately is what the better investors do. It is their edge!I will update this chart tomorrow once the employment levels for August have been reported. I expect the existing employment trend to continue and tomorrow’s figures to offer no surprise.