“Davidson” submits:

“Confusion reigns Supreme”!! If you spend even only a few minutes digesting the investment media you will hear someone say that recent rate rises are bad for economic expansion and all the uptrends we have been monitoring the past 4 ½ yrs are at risk of turning downward. I am both surprised and disappointed that the media with access to so many experts cannot seem to understand that rates rising at this point in the economy is a desired outcome for housing, economic expansion, higher employment and much higher stock markets. That many take as gospel the information put forth by the media places the media as a highly misleading source of investment information.

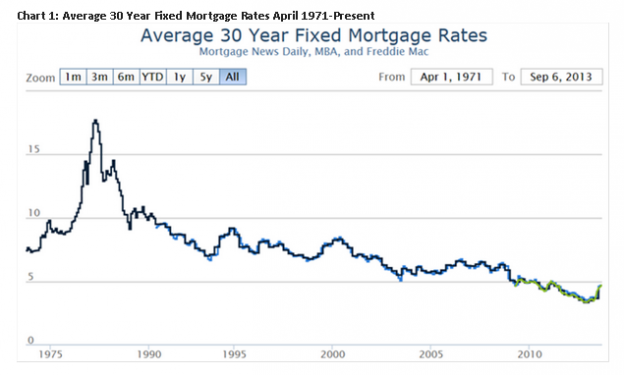

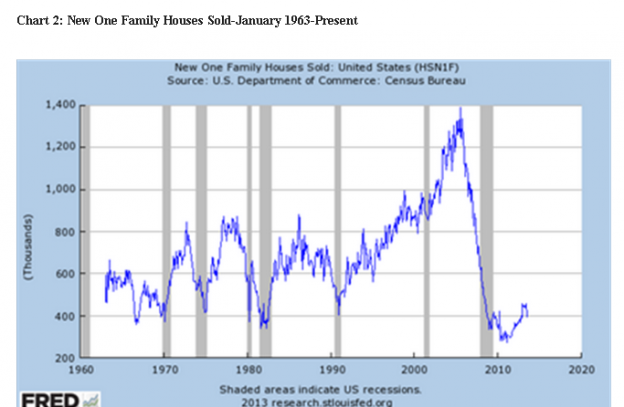

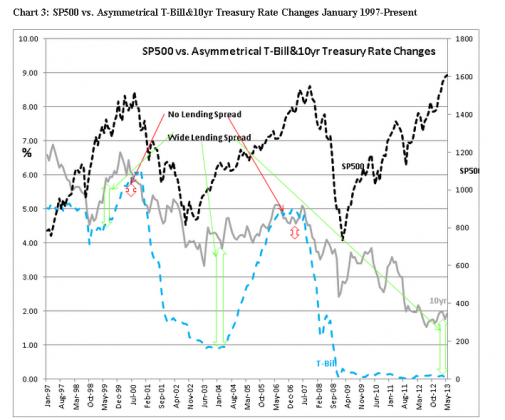

To sift the fact from the fallacy I will take you through 3 charts representing some of our financial history placed below: Chart 1: Average 30 Year Fixed Mortgage Rates April 1971-Present, Chart 2: New One Family Houses Sold-January 1963-Present and Chart 3: SP500 vs. Asymmetrical T-Bill&10yr Treasury Rate Changes January 1997-Present

There are several points good investors can take from this financial history:

1) Chart 1 shows us that today’s mortgage rates are the lowest since 1971.

2) Looking at Charts 1&2 together, one can see that home sales have had typical cycles throughout history when rates were much higher than they are today. Rates were lowest during recession periods(cycle lows) shown as Gray Bars in Chart 2 and highest at cycle peaks.

3) Again looking at Charts 1&2 actual mortgage rates by themselves have never choked off a housing or a business cycle. If so, we would have seen housing cycles peak at the same rate throughout history!!

4) Chart 3 shows us that short term rates rise and fall asymmetrically vs. long term rates. Short term rates rise later in the cycle than long term rates. Short term rates become equal to long term rates at the end of the economic cycle, at the peak in housing and stock markets.

Housing cycles rise and fall with the lending spread banks receive by taking low cost funds from short term rates and lending them at higher longer term rates. This spread in rates as shown in Chart 3 by T-Bills vs.10yr Treasuries is wider during recessions. A wide spread is what eventually stimulates lending. This lending comes to a halt when the spread closes to zero(or near zero). You can see that this occurs at housing market and stock market tops. Nothing stops an economic cycle like a sudden stop in the flow of available borrowed money. Look carefully at our recent market top. The Housing market actually stopped early in 2006 just when T-Bill rate became equal to the 10yr Treasury rate. The SP500 (monthly closing price) peaked in October 2007 at $1,549 , but did not rise much from the peak in May 2007 of $1,530 before we entered correction in 2008.

Let me repeat these points:

1) It is the spread which banks receive in their lending activity which is most important to economic expansion. Wider spread = more lending!

2) Not the level of the lending rate itself!!

I remain puzzled that I have not witnessed any of the analysts I have seen in the media explain the impact of rising rates on bank lending at this point in the economic cycle as a positive to future economic activity. What I have heard is a constant stream of hand-wringing that rising rates will choke off current economic activity and most are calling for the Fed to do more QE. QE has actually postponed economic activity in my observation as it has kept long term rates lower than they should have been. Lower long term rates chokes off bank lending, it does not make it more plentiful. You can see in Chart 3 that when QE2 was initiate the 10yr Treasury rate fell to ~1.5% from ~3.5% just months earlier causing lending spreads to narrow and bank lending whatever it was to slow.

Permit me to repeat this point once again: Rising rates at this point in our economy is strongly positive for expanding economic activity and higher stock prices.

Optimism is warranted. Mortgage rates are near 4.8% while T-Bill rates remain less than 0.01%. In a couple of months mortgage rates should be over 5% and lending for homes should widen appreciably and be strongly stimulating towards additional economic expansion.