“Davidson” submits:

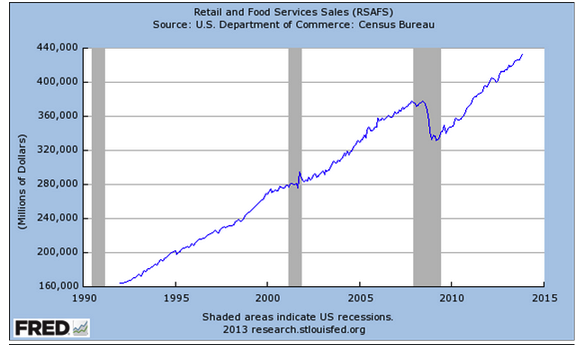

Retail and Food Services Sales were reported recently with levels decently better than most had expected. The report was met with a chorus of “But, this does not account for …..this…!!” or they said “But, this does not account for….that…!!”

There are 5 charts below which tell a very simple yet quite positive story.

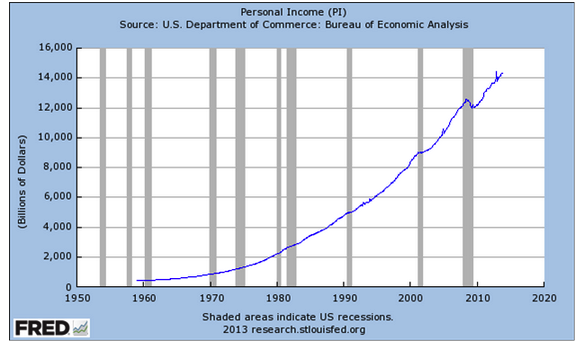

1) 1st two charts tell us-Retail sales are at a record as is Personal Income

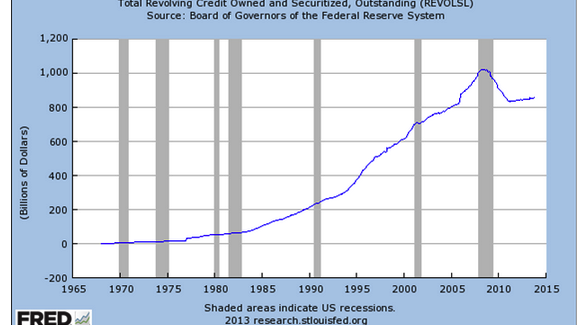

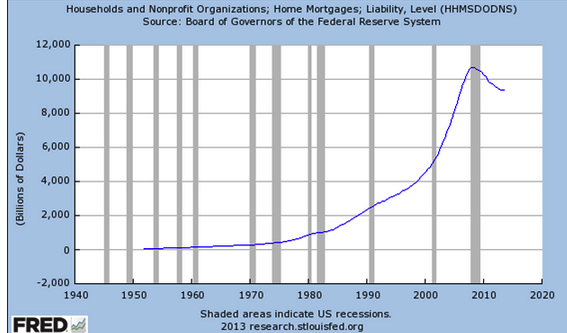

2) Next two charts tell us –Individuals have retired ~$200 Billion Credit Card Debt and ~$1 Trillion of Mtg Debt-at the same time as the 1st two charts.

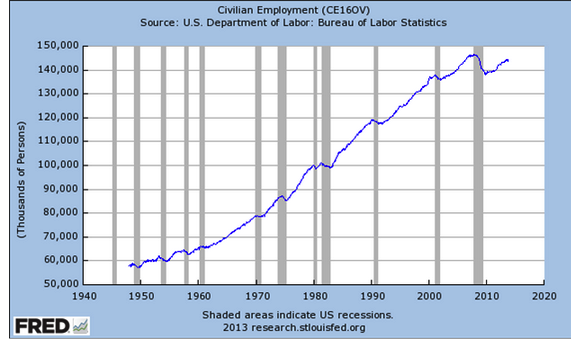

3) The last chart tells us we are doing all this without yet coming back to full-employment!!

The strength of the US economy, a free market economy, is as incredible today as it has been historically resilient. This is the stuff of rising stock markets. Most miss seeing this because they are too involved in locating the one negative data point to proclaim that things aren’t perfect or why they could get worse. The data is actually quite clear if one does not get lost in the details. The economy is good and in the process of getting better. This is why I focus on the trends and not specific data points.

The economy is good and in the process of getting better.

Stock markets rise on expanding economic activity. Stock markets do not stop till the economy stalls. We can monitor the economy and see it stalling up to 24mos before the stock markets reach their peaks. Once we are satisfied that the economy is headed higher, it is a matter of identifying the better portfolio managers and the better CEOs in which to invest. This is a relatively simple process. (Ask me. I will walk you through the process of identifying managers and CEOs) It requires constant monitoring to know where we are in the larger picture. But, economies and markets do not have a history of suddenly changing direction without enough warning that the prudent investor cannot take prudent action to preserve investment value.

Most of our economy has shown decent recovery while our housing and construction markets are in the early stages of expansion. They have been hindered, in my opinion, by Fed actions to keep long term rates low. The Fed has, in my opinion, misunderstood the necessary conditions for banks to expand credit. For banks to expand credit, they require higher long term rates. Higher rates have always been associated with economic expansion! We are a nation which has always used credit and the construction and housing markets are heavily dependent on an active lending climate. Expanding credit does not occur with mortgage rates at ~4.6%. We will see this emerge as mtg rates move into the 5%-6% range. This sounds counter intuitive, but you cannot borrow if the lender will not lend to you. The lender needs enough of a spread between the cost of funds and the lending rate to cover the risks perceived and the profit requirement. Rising long term rates while short term rates remain close to where they are will provide the spreads the banks require. Banks remain especially cautious today as they are under broader scrutiny since the sub-prime debacle.

The Fed, in my opinion, seems to be missing the counter intuitive argument which would let rates rise to a more normal level. I believe we will see rates rise in spite of the Fed’s actions as investors sell Treasury securities to invest in higher perceived returns elsewhere in the economy and the marketplace. It is the shift from Treasuries to higher return investment activities which result in rising economic activity and higher stock markets. Rising rates, an expanding economy and higher stock prices are the natural progression of the business/investment cycle.

It is the shift from Treasuries to higher return investment activities which result in rising economic activity and higher stock markets.

Expansion in housing and construction markets will complete our full economic recovery. When these markets return to historical levels we should witness upwards of 15mill new jobs added throughout the economy. The impact of this business activity on investor behavior has always meant significantly higher stock prices. History suggests this is likely to take roughly 5yrs or into late 2018.

I see continuous improvements ahead in the US and global economies. Higher stock prices typically follow. The ‘Big Picture’ is more important than its components or any single monthly report. Any market decline should be seen as an opportunity to invest more into equities ($SPY). Optimism is warranted in my opinion