“Davidson” suvbmits:

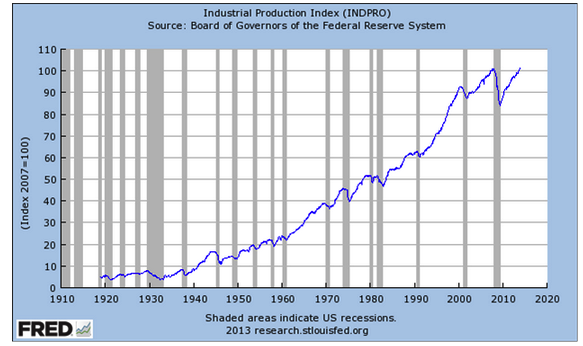

US Industrial Production Index was reported earlier today with the St Louis Fed releasing the long term chart below late this afternoon. Link: StLouisFed.org INDPRO There is a very useful comparison between the strength of INDPRO and recessions noted as the GRAY COLUMNS on the chart. If you look carefully, you will see that INDPRO stalls before each recession period begins. It can be used as an economic indicator by which to judge stock market price highs, but I prefer other economic trends which give us warning of to 24mos ahead of a market peak.

This is not a “Fed Stimulated” market. This is a market supported by strong INDPRO and other indicators as I have described in past notes.

As I have stressed in past notes, the economy is relatively strong without the housing and commercial construction sector. With the shift of construction to a higher gear which is apparent today, INDPRO will rise considerably before we reach an economic peak. My advice is buy stocks ($SPY), sell bonds before others do and hold’em